Funding & Investment in Travel

The Dual-Use Tech Surge: Innovation’s Double-Edged Sword

The rise of dual-use technologies — innovations with both civilian and military applications — is rapidly transforming the global tech landscape. Once a niche, largely avoided due to LP restrictions on defense-related investments, the category is now front and center for governments, VCs and startups alike.

The drivers are clear: Intensifying geopolitical tensions, ballooning defense budgets across NATO countries, and a growing awareness that critical future capabilities — from AI-driven surveillance to autonomous systems and secure communications — will increasingly originate not just from traditional defense contractors, but from agile, high-growth startups.

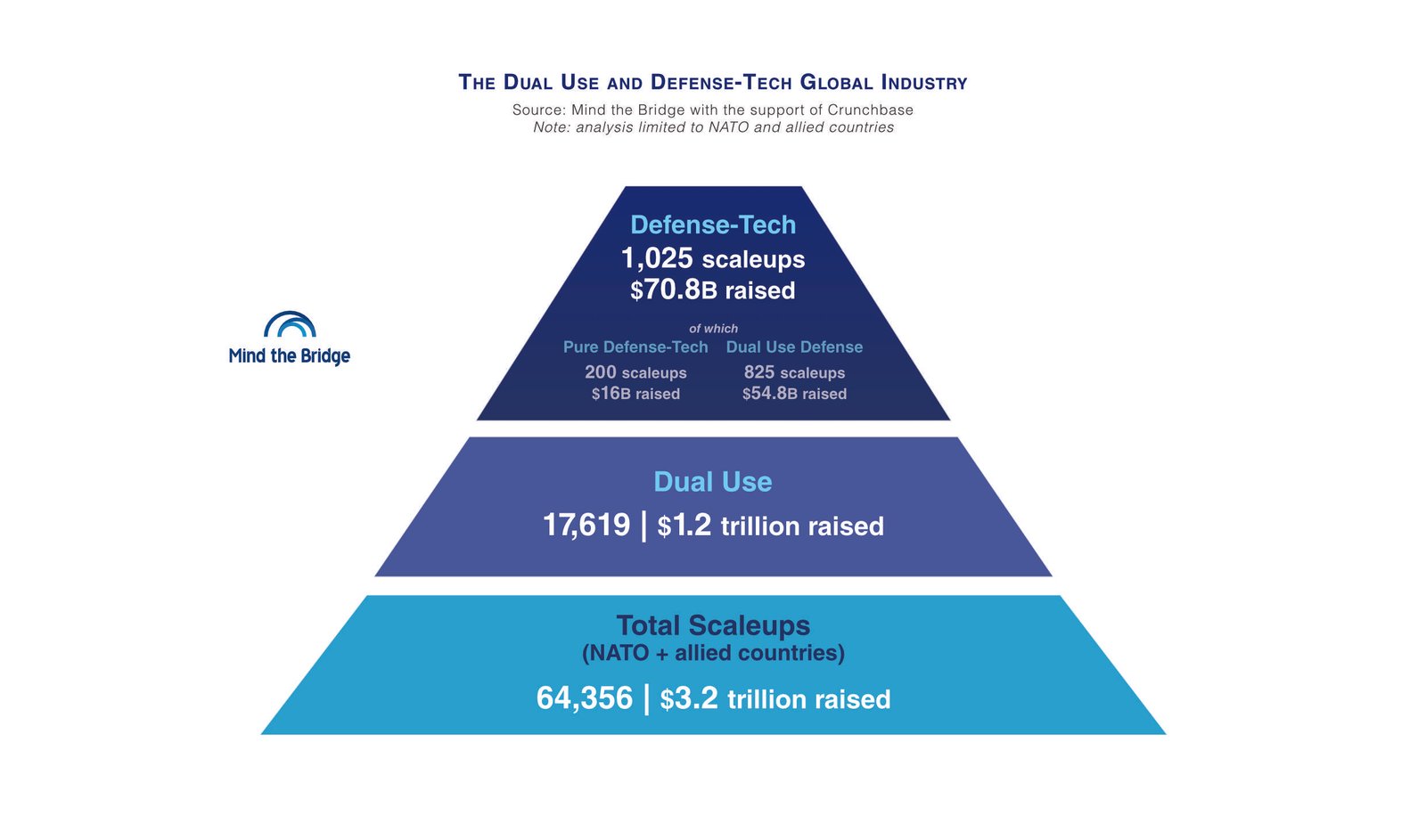

How big is dual-use tech? How much is defense?

