Funding & Investment in Travel

Venture-Backed IPOs Of 2025 Have Done Well Post-Debut; Now It’s Figma’s Turn

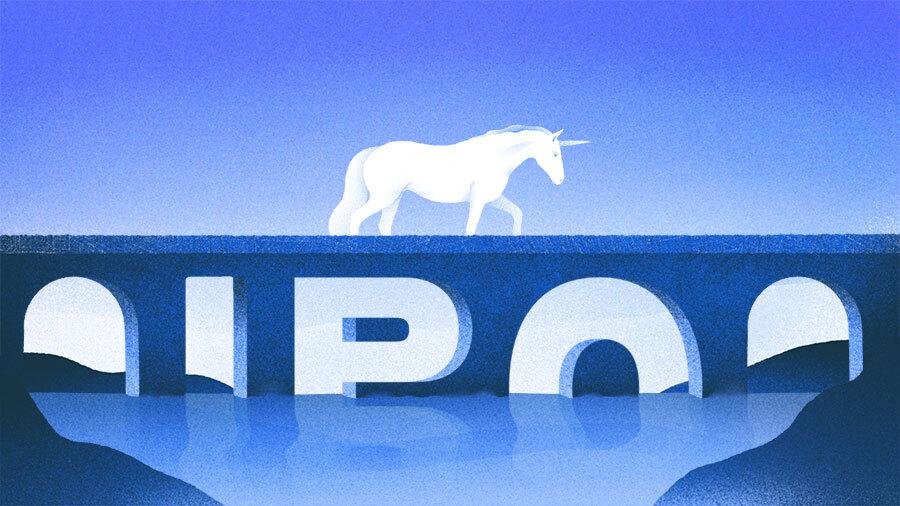

The U.S. tech IPO scene hasn’t exactly been busy this year. But for those who have made their debuts, the market reception has been exceptionally positive overall.

That could be a helpful tailwind for Figma, which priced its IPO late Wednesday at $33 per share, slightly above the projected range. Shares of the design software provider will trade on the New York Stock Exchange under the ticker symbol FIG.

If Figma follows in the footsteps of other big IPOs this year, we can expect shares to go up from there. That, at least, was the pattern we found in a Crunchbase review of venture-backed companies that went public on U.S. exchanges this year. Among the nine largest offerings, all were up from where they priced their IPOs.

Circle leads

Circle Internet Group is the top performer by a long shot. The New York-based stablecoin provider, currently valued above $40 billion, has seen the value of its shares rise more than 5x following its early June IPO.

The stupendous performance has helped spur a raft of other newcomers looking to test their luck on public markets. In the past few weeks, BitGo, a provider of secure wallets for digital assets, and Gemini, the crypto exchange founded by Cameron and Tyler Winklevoss, both submitted confidential draft registrations to go public. Also this month, digital asset platform Bullish filed publicly for its IPO.

It also likely helped that Circle’s debut coincided with a sharp rise in crypto values, with Bitcoin recently near its all-time high at more than $118,000.

CoreWeave, Chime and others still up

While Circle is the biggest gainer, AI infrastructure provider CoreWeave is still the most valuable venture-backed company to go public this year, with a recent market cap around $52 billion. Shares of the New Jersey company have also more than doubled since its April IPO.

Digital banking provider Chime, the next-largest offering, is also up a bit, albeit not so dramatically. And while a market cap over $12 billion certainly sounds like a lot, it’s still far below the $25 billion peak valuation Chime garnered several years ago.

Several mid-sized IPOs have also posted big gains. Metsera, a developer of therapies for obesity and metabolic diseases, is trading at roughly double the level it priced shares for its January IPO. And shares of MNTN, a targeted TV advertising platform, are also up sharply from the initial offering price in May.

Up next: More huge offerings

Even with some large offerings in the mix, the pace of venture-backed IPOs so far this year has been on the slow side. Granted, it’s a pickup from the latter part of 2024, which was even slower. But to really be able to declare the IPO market is back in a big way, we’ll need to see more large, successful offerings.

