Hotels & Accommodations

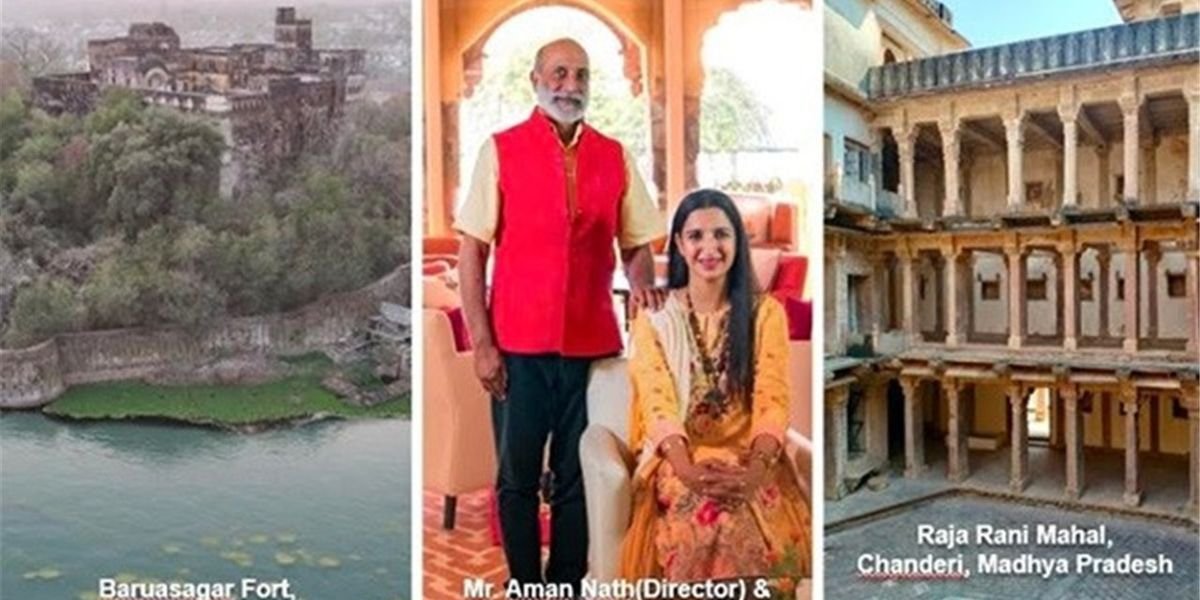

Neemrana Revives India Forts with Heritage Hospitality

The preliminary report, led by Indian authorities with experts from Boeing, General Electric, Air India, Indian regulators and participants from the U.S. and UK, raises several questions. The 15-page report stated that seconds after liftoff, both engine fuel control switches shifted from “RUN” to “CUTOFF” one second apart, shutting off fuel and causing engine failure.

Air India Flight AI 171, bound from Ahmedabad to London carrying 230 passengers and crew, crashed minutes after takeoff on June 12, killing 260 people in one of the deadliest aviation incidents in India in recent years.

The flight lasted about 30 seconds. The cockpit voice recorder captured one pilot asking the other why the “cut-off” was triggered, with the response denying responsibility. The recording does not identify who spoke.

At takeoff, the co-pilot was flying while the captain was monitoring. The switches were reset to their normal inflight position, triggering automatic engine relight. At the time of the crash, one engine was regaining thrust while the other had relit but had not yet restored power.

Aviation experts and Indian netizens have questioned both the report and Western media coverage that places sole blame on the pilots. The Pilots’ Association of India has objected to the investigation’s direction, alleging it presumes pilot guilt.

Fuel samples from the bowsers and tanks used to refuel the aircraft were tested at the DGCA lab and found satisfactory. Only a small amount of fuel was recovered from the APU filter and the left wing refuel/jettison valve. These samples will be sent to a facility equipped to test minimal quantities.

The report stated that the investigation team will review additional evidence from stakeholders.

Media reaction

After the report’s release, several media outlets attributed the crash to pilot error, naming Captain Sumeet Sabharwal, 56, and First Officer Clive Kunder, 32. The BBC headlined its story, “Pilot cut off fuel to engine — no fault with plane,” implying pilot responsibility, according to an Instagram post by Indian Pilot. Some reports also suggested the crash may have been a suicide.

