Brand Stories

Nvidia Just Became the World’s First $4 Trillion Stock. This Artificial Intelligence (AI) Giant — Which Is up 686,000% Since Its IPO — Might Be Next.

Nvidia supplies the world’s best artificial intelligence (AI) chips for data centers. Demand is heavily outstripping supply, sending the company’s sales — and its stock price — surging over the last couple of years. In fact, on July 9, Nvidia became the first company in history to achieve a market capitalization of $4 trillion.

But Microsoft (MSFT 0.39%) is nipping at Nvidia’s heels in terms of valuation. Its stock has soared by a whopping 686,858% since its initial public offering (IPO) in 1986, and the company’s market cap is now over $3.7 trillion.

In other words, Microsoft stock needs to gain only 8% more to place the company alongside Nvidia in the $4 trillion club. Here’s why its growing presence in AI software and infrastructure could fuel that move.

Image source: Getty Images.

Microsoft developed a powerful AI assistant called Copilot

Since 2019, Microsoft has invested around $14 billion in ChatGPT developer OpenAI. It has used the start-up’s latest large language models (LLMs) to craft its own AI assistant, called Copilot, which is embedded in almost all of its flagship software products. Copilot is accessible for free through Windows, Bing, and Edge, and it’s available as a paid add-on in a host of other products, creating new revenue streams for Microsoft.

For instance, enterprises can add Copilot to their Microsoft 365 subscription for an additional monthly fee, where it can boost their employees’ productivity in applications such as Word, Excel, and Outlook. Enterprises around the world pay for more than 400 million 365 licenses, so the Copilot add-on could generate billions of dollars in recurring revenue over time. During the fiscal 2025 third quarter (ended March 31), the number of organizations using Copilot for 365 tripled compared to the year-ago period, so uptake has certainly been rapid so far.

Then there is the Copilot Studio platform, which enables organizations to create custom AI agents to suit their workflows. For example, a business can create one agent to deal with customer service queries on their website and another agent to help manage their logistics network. The platform had over 230,000 customers at the end of the fiscal 2025 third quarter, and I expect that number to climb significantly as AI adoption becomes more widespread.

AI could drive a long-term acceleration in Azure cloud revenue

Microsoft’s AI opportunity in the cloud might be even bigger than the opportunity created by Copilot. Its cloud computing platform, Azure, offers hundreds of digital services to enterprises, helping them with everything from simple data storage and web hosting to more complex tasks such as software development. Now, it provides a growing list of tools that enterprises need to fuel their AI ambitions.

Microsoft operates centralized data centers filled with the latest graphics processing units (GPUs) from suppliers like Nvidia, and it rents the computing capacity to enterprises that use it to train and deploy AI applications. Microsoft spent over $60 billion to build AI infrastructure during the first three quarters of fiscal 2025 to meet demand. It sounds like a massive number, but CFO Amy Hood says there is an eye-popping $315 billion order backlog from customers who are waiting for Microsoft to bring more data centers online.

Besides AI hardware, Azure also offers access to the latest third-party LLMs from leading developers like OpenAI. Enterprises can plug their internal data into these models to create custom AI software to suit their needs. Using a ready-made LLM is much faster (not to mention cheaper) than building a model from scratch.

Azure revenue grew by 33% year over year during the fiscal 2025 third quarter, which marked an acceleration from the 31% growth it delivered in the second quarter three months earlier. AI services accounted for a record-high 16 percentage points of that growth, which highlights just how important this segment has become to Microsoft’s cloud division. In fact, if not for AI, Azure’s revenue growth would probably be decelerating sharply.

Microsoft could be the next member of the $4 trillion club

Microsoft’s $3.7 trillion market cap makes it the world’s second-largest company behind Nvidia, and it’s comfortably ahead of third-place Apple, which is worth $3.2 trillion. Microsoft stock isn’t cheap right now, so it may take some time to gain the final 8% it needs to reach the $4 trillion milestone, but I predict it will beat Apple and every other company to the punch.

