Dublin, Aug. 08, 2025 (GLOBE NEWSWIRE) — The “Taxi Market Trends & Forecast 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

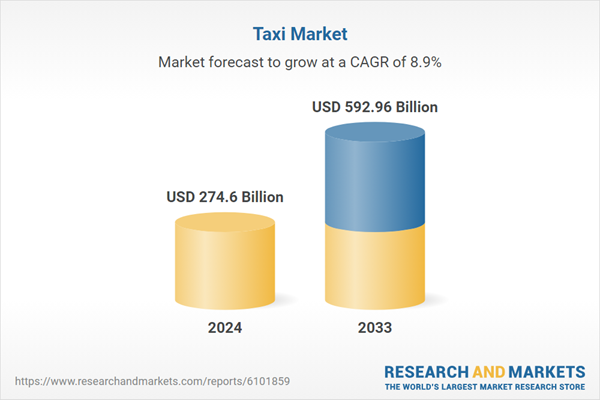

Taxi Market is expected to reach US$ 592.96 billion by 2033 from US$ 274.6 billion in 2024, with a CAGR of 8.93% from 2025 to 2033. Rapid urbanization, the extensive use of ride-hailing apps, and rising demand for flexible, convenient, and environmentally friendly modes of transportation are the main factors driving the region’s taxi industry

The need for transportation has increased due to the growing number of working professionals and visitors in metropolitan areas. Taxis, which usually provide speedier, more convenient alternatives to private vehicles, are made even more appealing by traffic congestion. Furthermore, ride-hailing applications improve convenience through quick reservations, well-planned routes, and clear pricing.

Regional differences exist in the worldwide taxi sector, with Asia-Pacific seeing rapid expansion, emerging regions in Latin America and Africa exhibiting rising demand despite infrastructural problems, and North America and Europe leading the way in ride-hailing adoption.

YelowSoft, for example, launched an in-app wallet for ride-hailing services in January 2024, allowing for smooth one-click payments, improved security, faster transaction speeds, and reward programs to increase customer retention and optimize operations. Furthermore, in cities with limited infrastructure, cabs are the best option when public transportation is unable to satisfy changing mobility needs.

Increased urbanization and the rising need for convenient transportation choices are driving the US taxi sector, which holds a sizable market share. As cities expand, traffic congestion increases, making taxis a more flexible option than private automobiles and public transportation. From ride-hailing applications and GPS integration to digital payment, the introduction of advanced technology in taxi services has significantly enhanced the client experience, making it easier and more efficient to acquire a trip. Another factor supporting sustainability and lowering carbon emissions is the use of electric or hybrid cars for cab rides.

For instance, in order to meet its 2030 all-electric fleet objective, Lyft extended its “Green” mode to 14 major U.S. cities in April 2023, allowing users to directly request electric and hybrid vehicles through the app. Additionally, the industry is further stimulated by government backing for smart city projects and ecological efforts. The U.S. taxi market’s development trajectory is being shaped by the growing preference for on-demand services, which is being driven by a tech-savvy populace.

Key Factors Driving the Taxi Market Growth

Population Growth and Urbanization

Metropolitan regions have grown significantly as a result of the world’s rapid urbanization, which has increased demand for more accessible and effective modes of transportation. The need for prompt and dependable transportation services, like taxis, grows as cities grow and population densities rise.

Due to traffic congestion, high maintenance expenses, a lack of parking spaces, and environmental issues, owning a private automobile might be problematic in densely populated metropolitan centers. Without the burden of ownership, taxis provide a versatile and reasonably priced substitute for both short- and long-distance travel requirements. The taxi industry is expanding and changing as a result of consumers’ increasing desire for on-demand transportation, particularly in developing nations experiencing rapid urbanization.

Growth of Ride-Hailing Services Based on Apps

The conventional taxi sector has seen a significant transformation due to the rise and quick uptake of app-based ride-hailing services like Uber, Lyft, Grab, and DiDi. By allowing users to schedule trips via smartphones with real-time monitoring, anticipated fares, and driver reviews, these digital platforms provide an improved user experience.

Quick service, clear pricing, and the simplicity of cashless transactions have all greatly raised consumer engagement and confidence. By using efficient matching algorithms, ride-hailing applications help drivers and fleet operators increase fleet utilization and decrease idle time. The taxi industry is seeing significant growth in both developed and emerging nations as a result of this digital revolution, which also increases operational efficiency and the client base.

Growing Travel for Business and Tourism

Another significant factor propelling the taxi industry is the increase in business and tourism travel worldwide. In unfamiliar places, tourists frequently depend on taxis for convenient, safe, and pleasant transportation, particularly when public transportation is scarce or difficult to use. In a similar vein, business travelers place a high value on timeliness and dependability, which makes taxis the perfect option for meetings, city trips, and airport transfers.

