Travel Market Insights

Luxury travel market customization, personalization expected to hit $620.71 million by 2032: Report

85 percent of hoteliers view personalization as a crucial driver of commercial value

Personalization is rapidly emerging as a significant trend in travel and tourism, particularly within the luxury sector, as travelers increasingly seek experiences tailored to their individual preferences and lifestyles.

At Arabian Travel Market (ATM) 2025, senior executives from prominent hotel groups, including Minor Hotels, Fairmont, and Marriott, explored the rising impact of ‘hyper-personalization,’ which shifts away from generic services to offer bespoke guest experiences. By leveraging tools such as AI-driven customization and chatbots, along with personalized welcome amenities and tailored dining options, these brands are redefining the customer journey in the luxury travel segment, which continues to experience substantial growth worldwide.

According to the ATM Travel Trends Report 2025, developed by ATM in collaboration with Tourism Economics, 85 percent of hoteliers now view personalization as a key driver of commercial value, with customized experiences shown to generate additional revenue of up to 5 percent. Furthermore, insights from market intelligence firm Future Market Insight Inc. indicate that the global market for customization and personalization in travel is projected to reach $620.71 million by 2032.

During the panel discussion, experts defined hyper-personalization as delivering individualized experiences that anticipate both expressed and unspoken guest needs. While technology and Artificial Intelligence (AI) play a crucial role in providing customized offerings at scale, the panellists agreed that human connection remains vital for a truly personalized hospitality experience.

Read more: Arabian Travel Market 2025 concludes with 55,000 attendees, 16 percent YoY growth

Hyper-personalization in luxury hospitality

Nicolas Hauvespre, VP of luxury brands at MEA Marriott, stated: “When it comes to hyper-personalization, for many brands, this goes far beyond traditional service. It’s about creating something highly tailored and curated through leveraging technology and building on your culture, so you can develop that anticipatory service and meet both the explicit and unspoken needs of your guests.”

The panel, which also featured Loay Nour, vice president Fairmont Brand and Marketing Communications, and Amir Golbarg, Senior Vice President Minor Hotels, discussed the importance of establishing an emotional connection, anticipating guest needs, and nurturing this relationship over time.

“Luxury is not one size fits all; it’s no longer about recognizing someone by name or knowing their preferences in their profile. You need to understand that these consumers are not just hotel consumers; they are accustomed to an ultra level of personalization from other brands and industries they interact with, so they have a certain minimum of expectations,” Nour explained.

In the Middle East and Africa, Marriott is embracing this shift while preserving brand distinctiveness, expanding its luxury footprint with projects such as the Ritz-Carlton Reserve at Nujuma in Saudi Arabia’s Red Sea, which focuses on immersive cultural experiences. Upcoming openings in the region include a portfolio of curated Ritz-Carlton safari lodges in eastern Africa, set to pioneer new destinations and offer guests highly authentic experiences.

Future of luxury travel at ATM 2026

Meanwhile, owner-led hospitality companies like Minor Hotels are leveraging their lean structures to pilot new concepts in-house before global rollout. This operational flexibility has allowed the company to invest in curated, experience-driven offerings that prioritize quality over quantity. A recent success story is the 22-room Anantara Santorini Abu Dhabi in Ghantoot, which has exceeded expectations by concentrating on hyper-personalized offerings in a unique setting.

Danielle Curtis, exhibition director ME, Arabian Travel Market, commented on these insights: “As luxury travel evolves, so too does the definition of what it means to deliver highly personalized experiences. Today’s travelers seek more than exceptional service; they expect tailored journeys that reflect who they are and what they value. At ATM, we are witnessing how hospitality brands are rising to the challenge, providing guests with luxury experiences that are personalized, sustainable, and connected to people and place.”

Luxury travel will take center stage at Arabian Travel Market 2026, scheduled for 4 to 7 May at the Dubai World Trade Centre. Concurrently, travel technology will remain a critical focus as innovation continues to reshape the industry’s future and transform every stage of the traveler’s journey.

Travel Market Insights

Etihad Airways CEO Unpacks Big Bet on Small Jets

In a region known for flying enormous 777s and double-decker A380s, Etihad’s newest star is a single-aisle jet. The Gulf carrier took delivery of its first Airbus A321LR this week, a long-range variant of a plane more typically used for short economy-focused flights.

The UAE airline is betting on the new aircraft to supercharge its network growth and broader brand revival. As Etihad CEO Antonoaldo Neves told Skift: “Today we show the world we’re back in the game, and specifically back in the premium game.”

That game involves an aircraft type already familiar to many travelers. The A321LR, an evolution of Airbus’ best-selling narrowbody, is new-generation, but not exactly groundbreaking.

JetBlue took delivery of its first in 2021, while Aer Lingus, Air Transat, and SAS are among others to use the jet on short transatlantic hops. But it’s the speed and scale at which Etihad is adding the A321LR – along with its distinctive three-class configuration – that is piquing industry interest.

30, Not 20, A321LRs on the Way

Speaking at a media briefing at Airbus’ Finkenwerder factory in Germany, Neves left reporters scrambling for their notes. What was meant to be a tranche of 20 A321LRs became a throng of 30. Asked for clarity on the 50% increase, Neves quipped: “You guys are reading the wrong newspaper.”

