Brand Stories

“Sometimes AI delivers great potential, and sometimes it poses significant risks”

“I do believe we are at the cusp of a technology revolution. If not already, AI will soon be everywhere and part of everything,” said Rotem Shacham, Director at PSG Equity, LLC. “As investors, we cannot treat it as a standalone segment. Rather, we should ask ourselves how AI is impacting whichever company we are looking at, in any field.”

Shacham joined CTech to discuss the power of artificial intelligence and how it determines investment decisions. “Sometimes AI delivers great potential, and sometimes it poses significant risks. Not all of today’s leading startups will be there 5 years from now. The question is, who will falter and who will be the next $1 trillion company?”

Fund ID

Name and Title: Rotem Shacham, Director

Fund Name: PSG Equity, LLC.

Founding Team: Peter Wilde and Mark Hastings

Founding Year: 2014

Investment Stage: Growth

Investment Sectors: AI, Fintech, Cyber, Mobility, Healthcare, Gaming, Foodtech, all sectors

On a scale of 1 to 10, how has AI impacted your fund’s operations over the past year – specifically in terms of the day-to-day work of the fund’s partners and team members?

10 – AI has impacted all walks of life, and investing is no exception. We see AI transforming all elements of the investment process. Starting from Sourcing, we use internally developed software to better identify attractive companies. AI is a force multiplier allowing us to comb through the vast amounts of companies and focus on what in our view are the most promising ones. Other areas that have seen productivity gains from AI are financial analyses and general due diligence processes. Apart from those, we also use AI in internal process optimization. We have a lot of internal proprietary data on what good internal process looks like. We use different AI tools to help generate insights from our internal data, to be used to better manage our portfolio.

Have you already had any significant exits from AI companies? If so, what were the key characteristics of those companies?

We believe AI has now become table stakes. Like the .com at the turn of the century, or cloud following the ’07-’08 innovation cycle, we believe AI has to be an integral part of any tech company these days. It’s more than a fad. We are in a midst of an innovation cycle and we believe that those companies that won’t join the bandwagon won’t survive. Even companies that were founded before, and are not AI native, need to think about how they are integrating AI into their business. These days, in nearly every exit scenario, every buyer considers this aspect. It doesn’t mean that every company has to suddenly transform into being OpenAI, because not every company can. What it does mean is that every management team needs to consider how they can help enhance their product offering with AI, how they can use AI in their R&D processes, how they can optimize the CS and Sales operations, and so on. In those respects, every company should aim to be an AI company.

Is identifying promising AI startups different from evaluating companies in your more traditional investment domains? If so, how does that difference manifest?

One of the biggest changes in evaluating AI startups has been the pace of change. Think about how recently LLMs were introduced, how ChatGPT changed the landscape, then consider the impact of the release of new reasoning models, vibe coding, etc. The world is changing at an increasing pace that makes assessing which company will be successful in 5 years’ time more challenging. In this regard, if forecasting 5 years ahead has always been challenging, with some new AI technologies, it is hard to ascertain what will happen 6 months from now.

What specific financial performance indicators (KPIs) do you examine when assessing a potential AI company? Are there any AI-specific metrics you consider particularly important?

In general, we look for the same KPIs across companies. One of the most important aspects is velocity. We look for positive momentum. As an example, the basic figure we look at is revenue. Of course, we would like to see revenues above a certain dollar threshold, which varies by company. On top of that, we focus on revenue growth. And beyond that, on the change in growth year over year. In essence, we’re looking at the first and second derivatives of different KPIs such as revenue, sales efficiency, R&D spend, etc. Strong momentum is a strong indicator of materializing potential.

How do you approach the valuation of early-stage AI startups, which often lack significant revenues but possess strong technological potential?

We have the benefit of investing in growth-stage companies. Notwithstanding, I think that the beauty of AI is that it allows companies to reach commercial milestones with fewer resources compared to the past. If anything, this quality will help change the paradigm slightly. It will bridge the gaps that we sometimes see between technological potential and revenue attainment.

What financial risks do you associate with investing in AI companies, beyond the usual technological risks?