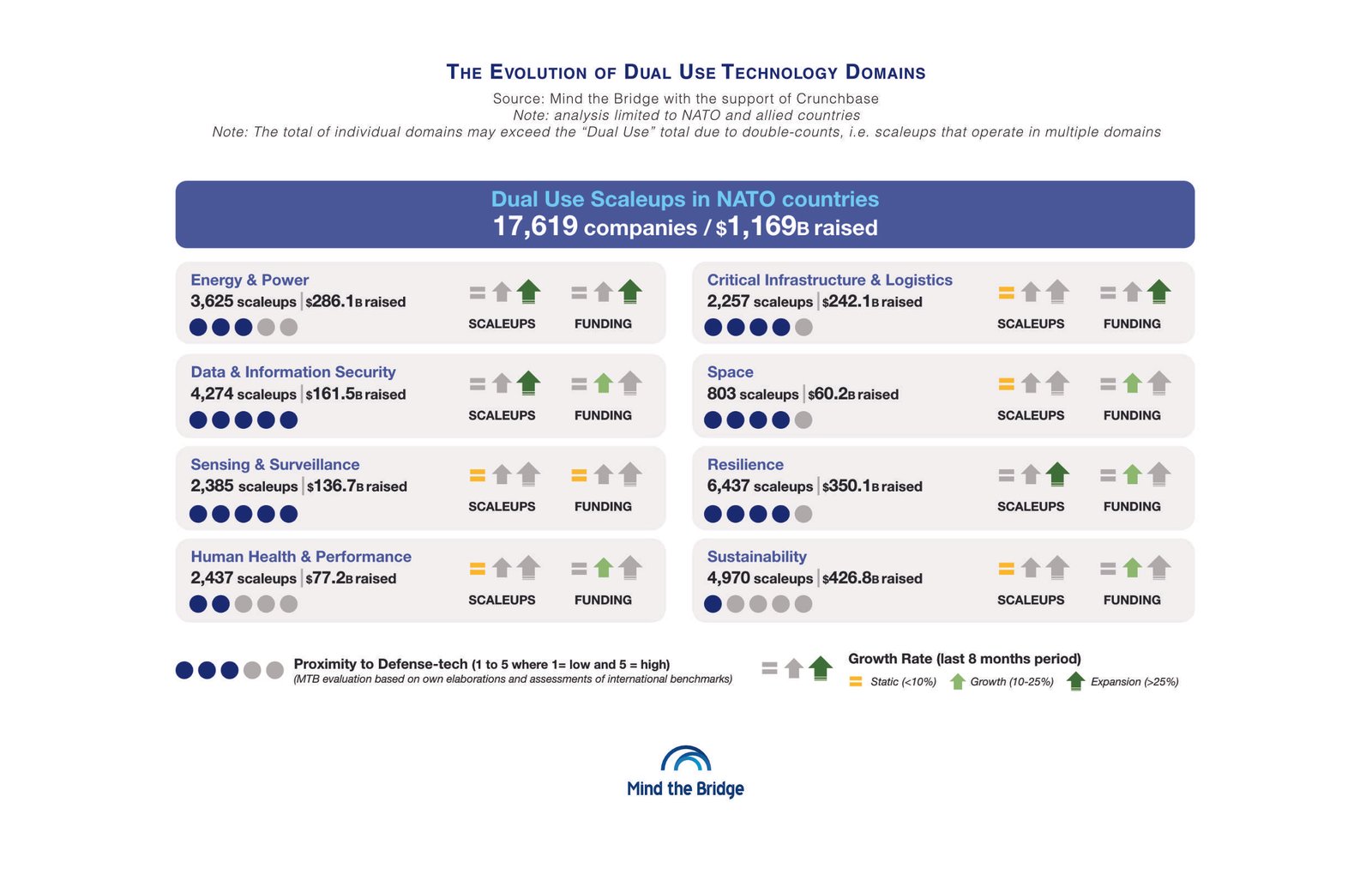

As of May 2025, there are 17,619 dual-use tech scaleups operating across NATO countries — out of a total of approximately 64,000 scaleups identified in the 47 countries analyzed.

Within this cohort:

- 1,025 are categorized as defense tech scaleups.

- Of these, 200 are “pure defense tech,” or startups focused exclusively on military applications.

- The remaining 825 are “dual-use defense tech” — startups that began with civilian technologies and later evolved to include defense-oriented solutions.

Put differently, dual-use tech scaleups now make up 27% of the total scaleup population in the countries examined. That’s 1 in every 4 scaleups developing technologies with potential military or defense applications.