Through a mix of leased aircraft and direct orders, Etihad will now receive 30 A321LRs over the next four years. A steady flow should result in 10 deliveries by the end of 2025, followed by another 10 the next year, then five each in 2027 and 2028. From the airline’s Abu Dhabi hub, the long-range jets will fly as far afield as Paris and Hanoi. Journey tim

Travel Market Insights

U.S. Hotel Industry Faces Continued Declines Amid Global Growth Trends

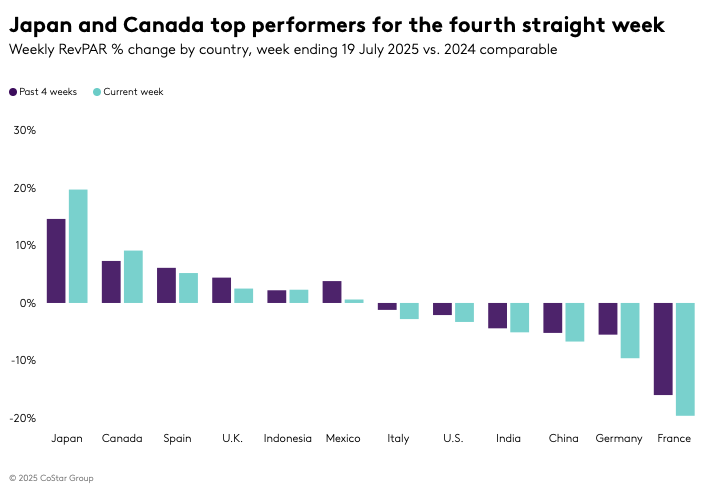

The U.S. hotel industry experiences a fourth consecutive week of declining revenue per available room (RevPAR), while Japan and Canada show strong growth in the global market.

U.S. Hotel Industry Trends

The U.S. hotel industry reported a continued decline in revenue per available room (RevPAR) for the week ending 19 July 2025, marking the fourth consecutive week of decreases. RevPAR fell by 3.3% year over year, slightly improving from the previous week’s 3.7% drop. The primary contributors to this decline were a 1.8% decrease in room demand and a 0.7% drop in the average daily rate (ADR). Despite a modest 0.8% increase in room supply, weekly occupancy fell by 1.9 percentage points to 71.6%.

The most significant RevPAR declines were observed in major metro markets, with the Top 25 Markets experiencing a 4.3% decrease and other metro markets seeing a 4.7% drop. Las Vegas, Houston, and Los Angeles were the primary drivers of this negative trend. Las Vegas experienced a 17.1% decline in RevPAR, primarily due to reduced international arrivals and the economic impact on lower-income households. Houston experienced a 38.3% drop due to tough comparisons with last year’s demand spikes from Hurricane Beryl and the “Derecho.” Los Angeles faced an 8.9% decline, with the Central Business District experiencing a 17.8% drop amid market tensions.

Impact on Different Market Segments

Excluding the three major markets of Las Vegas, Houston, and Los Angeles, the U.S. RevPAR would have declined by a lesser amount, at 1.9%. ADR, excluding these markets, was down by 0.2%, remaining below the rate of inflation. In the Top 25 Markets, RevPAR was relatively flat at -0.6%, with a 1.0% increase in ADR when excluding these markets.

Metro markets outside the Top 25 saw the largest RevPAR decline, at 4.7%, accompanied by a 2.8% decrease in ADR. Non-metro and rural markets also experienced decreases, primarily due to a 1.0 percentage point drop in occupancy. Since Memorial Day weekend, summer demand has decreased by 1.6 million room nights, or 0.7%, compared to the previous year, with ADR remaining flat at 0.1%. The Luxury segment was the only chain scale to see RevPAR growth, though demand increased in all scales except Economy and Independents.

Global Market Performance

Globally, RevPAR, excluding the U.S., increased for the third consecutive week, with a 0.5% rise driven entirely by ADR. Although occupancy fell by 1.3 percentage points compared to last year, it reached the highest level of the year at 72.2%. Japan maintained its top RevPAR position, with Osaka leading the gains, driven by the EXPO 2025 event. Canada posted the second-highest RevPAR gain, with ten of its 22 markets experiencing double-digit increases. Spain and the U.K. also showed strong performance, driven by significant events and increased travel.

Conversely, France and Germany experienced declines due to shifts in sporting event calendars, while China’s RevPAR fell by 6.7%, with significant declines in Beijing and Guangzhou.

Outlook

The U.S. hotel industry faces a mix of positive and negative signals moving forward. Analysts anticipate nuanced interpretations of performance data due to tough year-over-year comparisons, particularly in September and October, following the impacts of hurricanes Helene and Milton. Sociopolitical factors are also expected to affect short-term demand in select markets. Despite current challenges, American Airlines CEO Robert B. Isom expressed optimism, predicting that July will mark the low point, with performance expected to improve sequentially each month as demand strengthens.

Discover more at STR.

Travel Market Insights

Here’s How He’s Advising Other Hotel Groups

Neil Jacobs spent 13 years building Six Senses into a resort brand known for sustainability and wellness. Now, weeks after stepping down as CEO, Jacobs has launched Wild Origins, a new venture that advises hospitality groups and developers on everything from concept creation and brand strategy to design, operations, and execution.

“We can behave as a consultant, offering McKinsey-type advice in our industry, or we can actually do it for people,” Jacobs told Skift.

Wild Origins is currently advising Capella Hotel Group, which plans to increase its hotel openings next year. Jacobs is working with the group on growth strategy and senior leadership planning, including the recruitment of a new CEO.

“You go from opening one hotel every two or three years, to next year they’re g

-

Brand Stories6 days ago

Brand Stories6 days agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories23 hours ago

Brand Stories23 hours agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do7 days ago

Destinations & Things To Do7 days agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

AI in Travel7 days ago

AI in Travel7 days agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Destinations & Things To Do20 hours ago

Destinations & Things To Do20 hours agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

Asia Travel Pulse3 weeks ago

Asia Travel Pulse3 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel3 weeks ago

AI in Travel3 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login