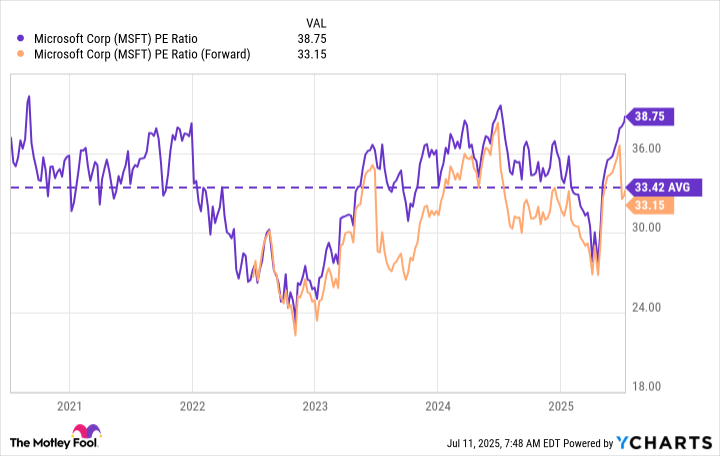

At the time of this writing, Microsoft stock is trading at a price-to-earnings (P/E) ratio of 38.7, which is a premium to its five-year average of 33.4. However, Wall Street’s consensus estimate (provided by Yahoo! Finance) suggests the company’s earnings per share could grow by 13% during fiscal 2026 (which officially started on July 1), placing its stock at a forward P/E ratio of 33.1:

MSFT PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

In other words, Microsoft stock would have to climb by around 17% over the next 12 months just to maintain its current P/E ratio of 38.7, which isn’t out of the question, considering the strong momentum in the company’s AI products and services. Since the stock market is a forward-looking machine, I think it’s possible for Microsoft shares to climb by 8% over the next six months or so, provided its quarterly financial results continue to come in as expected (or better).

As a result, I think Microsoft is likely to be the next member of the $4 trillion club.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Brand Stories

3 No-Brainer Artificial Intelligence (AI) Stocks to Buy Now and Hold Forever

Long-term competitive advantages ensure these companies aren’t some flash-in-the-pan AI stocks.

Excitement around artificial intelligence (AI) and its potential impact on businesses has led to soaring stock prices for many of the biggest tech companies. Nvidia, for example, has seen its stock price grow more than tenfold since the release of ChatGPT in late 2022, now topping $4 trillion in market cap.

Some investors may feel like they’ve missed the boat and they’re too late to buy AI stocks at a good price. It’s important to consider that today’s AI winners might not be the biggest companies to benefit from advancements in artificial intelligence over the long run. Finding a company that’s making excellent progress right now with sustainable long-term competitive advantages could end up being an even better stock to own when the dust settles.

These three companies are all well positioned to benefit from the continued growth and advancement in artificial intelligence. Their stocks are all attractive at today’s prices, too, which means you can buy them now and hold them forever.

Image source: Getty Images.

1. Amazon

Amazon (AMZN -0.23%) is home to the largest public cloud computing platform in the world, Amazon Web Services, or AWS. The segment generated $116.4 billion over the last 12 months, roughly 50% larger than its next-closest competitor, Microsoft‘s Azure.

Some have expressed concern about AWS for a few reasons. First, it was caught flat-footed as the generative AI opportunity was getting off the ground. That led it to cede market share to Microsoft and others who were earlier to invest in the space. However, it quickly course corrected, releasing its Bedrock platform, and it’s seeing triple-digit growth in AI services. As such, it’s been able to maintain most of its market share in a rapidly growing market (even though overall revenue growth has slowed to the high-teens).

The second reason is that AWS saw a significant decline in operating margin in the second quarter. Management explained half of that decline was due to the timing of stock-based compensation. The rest is explained by Amazon’s significant investments in capacity, as it notes the business remains capacity constrained. Over time, investors should see margin tick back up. It’s worth noting AWS still commands higher margins than its smaller competitors.

Meanwhile, the rest of Amazon looks strong. Its retail operations are seeing improved margins quarter after quarter, thanks in part to a strong advertising business. The international segment is notably on its way to becoming a meaningful contributor to operating income after years of investment.

The stock fell following the release of its second-quarter earnings based on a disappointing outlook. But the long-term potential for Amazon, particularly in AWS, remains strong. The pullback in price looks like an opportunity for long-term investors to buy this AI leader.

2. Salesforce

Salesforce (CRM -0.29%) provides a suite of software often found at the center of many enterprises’ operations. The company has seen very good results with its growing set of cloud-based software solutions, but the standout recently has been its Data Cloud offering. Data Cloud provides a single platform to aggregate all of a company’s data to create actionable insights from a single source.