One of the biggest risks by far is the pace of technology development. As growth investors, we focus on financial trends analysis. We look at historical growth trends and try to forecast the future. As one example, Gross Dollar Retention and Net Dollar Retention are key indicators of customer satisfaction and product value. However, these KPIs are trailing indicators. They cannot capture recent changes in product offering, competitors’ product launches, new entrants into the market, etc. When the pace of change is so fast, history may not be a good predictor of the future, and our job as investors becomes even more challenging.

Do you focus on particular subdomains within AI?

We invest across verticals, including all subdomains. We look for high-potential companies and are agnostic to their specific domain.

How do you view AI’s impact on traditional industries? Are there specific AI technologies you believe will be especially transformative in certain sectors?

As our own field of investing is being transformed by AI, I anticipate that AI will impact all industries. The world is still pretty early in the innovation cycle, so it is quite hard to forecast how and what those changes will be. However, consider the pace of change in the last decades in Information Technology or Software. 30 years ago, we were using mainframe computers and didn’t have the basic software tools each and every one of us is using today. The technological advancement this field has gone through is extensive to say the least. On the flip side, many other industries have not seen these leapfrog advancements. Aviation, Energy, Agriculture, to name a few, have been mostly stagnant from a technology perspective. I believe AI has the power to help change all of that – from increasing crop yields through AI-based irrigation and fertilization all the way to AI-based material design for aerospace. For me, the potential is huge.

What specific AI trends in Israel do you see as having strong exit potential in the next five years? Are there niches where you believe Israeli startups particularly excel?

We see innovative companies leveraging AI across the application layer in different verticals such as Healthtech, DefenseTech, LegalTech, developer tools, and others. There is no glass ceiling to Israeli talent in this space and we see promising opportunities in a wide spectrum of segments.

Are there gaps or missing segments in the Israeli AI landscape that you’ve identified? What types of AI founders are you especially looking to back right now in Israel?

So far, we’ve seen many local AI application layer companies and fewer on the foundational layer side. In general, I believe Israeli entrepreneurs are excellent in using technology in innovative ways and leveraging it to new use cases so the presence in the application layer makes a lot of sense. Especially in areas where one needs creative thinking rather than brute force. I truly believe in Israeli companies’ potential to disrupt multiple segments. Talent is one of our greatest competitive advantages in Israel and that is true in the perspective of AI as well. When we look back at a new opportunity, we look first and foremost at the leadership team and their ability to build a strong, valuable company.

Brand Stories

Kakao, Naver step up global AI hunt amid fierce tech race

South Korea’s internet pioneers, Kakao Corp. and Naver Corp., are ramping up overseas investments in artificial intelligence startups, shifting focus to North America in a move that is raising concerns among domestic startups over tighter funding at home.

After a two-year lull, both companies have resumed active startup investing but with a markedly global tilt.

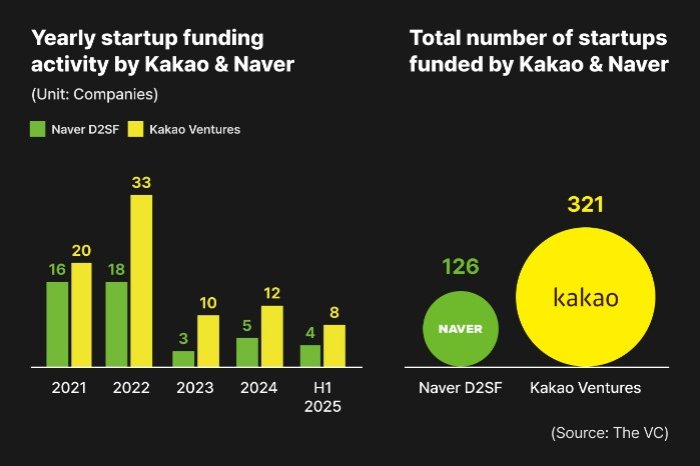

The pair, which respectively backed about 20 startups annually during 2021–2022, have since cut that pace by more than half, according to Seoul-based tracker The VC.

Now, their investments are skewed toward US-based companies developing next-generation AI technologies in hopes of tapping innovations that align with their core platforms or open up new growth paths.