The AAIB’s findings and their coverage drew criticism from the aviation sector. On Saturday, the Airline Pilots’ Association of India-I condemned the report’s “tone and direction,” alleging bias toward blaming the pilots.

“The investigation appears biased toward pilot error. ALPA-I rejects this presumption and demands a fair, fact-based inquiry,” said ALPA-I President Sam Thomas.

The association also reiterated its request to be included in the investigation as observers.

The Indian Commercial Pilots Association also condemned the suggestion of pilot suicide.

“We call upon media organisations and public commentators to act with restraint, empathy and respect for due process,” the ICPA said in a statement. “The crew of AI 171 acted in line with their training and responsibilities under challenging conditions. They deserve support—not vilification based on conjecture.”

The ICPA expressed “unwavering support” for the crew and criticised speculative narratives, particularly the insinuation of suicide.

“There is absolutely no basis for such a claim at this stage. Invoking such an allegation based on incomplete information is irresponsible and deeply insensitive to the individuals and families involved,” it said.

Ongoing investigation

Following the report’s release and the resulting debate, Union civil aviation minister Ram Mohan Naidu Kinjarapu clarified that the findings are preliminary and the matter remains under investigation, according to Times of India.

However, the report leaves key questions unanswered. It confirms that the engine fuel control switches moved from “RUN” to “CUTOFF” but does not explain how or why this occurred.

Former IAF director Sanjeev Kapoor called the report incomplete regarding the fuel switches.

“It is bizarre to suggest that any sane pilot would deliberately operate the fuel cut-off switches right after takeoff,” he told India Today. “Why would a pilot, having just lifted off manually, turn the aircraft 170 degrees just to shut down the engines? It defies logic.”

The investigation is ongoing, according to the agency. The team will review additional records, evidence, and information from stakeholders. The final report is expected in the coming months.

In June, Air India announced a 15 percent reduction in international widebody operations through at least mid-July following the crash.

Hotels & Accommodations

Now, Discover Modern, Design-Led Hotels with TRIBE’s Expanding Presence Across Europe

Sunday, August 3, 2025

London, United Kingdom – A modern hotel brand, TRIBE Hotels, part of IHG Hotels & Resorts, continues to grow further into Europe. IHG is now set to open multiple new hotels in Krakow, Paris, Budapest, Ljubljana and other major cities. TRIBE is renowned for its design-oriented hospitality and is known to offer modern, tiered, and affordable hotels. The speedy growth of this brand shows a soaring demand for excellently designed and affordable functional hotels for business and leisure travelers.

We’ve TRIBE Krakow Old Town now open, and Paris, Budapest, and Ljubljana as future projects, we can see the rapid development of TRIBE across the the rest of Europe, providing travelers modern and stylish hotels that showcase local culture.

A Brand Focused on Design for Today’s Travelers

TRIBE Hotels was launched in 2017 and has been committed to offering comfortable and functional design stays that are convenient and stylish for today’s traveler. Every hotel incorporates local and cultural design elements to give guests a refreshing yet modern feel. Every TRIBE hotel integrates local design elements to give a modern yet authentic feel. This approach, together with a design focus and a minimalist approach, guarantees that all TRIBE hotels deliver a remarkable stay.

New Openings Across Europe

TRIBE Hotels is further expanding their presence in Europe with the opening of new locations in key markets:

TRIBE Krakow Old Town, Poland: Opened in July 2025, this property is inspired by the cult TV show Twin Peaks, reflecting the cinematographic style of David Lynch. The hotel has 168 guest rooms, a coffee bar, a pan-Asian restaurant, a wellness area, and two meeting rooms. Moreover, the guests can relish the city and global local design while savoring Krakow’s rich history.

TRIBE Budapest Airport, Hungary: Located adjacent to Liszt Ferenc International Airport, this hotel, opened in May 2025, offers 167 guest rooms, five meeting rooms, a rooftop bar, and a fitness center. As one of the early adopters of BREEAM certification, one of the first BREEAM-certified Hotels in Hungary, it focuses on sustainable design while prioritizing guest comfort.

TRIBE Paris Pantin, France: This property is the newest addition to TRIBE, having opened in June 2025, and is situated pivot near La Villette’s cultural center.

The hotel includes a Social Hub with Italian restaurant, a fully equipped gym, a modern meeting room and philarmonic halls and zenith concert venues, and over 131 rooms, which gives a brilliant opportunity to explore Paris.