Data Cloud recurring revenue grew to $1 billion in Salesforce’s most recent quarter, up 120% year over year. It’s seeing strong attachment, with 60 of its top 100 deals including Data Cloud in the contract. And the most recent product built on top of Data Cloud, Agentforce, is seeing very strong adoption.

Agentforce allows businesses to build AI agents that can execute tasks or provide customer service with minimal human intervention. The key to building successful AI agents is access to pertinent data, which is exactly what Data Cloud brings to the table. Management says it’s made 8,000 deals with Agentforce since its launch last fall, representing $100 million in revenue. That makes it Salesforce’s fastest-growing product ever.

Considering Salesforce’s software suite is entrenched in the operations of so many enterprises, it’s in a prime position to benefit from growing spend on artificial intelligence, particularly through Data Cloud. It’s unlikely to lose that position. In fact, its expanding suite of software tools only serves to increase the switching costs for a company. With shares trading for just 22 times forward earnings estimates, Salesforce looks like a great buy at today’s price.

3. Meta Platforms

Meta Platforms (META 0.92%) may be the biggest investor in artificial intelligence in the world. It’s on track to spend between $66 billion and $72 billion on capital expenditures, and it’s only building compute power for itself (unlike the other hyperscalers, who serve cloud customers). There’s a good reason Meta is spending more than everyone else on artificial intelligence; it could be the biggest beneficiary of all generative AI has to offer.

Signs of that are already coming through. In the second quarter, Meta’s ad prices climbed 9% year over year and impressions grew 11%. CEO Mark Zuckerberg notes a significant portion of that improvement came from its AI-recommendation model. Additionally, time spent on Facebook and Instagram increased 5% and 6%, respectively, thanks to bigger AI models.

But the future is bright, too. Meta’s generative AI tools for ad creative are seeing strong adoption. Zuckerberg notes “a meaningful… [percentage] of our ad revenue now… [comes] from campaigns using one of our Generative AI features.” Long term, Meta is working on an AI agent that can develop and test ad creatives autonomously.

Meta’s AI chatbot now boasts over 1 billion users, creating an additional channel for monetization over the long run. Meta only recently started putting ads in WhatsApp and Threads, which should provide additional ad revenue as advertising on Meta grows increasingly easier thanks to generative AI capabilities.

Meta’s seeing excellent financial results from the growing adoption of its advertising platform and increased engagement from its users. Revenue climbed 22% last quarter and operating income grew an impressive 38%. Meta’s growing depreciation expense will likely weigh on earnings going forward as long as it continues to ramp up spending, but if it continues to produce top-line growth like last quarter, that’s easily digestible.

If you back out the depreciation expense using EBITDA, Meta shares trade for an attractive price with enterprise value around 16 times forward EBITDA estimates. Even on a more traditional forward P/E valuation, Meta shares look to be well worth the 27 times multiple you’ll have to pay for the stock today.

Adam Levy has positions in Amazon, Meta Platforms, Microsoft, and Salesforce. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Brand Stories

1 Brilliant Artificial Intelligence (AI) Stock Down 70% You Might Regret Not Buying on the Dip in August

Lemonade is shaking up the insurance industry, and it’s attracting new customers at an accelerated pace.

Last week, I predicted Lemonade (LMND -7.34%) stock would surge once the company released its operating results for the second quarter of 2025 (ended June 30) on Aug. 5. It rocketed higher by 30% on the day, thanks to a spectacular report that showed continued momentum across the business.

Lemonade sells insurance, but with a twist: It relies on artificial intelligence (AI) to write quotes, process claims, and even price premiums, creating a faster, more convenient experience compared to traditional insurance companies.

Despite its recent gains, Lemonade stock is still trading 70% below its record high from 2021, when a frenzy in the technology sector drove its valuation to unsustainable heights. However, the company believes it can grow its business tenfold over the next decade, so the recent upside in its stock could have serious legs.

Image source: Getty Images.

Lemonade’s customer base is growing rapidly

Lemonade operates in the renters, homeowners, pet, life, and car insurance markets. Prospective customers who want a quote can visit its website and speak to an AI chatbot named Maya, which can provide one in under 90 seconds. Existing policyholders who need to make a claim can go through AI Jim, which can pay them out in less than three minutes without human intervention.