AI IS A MUST FOR ANOTHER LEAP

According to the investment banking industry on Tuesday, Naver Cloud Corp., a cloud computing arm of Naver, recently led a Series A funding round for Urban Datalab, the developer of an AI medical platform, MeDiAuto, with its own investment of 3.5 billion won ($2.5 million).

Naver’s newly launched Naver Ventures also made its debut investment in TwelveLabs, a Silicon Valley-based startup with an unrivaled multimodal AI technology that has already attracted big-name backers, including Nvidia, Samsung Electronics Co. and Intel Corp.

“We are open to collaboration (between Naver and TwelveLabs) next year or later,” said Kim Sung-ho, head of Naver’s Immersive Media Platform team.

Naver’s renewed push into AI investing has gained further momentum since its founder Lee Hae-jin returned as chairman earlier this year.

“If David wants to beat Goliath, he must aim well with the right stone,” said Lee at a ceremony celebrating the opening of Naver Ventures, the company’s first dedicated overseas venture capital in Silicon Valley, last month. “We are in the middle of picking the right stone.”

In this analogy, Naver is the underdog battling US tech giants in the AI race.

Naver’s in-house corporate venturing (CV) team, D2SF, has also made a series of AI-focused investments this year.

It has invested in AI-powered logistics platform startup Techtaka; AI game developer Anchor Node; AI-supported autonomous driving technology developer whereable.ai; and multi-modal commerce AI startup Studio Lab.

Kakao has been similarly active in investing in AI companies.

According to The VC, Kakao Investment Co., Kakao’s venture investment arm, has recently invested 3 billion won in Seoul-based AI chip startup FurisosaAI Inc.

Its another venture capital company, Kakao Ventures Corp. has joined early-stage funding rounds of AI agent developer Tzafon and large language model startup Trillion Labs.

NORTH AMERICA EMERGES AS A NEW BATTLEGROUND

While the uptick in tech investment is a welcome shift after years of slowdown, Korean startups now worry they may be left behind.

Historically reliant on Kakao and Naver for early-stage capital, domestic startups fear the funding tide may be turning westward – just as global AI interest is surging.

Of five startups Naver D2SF has invested in 2024, three are US-based, including 3D content developer Claythis and YesPlz AI, a fashion-focused multimodal AI developer.

Kakao Ventures has also invested in FS2, a 3D AI chip design company led by MIT engineers; Oligo Space, an automated spacecraft design and production toolchain developer; and medTech startup Kompass Diagnostics.

To deepen its reach in the North American venture capital ecosystem, Naver opened D2SF’s US office in Silicon Valley last year and launched Naver Ventures in the global tech hub to scout growth-stage firms.

Kakao Ventures’ officials regularly visit the US once every two to three months to build ties with local VCs, engineers and researchers.

Investors see more room for upside in US startups than in their Korean counterparts, offering greater synergy.

“The ecosystem for tech-based startups is more mature in the US, and top US universities generate stronger pipelines of investable early-stage companies,” said an official from a Korean VC company.

The trend also reflects a strategic calculus, said industry observers.

Korean tech giants face less public scrutiny abroad compared to frequent domestic criticism over big tech firms’ aggressive M&A moves with startups after investment.

That’s prompting concern that capital could increasingly flow to overseas startups instead of bolstering the local tech scene.

“Startup funding is borderless,” said an official in the VC industry. “Without competitiveness to appeal globally, any startups won’t survive.”

Write to Eun-Yi Ko at koko@hankyung.com

Sookyung Seo edited this article.

Brand Stories

‘Cruising is booming:’ Why luxury hotel brands are launching lavish cruise ships | Exclusive

Ritz-Carlton and Four Seasons are two of the world’s most renowned and expensive and hotel companies.

But forget staying in their hotel rooms – they’re among the top travel brands taking to the water.

And Waldorf Astoria – which is owned by Hilton – is the latest travel firm to strike out, launching a luxury Nile cruise in 2026.