Fortunately, those are likely on tap. Most anticipated of all is probably design software developer Figma, which recently boosted the proposed price range for its upcoming IPO, raising its expected initial valuation to up to $18.8 billion.

Another smaller but nonetheless successful debut came to fruition on Wednesday as Ambiq Micro, a maker of low-power chips for AI computing, began trading on the New York Stock Exchange. Shares closed up 61% in first-day trading.

Given that preparing for an IPO is a notoriously demanding process, it remains to be seen how many of today’s eligible unicorns will add themselves to the public offering pipeline. If things continue in the current fashion, though, many of those who opted to stay private may be regretting their decision.

Related Crunchbase query:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Investment in Travel

Ramp Ramps Up While AI And Healthcare Hold Strong

Want to keep track of the largest startup funding deals in 2025 with our curated list of $100 million-plus venture deals to U.S.-based companies? Check out The Crunchbase Megadeals Board.

This is a weekly feature that runs down the week’s top 10 announced funding rounds in the U.S. Check out last week’s biggest funding rounds here.

This was a big week for big checks, both confirmed and reported. Among confirmed rounds, the largest financing went to fintech provider Ramp, which landed $500 million at a $22.5 billion valuation to scale its visions around agentic AI. The next-largest financings went to MapLight Therapeutics, a developer of medicines for brain disorders, and Ambience Healthcare, a healthcare AI startup.

As for giant deals that were reported but not officially closed, Anthropric was said to be close to finalizing a round of up to $5 billion led by Iconiq Capital that would push its valuation all the way to $170 billion.

1. Ramp, $500M, fintech: New York-based Ramp, a provider of financial products and tools for businesses to automate finance tasks, raised $500 million at a $22.5 billion valuation. Iconiq Capital led the Series E financing, which brings total equity funding to date to $1.9 billion.

2. MapLight Therapeutics, $372.5M, biopharma and neuroscience: MapLight Therapeutics, a biopharma startup developing medicines for brain disorders, announced that it raised $372.5 million in Series D funding. Forbion and Goldman Sachs Alternatives co-led the financing for the 7-year-old, Redwood City, California-based company.

3. Ambience Healthcare, $243M, healthcare AI: Ambience Healthcare, an AI platform for healthcare systems to use in documentation, coding and clinical documentation, raised $243 million in a Series C round. Oak HC/FT and Andreessen Horowitz led the financing for the San Francisco-based company.

4. Quince, $200M, fashion: Quince, an affordable luxury brand online retailer, raised $200 million at a valuation of more than $4.5 billion, according to a report from Bloomberg. Iconiq Capital reportedly led the San Francisco-based company’s latest financing.

5. Observe, $156M, AI enterprise software: San Mateo, California-based Observe, a provider of AI-enabled observability tools for businesses, raised $156 million in a Series C funding round led by Sutter Hill Ventures. The financing brings funding to date for the 8-year-old company to more than $460 million, per Crunchbase data.

6. (tied) Motive, $150M, fleet management: San Francisco-based Motive, a provider of fleet tracking and driver safety software, raised $150 million in a new funding round led by Kleiner Perkins. The 12-year-old company is also reportedly taking steps toward an IPO.

6. (tied) Anaconda, $150M, AI software: Anaconda, a provider of AI tools for businesses using Python and open source applications, announced it raised over $150 million in a Series C funding round led by Insight Partners. The Austin, Texas-based company said it currently operates profitably with over $150 million in annual recurring revenue as of July.

8. Artbio, $132M, radiopharmaceuticals: Cambridge, Massachusetts-based Artbio, a clinical-stage radiopharmaceutical startup developing therapies (ARTs) to treat a range of cancers, raised $132 million in a Series B round that included Sofinnova Investments and B Capital as lead investors.

9. Fal, $125M, generative media: San Francisco-based Fal, a startup offering a generative image, video and audio platform for developers, raised $125 million in a Series C led by Meritech Capital Partners. The 4-year-old company said it has seen revenue increase 60x in the past 12 months.