The surge of dual-use technologies

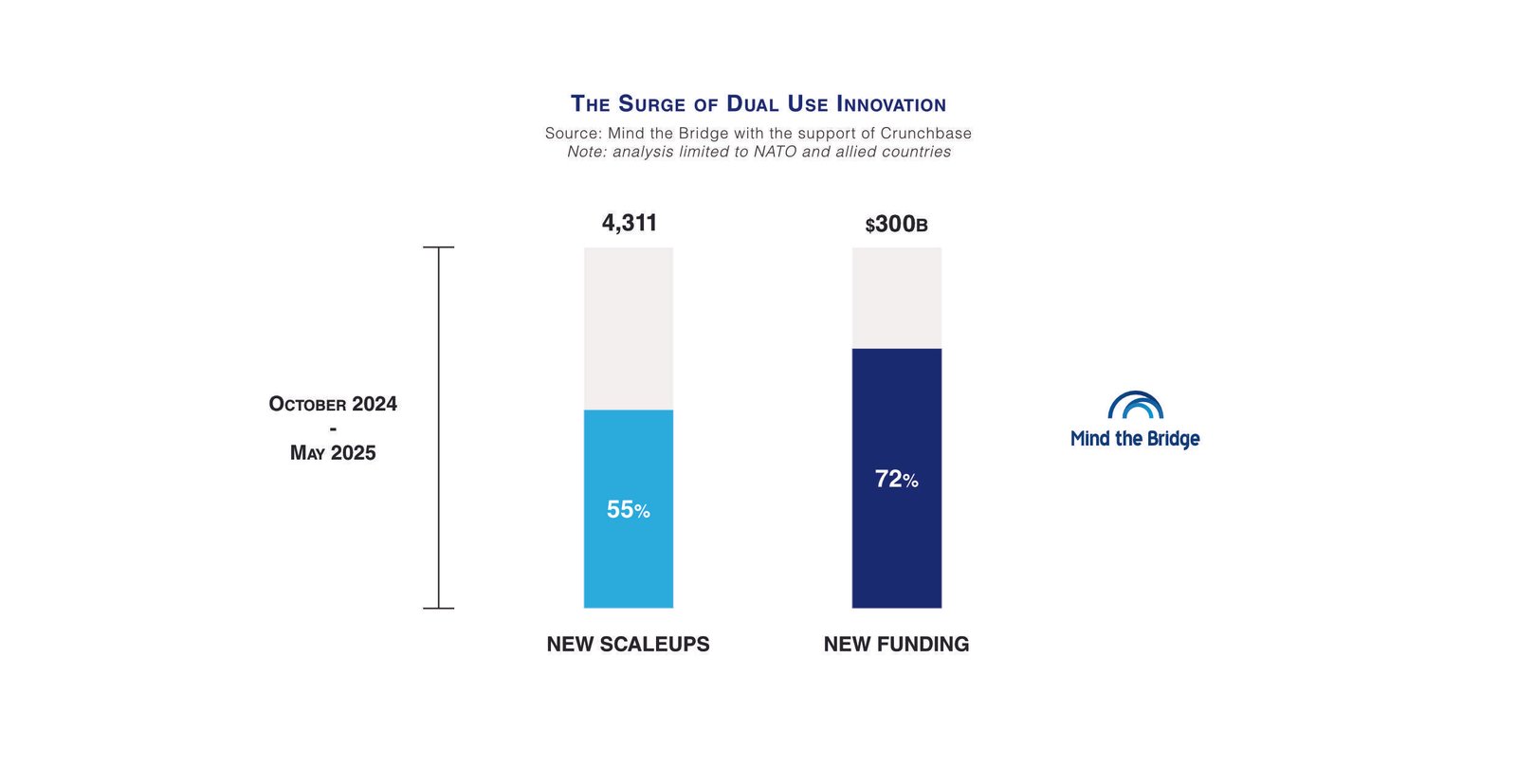

This is no longer a trend — it’s a surge. Powered by Fincantieri, Mind the Bridge and Crunchbase conducted a first analysis in late 2024 (report here). Midway through 2025, we updated it (download here) to reflect the latest developments.

What we found is that in just six to eight months, growth has been nothing short of explosive.

- The number of dual-use tech scaleups rose from 15,260 to 17,619, a 16% increase.

- Defense tech scaleups crossed the 1,000 mark (up 13%), with pure defense tech growing even faster at a rate of 18%-plus.

- Investment in dual-use tech skyrocketed 25%, from $954.5 billion in Q3 2024 to nearly $1.2 trillion in May 2025.

- Defense tech-specific investment jumped 27%, reaching $70.8 billion.

Between October 2024 and May 2025 alone:

- 4,311 new scaleups were created across NATO and allied countries.

- More than half (2,359) are dual-use tech companies.

- Roughly 70% of all new scaleup investment during this period went to dual-use tech startups.

Where dual-use tech is more advanced

Israel pioneered the model, converting military R&D into a startup-driven tech powerhouse. The U.S. follows with a growing network of integration programs (DIU, AFWERX, NSIN) to onboard commercial innovation into the defense ecosystem.