TRIBE Montpellier Gare Sud de France, France: This hotel is based further from the city centre, but is easy to reach via the Montpellier Sud de France train station. With 120 rooms, and a TRIBE restaurant, the hotel also includes a rooftop bar and swimming pool.

TRIBE Reims Centre, France: This hotel is one of the many TRIBE Redesigns and will be located right in the heart of the Champagne capital of France, Reims. With 92 guest rooms, the hotel will also feature a restaurant, meeting rooms and provide a rooftop terrace boasting beautiful views of the Reims Cathedral.

TRIBE Den Haag Centraal, Netherland: With a late 2025 opening, this is the only design hotel in featuring business oriented meeting rooms along with 159 guest rooms focused on leisure.

From the hotel’s rooftop bar, guests will enjoy breathtaking views of The Spui Square.

TRIBE Ljubljana, Slovenia: This hotel is expected to open in 2027 and will be the first hotel of the brand in Slovenia. It will be design driven, integrating the vibrancy of the city. The hotel will be centrally located and will have particular design features inspired by the city’s rich culture and history.

TRIBE Porto Gaia, Portugal: Scheduled for 2027, this hotel will serve as a stylish and functional TRIBE brand hotel in the dynamic Porto city, merging modern design and local cultural influences. The hotel will be located in a great area for exploring Porto’s rich history and wine culture.

TRIBE Rostock, Germany: Scheduled to open in 2028, the hotel will infuse new life into Germany’s Baltic coast. The property will have 157 rooms, a rooftop bar, and extensive meeting spaces, including an 115 m² auditorium which will elegantly host both business and leisure events.

Sustainability and Community Focus

Eco-friendly operations is at the core of the brand, and as part of its sustainability strategy many TRIBE hotels in Europe are pursuing BREEAM certification, reflecting the brand’s dedication to sustainability.

While sustaining ecological and environmental efforts in the hospitality industry, the hotel still guarantees that guests can relish on a cozy and a stylish stay.

What is TRIBE USPs for European Visitors

TRIBE Hotels is making business travel easier with their smart, design-forward hotel offering that includes a TRIBE branded restaurant. Each hotel includes high-speed internet and self-service kiosks, making it more efficient for business guests, and has flexible workstations. Every TRIBE hotel has a Social Hub, a shared space that combines work, leisure, and social activities in an engaging atmosphere. Guests can have a walk in the dynamic settings and relish healthy meals inspired from the local cuisine at TRIBE Table.

Hotels & Accommodations

US restricts staff from visiting Karachi hotels over security threat

The United States has temporarily restricted its government personnel from visiting upscale hotels in Karachi, Pakistan, following a reported threat targeting these establishments. The move was confirmed in a security alert issued Friday by the US State Department.

Hotels & Accommodations

Park Hotels & Resorts Embraces Strategic Capital Management To Navigate Market Challenges And Drive Growth

Sunday, August 3, 2025

Amid labor shortages, inflationary pressures, as well as evolving consumer preferences, Park Hotels & Resorts has invested in disciplined capital management. This year, the company’s asset rationalization focus and reallocation of capital has placed it well for both long-term value creation and short-term challenges.

From an investor’s standpoint, the company’s approach invites two critical considerations: first, whether its focus on value-add refurbishments and fine-tuning the asset mix can generate durable, above-average returns; and second, what unique variables set Park apart in an environment where rivals are increasingly squeezed by narrowing spreads.

Focusing Capital On High-Impact Growth

Park’s 2025 strategy is rooted in divesting non-core assets to fund more valuable projects. The 80 Million USD sale of the Hyatt Centric Fisherman’s Wharf in San Francisco, achieved with a remarkable 64x 2024 EBITDA multiple, exemplifies this approach.

This sale aligns with the company’s broader target of disposing of 300–400 Million USD in assets during 2025. If achieved, this could reduce net debt of 3.7 Billion USD by a significant margin, freeing up funds for reinvestment in high-potential properties.

In 2024, Park sold three hotels for 76 Million USD, achieving a trailing EBITDA multiple of 12.2x, including capital expenditures. The proceeds from these sales are being reinvested into major renovations at select properties. For example, the Royal Palm South Beach Miami is undergoing a 103 Million USD renovation to modernize 393 rooms and add 11 new ones.