10. Oxide Computer Co., $100M, cloud infrastructure: Oxide Computer Co., a developer of cloud infrastructure for on-premises computing, raised $100 million in a Series B round led by US Innovativr Technology. Founded in 2019, the Emeryville, California-based company has raised over $260 million to date, per Crunchbase data.

Methodology

We tracked the largest announced rounds in the Crunchbase database that were raised by U.S.-based companies for the seven-day period of July 26-Aug. 1. Although most announced rounds are represented in the database, there could be a small time lag as some rounds are reported late in the week.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Investment in Travel

Why More Startups Are Buying Other Startups In 2025

Despite a pickup in IPOs, startup exits and funding are still harder to come by than in years past. Add to that an increasingly competitive landscape for AI startups, and it’s no surprise that we’ve seen an upturn in startups buying other startups this year.

The reasons for the rise in startups buying their brethren are varied. In many cases, consolidation is driven by market forces, including a more challenging fundraising environment and more affordable valuations for buyers. For other startups, it’s simply faster to buy another company than try to build out certain technologies themselves.

By the numbers

In the first half of 2025, there were 427 reported M&A deals globally, according to Crunchbase data. That compares to 362 in the same period last year, representing an 18% increase.

For comparison’s sake, in the full years 2021 and 2022, there were more than 1,000 deals in which startups bought other startups, per Crunchbase data.

Buyer’s market

Michael Mufson, managing partner of investment banking firm Mufson Howe Hunter, believes that we’re seeing more early-stage startups combining forces because the fundraising environment “has become so challenging.”

“Venture capital is still tight, and without enough liquidity events to cycle capital back to LPs, VCs are being far more selective,” he told Crunchbase News. “For founders, it’s survival of the fittest — and that means getting creative to build a very tight investment thesis.”

In many cases, a merger between two early-stage companies can create a stronger, more compelling narrative for investors, in Mufson’s view.

“It may broaden the customer base, consolidate IP, or, increasingly, bring in critical capabilities like AI,” he added. “For startups lacking in AI expertise, acquiring or merging with a team that has that technical depth can help accelerate product development and improve funding prospects in a highly competitive market.”

Startup adviser Itay Sagie, owner of Israel-based Sagie Capital Advisors, agrees that the most significant driver of the startup-to-startup M&A uptick is the tightening of venture funding — despite a modest bump in venture funding globally in Q2.

“Small scale, startups which are far from being profitable have a hard time raising capital as VCs become more conservative, so they see M&A as the most logical option,” he told Crunchbase News in an email interview.

Another driver, Sagie believes, is that valuations appear to be “stabilizing at reasonable ARR multiplier ranges.”

This allows for larger startups that raised large rounds in 2021 at 40x-70x ARR valuations to use cash reserves to acquire smaller startups at reasonable valuations.

“So rather than facing a down round, they’re deploying that capital toward acquiring startups, especially ones that offer one of the three “Ts: complementary tech, traction, or talent,” Sagie added.

On the other side of the spectrum, the larger startups who are more financially sustainable with impressive unit economics and growth KPIs are even more attractive as startup buyers, in Sagie’s view, “as their equity is a more valid asset versus an overpriced, cash burning unicorn.”

Purchases include larger deals

Some of the deals this year have also been high-dollar transactions. And unsurprisingly, some of the larger deals involved AI companies.

- Specifically in the AI arena, one of the buzziest M&A transactions was OpenAI’s May purchase of Io, the device startup co-founded by famed Apple product designer Jony Ive, for a reported $6.5 billion.

- OpenAI also tried to purchase artificial intelligence-assisted coding tool Windsurf for $3 billion but that deal fell through. Instead, Cognition swept in to scoop up what was left of Windsurf after Google announced in mid-July that it was paying $2.4 billion to license Windsurf’s technology and for compensation.