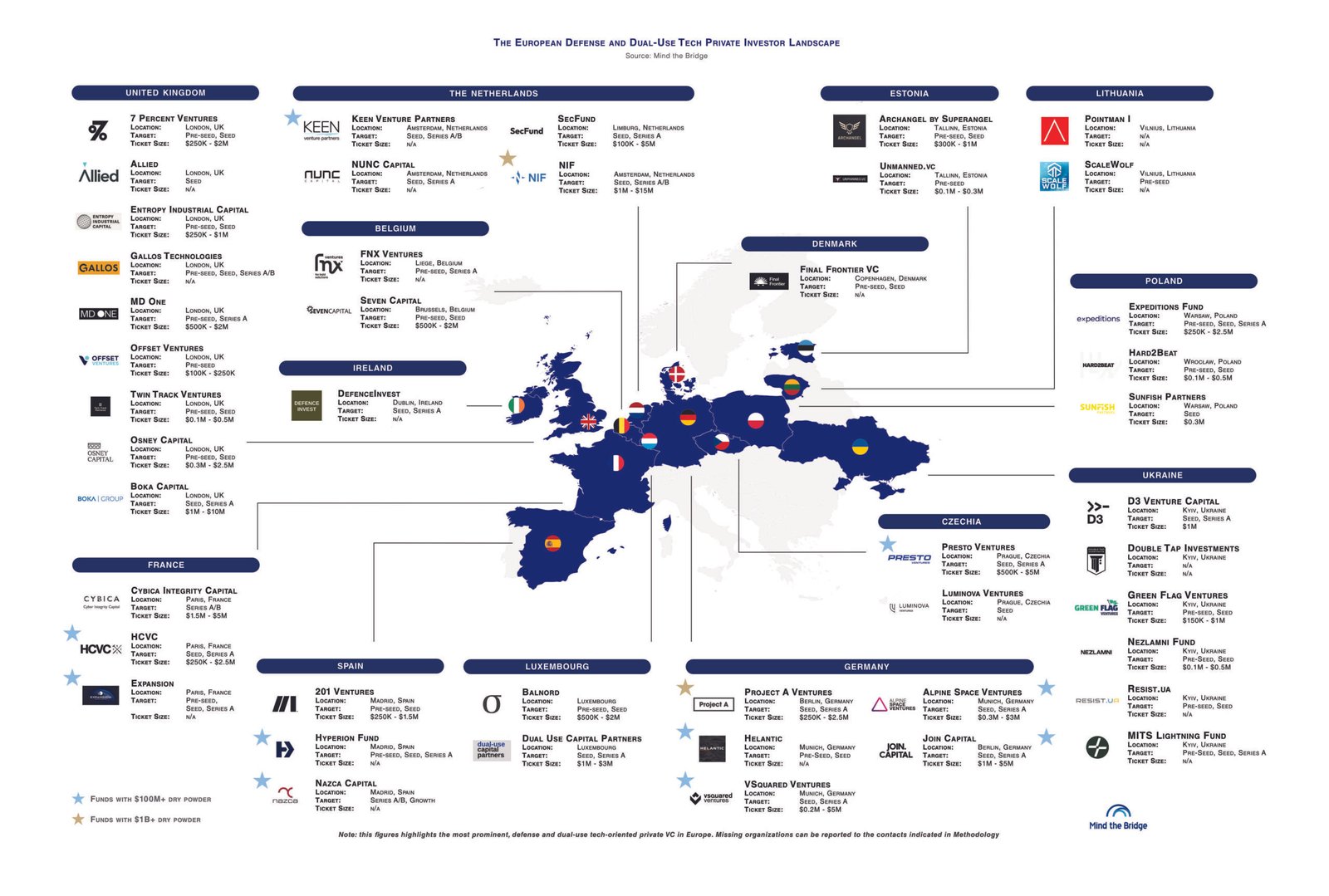

Europe is catching up. In 2024 alone, the EU committed €1.5 billion to defense-related R&D via initiatives like EDIRPA and the European Defence Fund. Meanwhile, national programs are expanding:

- The U.K. pledged £400 million for defense innovation;

- Germany doubled its military procurement budget; and

- NATO’s €1 billion Innovation Fund has begun backing dual-use startups across the alliance.

Even smaller, digitally advanced countries are moving quickly. Estonia stands out for integrating its startup ecosystem into national defense strategy. But it’s not alone: Ukraine, Poland, Czechia and other Eastern European countries are also investing heavily in defense innovation.

Barriers do exist

Despite this momentum, dual-use innovation still faces serious challenges. These startups develop hard tech with critical military applications — often requiring long R&D cycles and large funding rounds.

Our data shows that defense tech startups are more capital-intensive. Pure defense tech scaleups have raised an average of $80 million. That compares with $66 million on average for dual-use tech and $50 million for purely civilian tech scaleups.

They also face longer time-to-market, due to procurement bottlenecks and outdated acquisition models. This creates a notorious “Valley of Death” post-pilot phase.

Common barriers include:

- Startup fragility raises real concerns about survivability;

- Many armed forces are unaccustomed to working with TRL 6-stage startups; and

- Scaling and field deployment remain major bottlenecks. Defense startups can’t go it alone. Most lack the infrastructure to scale hardware production.

Moreover, dual-use startups often suffer from a “not here nor there” syndrome — torn between two demanding markets, without fully committing to either. This can dilute strategic focus and stall growth.

Fundraising and exit opportunities are another friction point:

- Many institutional LPs remain hesitant or hindered to back defense-related ventures.

- Exit options are limited. National security restrictions often block foreign M&A, while local buyers are few and far between.

That said, the landscape is shifting. Mind the Bridge identified 74 VC funds globally that actively invest in dual-use startups. More than one third (35%) are based in the United States, followed by the U.K. (12%). Another 22% are located in Ukraine, the Baltics and Eastern Europe — a sign of the growing relevance of defense and security tech in these regions. (A searchable global directory of investors active in dual-use is available here.)