Both the leisure and business travel industries are thriving as a result of the growth of international flights and the increased demand for travel experiences. Because of this, there is a growing need for effective on-demand transportation services like taxis, which forces service providers to improve availability, multilingual assistance, and traveler-specific customer care.

Challenges in the Taxi Market

Workforce Problems and Driver Shortages

Professional drivers are becoming increasingly scarce in the taxi sector, a problem made worse by the COVID-19 epidemic and the growth of gig economy platforms. Traditional taxi businesses are finding it difficult to attract and retain talent as many drivers have moved to more flexible or lucrative options, such food delivery or ride-hailing services.

Long hours, uneven pay, safety issues, and little perks are some of the factors that make driving a cab a less desirable employment choice. The issue is further exacerbated by an aging workforce and a dearth of fresh hires. In order to draw and keep dependable drivers, fleet operators must figure out how to manage growing operating expenses while providing incentives, better working conditions, and competitive pay.

Gaps in technological adaptation

In a tech-driven industry, traditional taxi businesses are at a major disadvantage since they frequently embrace new technology more slowly than their ride-hailing competitors. Many still do not have integrated GPS navigation, computerized booking systems, real-time tracking, or cashless payment options – all of which are now considered necessities for contemporary travelers. This technical gap restricts market reach and lowers customer happiness, especially among younger, tech-savvy consumers who place a high value on ease and transparency.

Additionally, operational effectiveness and data-driven decision-making are hampered by inadequate tech integration. Taxi companies must engage in digital transformation to remain competitive, but these improvements can be challenging to execute successfully and on a large scale due to financial limitations, a lack of technological know-how, and employee reluctance to change.

Company Analysis: Overviews, Key Persons, Recent Developments, SWOT Analysis, Revenue Analysis

- BlaBlaCar

- Bolt Technologies OU

- Curb Mobility LLC

- (Didi Chuxing) Beijing Xiaoju Technology Co. Ltd

- Flywheel Software Inc.

- Gojek Tech

- Grab Holdings Inc.

- FREE NOW

- Kabbee Exchange Limited

- Lyft Inc.

- Uber Technologies Inc.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 200 |

| Forecast Period | 2024 – 2033 |

| Estimated Market Value (USD) in 2024 | $274.6 Billion |

| Forecasted Market Value (USD) by 2033 | $592.96 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

Key Topics Covered:

1. Introduction

2. Research & Methodology

2.1 Data Source

2.1.1 Primary Sources

2.1.2 Secondary Sources

2.2 Research Approach

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Forecast Projection Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Taxi Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share Analysis