While this project will impact Hotel Adjusted EBITDA by 17 Million USD in 2025, management anticipates a post-reopening return of 15–20% by 2026. Similar investments are planned for properties in Hawaii and New Orleans, aiming to capitalize on markets that are still recovering.

Strengthening The Balance Sheet And Rewarding Shareholders

Park’s capital reallocation strategy is focused on maintaining a balanced, disciplined approach to debt and liquidity. As of mid-2025, the company reported 1.3 Billion USD in liquidity, including a 950 Million USD revolving credit facility.

This flexibility provides the company with the ability to meet near-term obligations and prepare for the refinancing of a 1.3 Billion USD mortgage on its Hilton Hawaiian Village Waikiki Beach Resort in 2026.

Park’s commitment to shareholder value is evident in its repurchase of over 15% of its outstanding shares since 2022. In Q4 2024 alone, the company spent 26 Million USD on buybacks. Additionally, its quarterly dividend of 0.25 USD per share (yielding a 9% annualized return as of July 2025) further emphasizes its focus on returning capital to shareholders.

This combination of deleveraging and returning value positions Park as a growth and income hybrid in an industry where many peers prioritize one over the other.

Premium Assets In Gateway Cities

Park has carved out a unique position by focusing on premium properties in high-demand urban and resort locations. The acquisition of Chesapeake Lodging Trust in 2019, which added 18 upper-upscale hotels to its portfolio, diversified Park’s brand mix to include Marriott, Hyatt, and IHG properties.

This strategic move allowed Park to move beyond its Hilton-centric roots and tap into resilient market segments. In 2025, Park’s strategy is already paying off. Urban properties like the JW Marriott San Francisco and Hilton New York Midtown saw RevPAR growth of 17% and 10%, respectively, in Q2 2025.

These results contrast with broader industry trends, especially in Hawaii, where labor actions and slow international recovery have put pressure on RevPAR. By concentrating on high-traffic urban hubs, Park mitigates risks and benefits from the long-term appeal of premium accommodations.

Competing With Technology And Personalization

Park’s strategy aligns with key industry trends. Competitors like Hilton and Marriott are leveraging AI-driven automation and sustainability initiatives to reduce costs and enhance guest experiences. Park is following suit with its 103 Million USD renovation of the Royal Palm South Beach, which integrates smart technology and energy-efficient infrastructure.

Moreover, Park’s emphasis on personalized guest experiences, including tailored amenities and data-driven service, ensures it can compete with boutique operators targeting high-net-worth travelers.

Despite these advancements, the company’s strategy does face risks. The 17 Million USD EBITDA disruption from the Royal Palm renovation highlights the challenges of capital-intensive projects. Moreover, Park’s reliance on gateway markets makes it vulnerable to macroeconomic shifts, such as a global recession or a slowdown in international travel.

Balancing Risks And Rewards

Park’s strategy offers a promising long-term value proposition for investors. Its disciplined approach to asset rationalization, combined with a focus on high-return renovations and shareholder value, creates a self-reinforcing cycle: asset sales fund growth, growth drives cash flow, and cash flow enables further value creation.

Key metrics to watch include the success of its 2025 disposal targets, the post-renovation performance of the Royal Palm South Beach, and the refinancing of the Hilton Hawaiian Village mortgage.

Historical performance data also provides insights into how the stock has reacted around earnings releases. From 2022 to present, Park’s stock has generally shown positive short-term movement following earnings reports, with a 42.86% win rate over three days, a 35.71% win rate over ten days, and a 50% win rate over 30 days.

A Clear-Cut Strategy For Sustained Shareholder Value

Park Hotels & Resorts field-tested approach to asset rationalization and smart capital reallocation signals it is playing the long game even through immediate turbulence. Renovation-season noise and one-time EBITDA hits are no surprise to management, and the forward-looking balance sheet, on track to shed low-yielding assets in favor of a streamlined, higher-margin lineup, should firmly protect long-term profit expansions.

Coupled with steadfast discipline on non-essentials, the Company is trading near-term noise for a cleaner, higher-velocity revenue machine. Investors with a 3 to 5 year horizon should keep the name on the watch list, even look to nudge underweights, confident in the underappreciated optionality now pricing in a cautious market.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 week ago

Brand Stories1 week agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse4 weeks ago

Asia Travel Pulse4 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel4 weeks ago

AI in Travel4 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login