Alberto Onetti is chairman of Mind the Bridge and a professor at University of Insubria. He is a serial entrepreneur who has started three startups in his career, the last of which is Funambol, among the five Italian scaleups that have raised the largest amount of capital. He is recognized among the leading international experts in open innovation and has wide experience in setting up and managing open innovation projects — venture clients, venture builders, intrapreneurship, CVCs — with large multinational companies, as well as advising and training on this subject. Onetti has a column on Sifted (Financial Times) and several other tech blogs.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Investment in Travel

The New Shape Of AI Acquisitions

In late May, OpenAI quietly announced its $6.5 billion acquisition of Io, a little-known but highly technical company focused on model deployment and orchestration. This deal was interesting not because of the size of the deal. It was what the deal revealed.

The most aggressive buyers in AI are no longer chasing novelty. They are chasing infrastructure. As AI shifts from lab to production, the real battle is not about building models. It is about running them at scale — reliably and securely.

Volume is up, but value is polarized

Across the three half-year periods from H1 2024 to H1 2025, AI M&A volume climbed steadily, reaching 262 deals in the most recent half, Crunchbase data shows. That marks a 35% increase year over year.

On the surface, it looks like a market firing on all cylinders. But the data tells a more nuanced story. The median deal size stayed flat at $67.5 million, while the average soared past $435 million, per Crunchbase data.

That spread is significant. It reflects a bifurcated market. On one end, a small number of strategic infrastructure plays are driving billion-dollar outcomes. On the other, a long tail of smaller, often modest acquisitions is quietly taking place at a steady pace.

That long tail deserves more attention.

These companies tend to be less heavily funded, more capital efficient and focused on solving very specific business needs. Their exits may not make headlines, but they create tangible value for acquirers who need domain expertise, internal automation or edge-case capabilities.

These are disciplined businesses built for sustainability, not spectacle. In many cases, their modest M&A outcomes are not a reflection of failure but a sign of good market fit.

Beyond Big Tech: Strategic buyers step in

While companies such as Nvidia and OpenAI continue to lead in both frequency and deal value, a different class of acquirer is emerging. Mastercard, ServiceNow, Accenture and a growing roster of vertical SaaS players have stepped into the M&A market with strategic intent.

These buyers are not looking for demos or experiments. They are seeking AI that can be embedded, deployed and commercialized inside industries that demand performance and reliability. In sectors like healthcare, legal, financial services and compliance, the startups getting acquired are not pitching bold visions.

They are delivering operational results, often in regulated or high-stakes environments. That makes them highly valuable, even if they fly under the radar.

From novelty to necessity

What we are seeing now is not a trend. It is a reset. AI has matured from a futuristic edge into a commercial foundation. M&A activity reflects that shift.

The startups commanding the most interest are not those with the most powerful models or the flashiest interfaces. They are the ones solving persistent, expensive problems in a way that integrates cleanly into existing systems.

For founders, the lesson is increasingly clear. The real question is not how impressive the tech is. It is how difficult the company would be to replace. Whether the focus is on infrastructure, domain-specific automation or a narrow but mission-critical workflow, the market is rewarding precision and purpose.

These are the quiet wins that will define the next phase of AI.

Itay Sagie is a strategic adviser to tech companies and investors, specializing in strategy, growth and M&A, a guest contributor to Crunchbase News, and a seasoned lecturer. Learn more about his advisory services, lectures and courses at SagieCapital.com. Connect with him on LinkedIn for further insights and discussions.

Related Crunchbase query:

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Investment in Travel

startup funding challenges – Travel And Tour World

startup funding challenges

Copyright © Travel And Tour World – All Rights Reserved

Funding & Investment in Travel

Ramp Ramps Up While AI And Healthcare Hold Strong

Want to keep track of the largest startup funding deals in 2025 with our curated list of $100 million-plus venture deals to U.S.-based companies? Check out The Crunchbase Megadeals Board.