6.1 By Booking Type

6.2 By Vehicle Type

6.3 By Service Type

6.4 By Countries

7. Booking Type

7.1 Online Booking

7.1.1 Market Analysis

7.1.2 Market Size & Forecast

7.2 Offline Booking

7.2.1 Market Analysis

7.2.2 Market Size & Forecast

8. Vehicle Type

8.1 Cars

8.1.1 Market Analysis

8.1.2 Market Size & Forecast

8.2 Motorcycle

8.2.1 Market Analysis

8.2.2 Market Size & Forecast

8.3 Other

8.3.1 Market Analysis

8.3.2 Market Size & Forecast

9. Service Type

9.1 Ride Hailing

9.1.1 Market Analysis

9.1.2 Market Size & Forecast

9.2 Ride Sharing

9.2.1 Market Analysis

9.2.2 Market Size & Forecast

10. Countries

10.1 North America

10.1.1 United States

10.1.1.1 Market Analysis

10.1.1.2 Market Size & Forecast

10.1.2 Canada

10.1.2.1 Market Analysis

10.1.2.2 Market Size & Forecast

10.2 Europe

10.2.1 France

10.2.1.1 Market Analysis

10.2.1.2 Market Size & Forecast

10.2.2 Germany

10.2.2.1 Market Analysis

10.2.2.2 Market Size & Forecast

10.2.3 Italy

10.2.3.1 Market Analysis

10.2.3.2 Market Size & Forecast

10.2.4 Spain

10.2.4.1 Market Analysis

10.2.4.2 Market Size & Forecast

10.2.5 United Kingdom

10.2.5.1 Market Analysis

10.2.5.2 Market Size & Forecast

10.2.6 Belgium

10.2.6.1 Market Analysis

10.2.6.2 Market Size & Forecast

10.2.7 Netherlands

10.2.7.1 Market Analysis

10.2.7.2 Market Size & Forecast

10.2.8 Turkey

10.2.8.1 Market Analysis

10.2.8.2 Market Size & Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Analysis

10.3.1.2 Market Size & Forecast

10.3.2 Japan

10.3.2.1 Market Analysis

10.3.2.2 Market Size & Forecast

10.3.3 India

10.3.3.1 Market Analysis

10.3.3.2 Market Size & Forecast

10.3.4 South Korea

10.3.4.1 Market Analysis

10.3.4.2 Market Size & Forecast

10.3.5 Thailand

10.3.5.1 Market Analysis

10.3.5.2 Market Size & Forecast

10.3.6 Malaysia

10.3.6.1 Market Analysis

10.3.6.2 Market Size & Forecast

10.3.7 Indonesia

10.3.7.1 Market Analysis

10.3.7.2 Market Size & Forecast

10.3.8 Australia

10.3.8.1 Market Analysis

10.3.8.2 Market Size & Forecast

10.3.9 New Zealand

10.3.9.1 Market Analysis

10.3.9.2 Market Size & Forecast

10.4 Latin America

10.4.1 Brazil

10.4.1.1 Market Analysis

10.4.1.2 Market Size & Forecast

10.4.2 Mexico

10.4.2.1 Market Analysis

10.4.2.2 Market Size & Forecast

10.4.3 Argentina

10.4.3.1 Market Analysis

10.4.3.2 Market Size & Forecast

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.1.1 Market Analysis

10.5.1.2 Market Size & Forecast

10.5.2 UAE

10.5.2.1 Market Analysis

10.5.2.2 Market Size & Forecast

10.5.3 South Africa

10.5.3.1 Market Analysis

10.5.3.2 Market Size & Forecast

11. Value Chain Analysis

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Pricing Benchmark Analysis

14.1 BlaBlaCar

14.2 Bolt Technologies OU

14.3 Curb Mobility LLC

14.4 (Didi Chuxing) Beijing Xiaoju Technology Co. Ltd

14.5 Flywheel Software Inc.

14.6 Gojek Tech

14.7 Grab Holdings Inc.

14.8 FREE NOW

14.9 Kabbee Exchange Limited

14.10 Lyft Inc.

14.11 Uber Technologies Inc.

15. Key Players Analysis

15.1 BlaBlaCar

15.1.1 Overviews

15.1.2 Key Person

15.1.3 Recent Developments

15.1.4 SWOT Analysis

15.1.5 Revenue Analysis

15.2 Bolt Technologies OU

15.2.1 Overviews

15.2.2 Key Person

15.2.3 Recent Developments

15.2.4 SWOT Analysis

15.2.5 Revenue Analysis

15.3 Curb Mobility LLC

15.3.1 Overviews

15.3.2 Key Person

15.3.3 Recent Developments

15.3.4 SWOT Analysis

15.3.5 Revenue Analysis

15.4 (Didi Chuxing) Beijing Xiaoju Technology Co. Ltd

15.4.1 Overviews

15.4.2 Key Person

15.4.3 Recent Developments

15.4.4 SWOT Analysis

15.4.5 Revenue Analysis

15.5 Flywheel Software Inc.

15.5.1 Overviews

15.5.2 Key Person

15.5.3 Recent Developments

15.5.4 SWOT Analysis

15.5.5 Revenue Analysis

15.6 Gojek Tech

15.6.1 Overviews

15.6.2 Key Person

15.6.3 Recent Developments

15.6.4 SWOT Analysis

15.6.5 Revenue Analysis

15.7 Grab Holdings Inc.

15.7.1 Overviews

15.7.2 Key Person

15.7.3 Recent Developments

15.7.4 SWOT Analysis

15.7.5 Revenue Analysis

15.8 FREE NOW

15.8.1 Overviews

15.8.2 Key Person

15.8.3 Recent Developments

15.8.4 SWOT Analysis

15.8.5 Revenue Analysis

15.9 Kabbee Exchange Limited

15.9.1 Overviews

15.9.2 Key Person

15.9.3 Recent Developments

15.9.4 SWOT Analysis

15.9.5 Revenue Analysis

15.10 Lyft Inc.

15.10.1 Overviews

15.10.2 Key Person

15.10.3 Recent Developments

15.10.4 SWOT Analysis

15.10.5 Revenue Analysis

15.11 Uber Technologies Inc.

15.11.1 Overviews

15.11.2 Key Person

15.11.3 Recent Developments

15.11.4 SWOT Analysis

15.11.5 Revenue Analysis

Companies Featured

- BlaBlaCar

- Bolt Technologies OU

- Curb Mobility LLC

(Didi Chuxing) Beijing Xiaoju Technology Co. Ltd

- Flywheel Software Inc.

- Gojek Tech

- Grab Holdings Inc.

- FREE NOW

- Kabbee Exchange Limited

- Lyft Inc.

- Uber Technologies Inc.

For more information about this report visit https://www.researchandmarkets.com/r/cw7tsq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

You must be logged in to post a comment Login