Not all large M&A deals involved AI companies. Other notable startup purchases of peers this year include:

- Prime brokerage Hidden Road was acquired by crypto payments company Ripple in a $1.25 billion transaction announced in early April;

- In mid-May, Databricks announced its plans to acquire database management platform Neon in a deal reportedly valued at around $1 billion;

- More recently, cybersecurity unicorn Axonious announced it was purchasing Cynerio, a medical device security startup in a deal valued at just over $100 million; and

- On July 1, Canada-based legal software company Clio said it plans to acquire Spain’s vLex from Oakley Capital for $1 billion.

Also, many of the major acquirers raised large rounds before making their buys — with OpenAI in early April announcing a staggering $40 billion investment led by SoftBank. That deal marked the biggest venture investment ever. Last December, Databricks raised $10 billion at a $62 billion valuation, marking one of the largest venture capital raises of 2024 and one of the largest on record.

Asset purchases and acquihires

Lindsey S. Mignano, co-founder of SSM Law, notes an interesting trend she’s seeing: more asset acquisitions plus acquihires. This is where larger technology companies are buying the assets (think IP portfolio) of an early-stage company and taking one to three people from the founding team to integrate the technology and transition customer relationships.

SSM Law generally represents tech startups being acquired by larger, more established startups who have received more venture capital financing. An example of this would be an AI company that received a seed or Series A funding being acquired by a Series C or D company.

“The seller’s motivation to sell is often economic or market related — i.e., this company could not raise another round of venture capital or simply saw the writing on the wall that a big tech company was going to surpass them on ‘go-to-market’ due to strategic acquisitions or consolidations,” she told Crunchbase News in an interview.

The buyer’s motivation to buy is likewise economic, Mignano notes. It’s typically cheaper to buy the technology than build it, and cheaper “to buy the team with a six-month golden handcuff earnout than recruiting.”

But it’s also based on a rush to market, most particularly in the extremely competitive AI field.

“For AI companies, the buyer has immediate access to proprietary model architectures, inference platforms or edge-device integrations without the spend associated with AI training,” she said. “The buyer gets to immediately procure specialized datasets or fine-tuned models from a seller that effectively block out the competition in verticals with especially clunky sales cycles such as law, government or hospitals.”

In general, Mignano believes that “buyers are in a really good place right now.”

Related Crunchbase query:

Related Reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Investment in Travel

Figma Triples In First-Day Trading

Shares of design software provider Figma soared more than 200% in first-day trading Thursday, the latest indication that the tech IPO market is alive and very enthusiastic.

Previously, San Francisco-based Figma had priced shares for its initial public offering at $33 each late Wednesday, above the projected range of $30 to $32.

The IPO set an initial valuation for the company of just over $19 billion. But given first-day performance, Figma has already blown past that level by a long shot.

The market debut comes amid a bullish streak for venture-backed technology IPOs. After several sluggish quarters, activity has rebounded a bit in recent months, with large, well-received debuts from CoreWeave, Circle Internet Group, Chime and others.

Figma’s IPO raised about $1.2 billion, with about a third of the proceeds going to the company and the rest to existing stakeholders selling shares in the offering.

It appears Figma has ambitious plans for its share of the proceeds. In a letter included in the company’s IPO filing, co-founder and CEO Dylan Field told prospective shareholders: “Expect us to take big swings when we see a chance to invest in our platform or pursue M&A at scale.”

The company’s much-anticipated public market entrance also follows a period of strong revenue growth. Figma reported revenue of $749 million in 2024 — up close to 50% year over year. Earnings for the first quarter of this year showed similar growth momentum.

The company has also been a longtime venture capital favorite. Founded in 2012, Figma has raised about $700 million in venture funding from investors over the years. It also closed on $700 million in secondary financing last year, several months after the termination of its planned merger with Adobe.

Looking at Figma’s IPO prospectus, its lead shareholders look like a Who’s Who of Silicon Valley. Its biggest stakeholder is Index Ventures (16.8% of Class A shares), followed by Greylock (15.7%), Kleiner Perkins (14%) and Sequoia Capital (8.7%).

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories7 days ago

Brand Stories7 days agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do7 days ago

Destinations & Things To Do7 days agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse4 weeks ago

Asia Travel Pulse4 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel4 weeks ago

AI in Travel4 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login