DEAL: Save hundreds on a Queensland holiday with Discovery Parks

More akin to mega yachts and much smaller than regular cruise ships these vessels hold just a few hundred cashed-up guests.

Ritz Carlton recently launched its third ship, Luminara, with an A-list filled party.

READ MORE: Why Orange is the ultimate winter escape you haven’t considered (but really should)

Models Kendall Jenner and Naomi Campbell, TV host Martha Stewart, and actors Orlando Bloom and Kate Hudson were among those invited to the extravagant party.

Outside of hotels, on-the-ground tour company Trafalgar announced it is also expanding into river cruising with two new ships, the Trafalgar Verity and Trafalgar Reverie, for sailings on the Rhine and Danube rivers, starting in April 2026.

Ted Blamey Principal at specialist cruise consulting firm CHART Management Consultants says there are many reasons all these firms want in on the water-bound holidays.

“The first is basically that cruising is booming, so it’s a great opportunity for experienced travel and accommodation companies to capitalise on,” he tells 9Travel.

“Second, I guess, would be, that these organisations, they have very powerful existing guest basis.

READ MORE: Hawaii is the most popular US destination for Aussies, as new figures show a major shift in travel

“They have a very significant number of past guests who are loyal to the brand, and love it, and why not offer them something new that will continue to get their loyalty and of course, earn revenues.

“I guess another reason is that these same people are open to new experiences.”

Meanwhile he said cruising is unique from a business point of view because guests are captive on the vessel much of the time.

And that means you can control their holiday – as well as retain much of the money they pay to be there.

READ MORE: Best time to visit Bali: How to avoid crowds, high prices and the rainy season

The new players are competing against other luxury cruise brands such as Crystal Crusies, Ponant, Explora Journeys, Azamara, Silversea, and Regent Seven Seas.

But this could be good for the whole industry Ted says.

“I think all of us in the industry have felt for years that competition is a good thing, it grows the market,” he says.

Even Orient Express, most famous for its lavish trains, is getting involved. It’s planning the world’s largest sailing ship, Orient Express Silenseas, for next year.

Smaller Swiss brand, Aman is also setting sail.

Meanwhile, images show the first vessel for Four Seasons won’t be anything like normal cruiser.

The yacht will have an extendable marina on both sides for water sports, swimming or simply posing for Instagram photos.

Captain Kate McCue has jumped ship from Celebrity Cruises to captain it.

But one thing all the vessels will have in common is that their high-net-worth guests can enjoy the finest things the world can offer.

That includes an almost one to one crew member to guest ratio, fine dining meals from top chefs and lavish suites with huge terraces.

Prices are not always widely advertised but run into the tens of thousands, making a trip something everyday Aussie cruises can only dream of.

Brand Stories

Vermont lawmaker co-chairs national AI task force

MONTPELIER, Vt. (WCAX) – A Vermont lawmaker has been selected to co-lead a national task force on artificial intelligence policy.

Bradford Democratic Rep. Monique Priestley co-chairs the task force with a Republican representative from Utah.

She says her focus is to learn more about how AI impacts consumer protection and data policy.

“Right now, AI is touching everything that we are interacting with. It’s used in software that determines if you can get a loan, if you can get an apartment, or whether or not you qualify for different education. Your health care is largely impacted by artificial intelligence,” Priestley said.

The task force will connect lawmakers with expert voices in the industry and create a first-of-its-kind bipartisan state AI policy memo to guide policymaking across the country.

Copyright 2025 WCAX. All rights reserved.

-

Brand Stories2 days ago

Brand Stories2 days agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 day ago

Brand Stories1 day agoOlive Living: India’s Intelligent, Community-Centric Hospitality Powerhouse

-

Destinations & Things To Do3 days ago

Destinations & Things To Do3 days agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

AI in Travel3 days ago

AI in Travel3 days agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse3 weeks ago

Asia Travel Pulse3 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel3 weeks ago

AI in Travel3 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoChatGPT — the last of the great romantics

-

The Travel Revolution of Our Era1 month ago

The Travel Revolution of Our Era1 month agoCheQin.ai Redefines Hotel Booking with Zero-Commission Model

You must be logged in to post a comment Login