Lemonade’s approach is in stark contrast to the processes at traditional insurance companies, especially when it comes to claims, which often require several phone calls and lengthy waiting periods. Its popularity is soaring as a result; Lemonade had a record 2.7 million customers at the end of the second quarter, which was up 24% from the year-ago period. That growth rate marked an acceleration from its first-quarter result of 21%, which highlights the company’s momentum.

Further, Lemonade’s in-force premium (IFP, or the combined value of premiums from all outstanding policies) reached a record high of $1.08 billion in Q2, representing a 29% year-over-year increase. That was the seventh straight quarter in which IFP growth accelerated.

But there is more to Lemonade’s success than its fantastic customer experience. The company’s Lifetime Value (LTV) models, which are powered by AI, calculate the likelihood of a customer making a claim, switching insurers, and even buying multiple policies, in order to charge the most accurate premiums. These models also identify products and geographic markets that are underperforming, so management can pivot its operating costs to maximize revenue.

Lemonade significantly increased its revenue guidance for 2025

Lemonade’s soaring IFP wouldn’t mean much without a sustainable gross loss ratio, which is the proportion of premiums paid out as claims. The company believes a gross loss ratio of 75% is the sweet spot for a thriving insurance business, and it came in at an even better level of 70% during the second quarter.

When IFP increases and gross losses decline, the net result is more revenue. After discounting the premiums Lemonade paid to other insurers to reduce risk, its revenue came in at a record $164.1 million during Q2, which was up 35% year over year. That was comfortably above management’s forecast of $158 million.

On the back of the strong result, management increased its full-year revenue guidance for 2025 by a staggering $50.5 million, from $662 million to $712.5 million.

With all of that said, there is still some room for improvement at the bottom line. Lemonade’s preferred measure of profitability is adjusted earnings before interest, tax, depreciation, and amortization (EBITDA), where it lost $40.9 million during Q2. But it was better than the adjusted EBITDA loss of $43 million from the year-ago period, so the company is on the right track.

Plus, Lemonade had over $1 billion in liquidity on its balance sheet at the end of Q2, so it has plenty of runway to continue investing aggressively in growth initiatives, as long as its losses don’t increase too dramatically from current levels.

Lemonade stock might be cheap right now

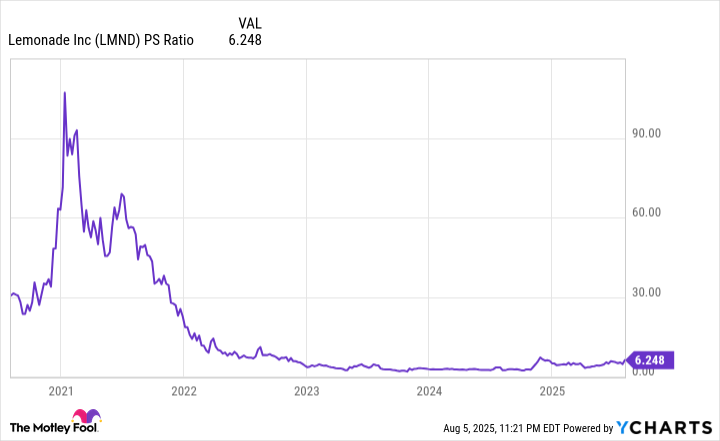

When Lemonade stock peaked during the tech frenzy in 2021, its price-to-sales (P/S) ratio topped 90, which was completely unsustainable. But the decline in the stock since then, combined with the company’s surging revenue growth, has pushed its P/S ratio down to just 6.1.

That’s near the cheapest level since Lemonade went public. Therefore, the stock still looks very attractive, even after the blistering gains that followed its Q2 earnings report.

LMND PS Ratio data by YCharts

As I mentioned, the recovery in Lemonade stock might just be getting started. The company plans to grow its IFP to $10 billion over the next decade, representing a near-tenfold increase from its current level, so investors willing to hold this stock for the long term could reap significant rewards from here.

Brand Stories

OpenAI launches GPT-5, a potential barometer for whether AI hype is justified – Toronto Star

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do3 weeks ago

Destinations & Things To Do3 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel3 weeks ago

AI in Travel3 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories1 month ago

Brand Stories1 month agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoContactless Hospitality: Why Remote Management Technology Is Key to Seamless Guest Experiences

-

Asia Travel Pulse1 month ago

Asia Travel Pulse1 month agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel1 month ago

AI in Travel1 month ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China