This is a weekly feature that runs down the week’s top 10 announced funding rounds in the U.S. Check out last week’s biggest funding rounds here.

This was a big week for big checks, both confirmed and reported. Among confirmed rounds, the largest financing went to fintech provider Ramp, which landed $500 million at a $22.5 billion valuation to scale its visions around agentic AI. The next-largest financings went to MapLight Therapeutics, a developer of medicines for brain disorders, and Ambience Healthcare, a healthcare AI startup.

As for giant deals that were reported but not officially closed, Anthropric was said to be close to finalizing a round of up to $5 billion led by Iconiq Capital that would push its valuation all the way to $170 billion.

1. Ramp, $500M, fintech: New York-based Ramp, a provider of financial products and tools for businesses to automate finance tasks, raised $500 million at a $22.5 billion valuation. Iconiq Capital led the Series E financing, which brings total equity funding to date to $1.9 billion.

2. MapLight Therapeutics, $372.5M, biopharma and neuroscience: MapLight Therapeutics, a biopharma startup developing medicines for brain disorders, announced that it raised $372.5 million in Series D funding. Forbion and Goldman Sachs Alternatives co-led the financing for the 7-year-old, Redwood City, California-based company.

3. Ambience Healthcare, $243M, healthcare AI: Ambience Healthcare, an AI platform for healthcare systems to use in documentation, coding and clinical documentation, raised $243 million in a Series C round. Oak HC/FT and Andreessen Horowitz led the financing for the San Francisco-based company.

4. Quince, $200M, fashion: Quince, an affordable luxury brand online retailer, raised $200 million at a valuation of more than $4.5 billion, according to a report from Bloomberg. Iconiq Capital reportedly led the San Francisco-based company’s latest financing.

5. Observe, $156M, AI enterprise software: San Mateo, California-based Observe, a provider of AI-enabled observability tools for businesses, raised $156 million in a Series C funding round led by Sutter Hill Ventures. The financing brings funding to date for the 8-year-old company to more than $460 million, per Crunchbase data.

6. (tied) Motive, $150M, fleet management: San Francisco-based Motive, a provider of fleet tracking and driver safety software, raised $150 million in a new funding round led by Kleiner Perkins. The 12-year-old company is also reportedly taking steps toward an IPO.

6. (tied) Anaconda, $150M, AI software: Anaconda, a provider of AI tools for businesses using Python and open source applications, announced it raised over $150 million in a Series C funding round led by Insight Partners. The Austin, Texas-based company said it currently operates profitably with over $150 million in annual recurring revenue as of July.

8. Artbio, $132M, radiopharmaceuticals: Cambridge, Massachusetts-based Artbio, a clinical-stage radiopharmaceutical startup developing therapies (ARTs) to treat a range of cancers, raised $132 million in a Series B round that included Sofinnova Investments and B Capital as lead investors.

9. Fal, $125M, generative media: San Francisco-based Fal, a startup offering a generative image, video and audio platform for developers, raised $125 million in a Series C led by Meritech Capital Partners. The 4-year-old company said it has seen revenue increase 60x in the past 12 months.

10. Oxide Computer Co., $100M, cloud infrastructure: Oxide Computer Co., a developer of cloud infrastructure for on-premises computing, raised $100 million in a Series B round led by US Innovativr Technology. Founded in 2019, the Emeryville, California-based company has raised over $260 million to date, per Crunchbase data.

Methodology

We tracked the largest announced rounds in the Crunchbase database that were raised by U.S.-based companies for the seven-day period of July 26-Aug. 1. Although most announced rounds are represented in the database, there could be a small time lag as some rounds are reported late in the week.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 week ago

Brand Stories1 week agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories1 month ago

Brand Stories1 month agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse1 month ago

Asia Travel Pulse1 month agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel1 month ago

AI in Travel1 month ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoContactless Hospitality: Why Remote Management Technology Is Key to Seamless Guest Experiences

You must be logged in to post a comment Login