Call it the White Lotus effect, but recent years have seen the emblematic crests of the world’s most luxurious and exclusive hotels – from the Ritz to Il Pelicano – become as valuable to such storied institutions as the rooms themselves. Such is the power of hotel ’merch’ – a way to demonstrate your affinity with the heady world of five-star hospitality, without the necessity of even staying a single night. The more obscure, the better: like an embroidered trio of fish on a bathrobe, which, for those in the know, will show you have stayed the night at Lake Como’s Passalacqua hotel – long a bolthole for the upper echelons, from world leaders to Hollywood royalty (or simply found your way to its webstore).

Here, as chosen by the Wallpaper* style team, a selection of these contemporary status symbols: from the cult Ritz Paris x Frame cap (now in its fourth iteration) to Jacquemus’ banana-hued accessories as part of his 2025 takeover of the Monte-Carlo Beach Club, and a T-shirt adorned with a perennial piece of Hollywood iconography: the Chateau Marmont sign.

Ritz Paris x Frame

Ritz Paris Cap

‘Laid-back insouciance’ is how Frame co-founder Erik Torstensson describes the latest iteration of the Los Angeles-based denim brand’s collaboration with Ritz Paris – the grand dame of French hospitality. The 35-piece collaboration (which launched in December) comprises crest-adorned knit polos, 1990s-inflected slogan sweaters and tees, though it is the ‘Ritz Paris’ cap which remains the most covetable take-home (and it’s still in stock).

Jacquemus

The Pompon Keyring

This summer, Simon Porte Jacquemus has partnered with Monte-Carlo Société des Bains de Mer to take over the Monte-Carlo Beach Club in his now-signature banana-yellow hue (think striped sunbeds, parasols and cushions which draw inspiration from his recent La Croisière collection). Alongside, a line-up of playful ‘merch’ – from stripey beach towels, caps and logo T-shirts, to key tassels evoking nostalgic hotel check-ins.

Sporty & Rich

Crest Seal Tote Bag

‘A special feeling history and elegance’ is how Emily Oberg, founder of Sporty & Rich, describes a stay at Le Bristol Paris, the opulent five-star hotel on Rue du Faubourg Saint-Honoré (founded in 1925, it celebrates a century in business this year). Oberg’s take on Le Bristol merch is less hallowed institution, more the hedonistic starlets that wander its halls – from thrown-in-everything tote bags to caps, slouchy hoodies, sports socks and monogrammed pyjama shorts,

Sporty & Rich

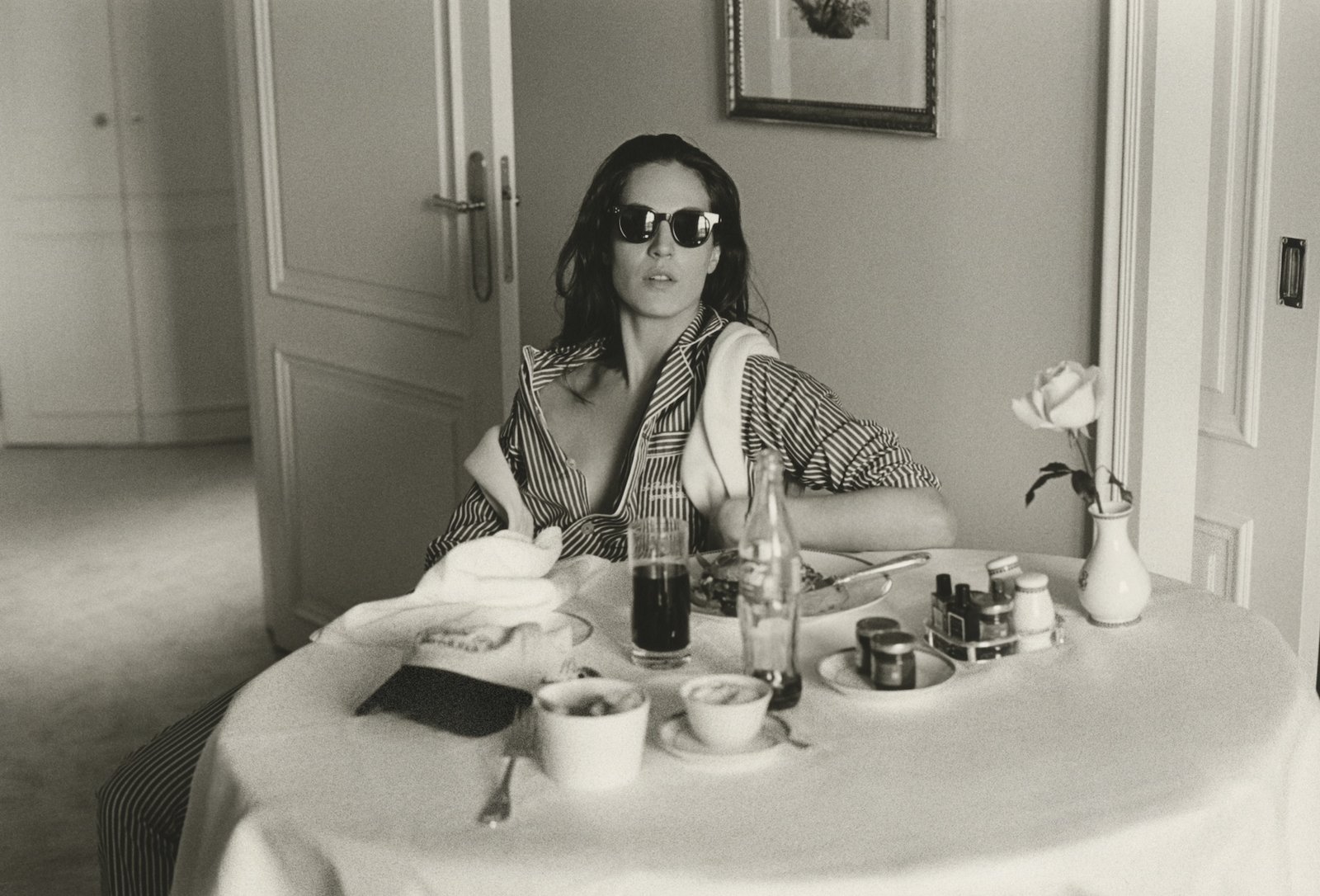

The Carlyle Script Pyjama Top

Over the pond, Oberg has united with The Carlyle, an emblematic Uptown institution which retains a mood of old-world New York glamour and dimly-lit discreetness. This striped pyjama shirt, embroidered with ‘The Carlyle’ monogram, is made for hotel-room luxuriating, though will equally elevate indolent days at home.

Passalacqua

Passalacqua Bathrobe

Preventing the need to commit in-room robbery, Passalacqua – a converted villa on the shores of Lake Como which has long housed the locale’s celebrity visitors – has made its bathrobe available for sale (without having to even check in). The memorable monogram, comprising three vertically stacked fish and derived from the crest of the Lucini Passalacqua family who built the villa in the late 18th century, will provide the right signal to those in the know.

The Standard x Hunza G

The Red Bikini

The rebooted Hunza G made Wallpaper’s list of the Best Swimwear Brands in the World (Mary Cleary praised its signature crinkle fabric as ‘universally flattering, with an extraordinarily stretchy composition that conforms to a wide range of body types’). A collaboration with The Standard sees its crinkle bikini reimagined in the hotel chain’s signature shade of signal red.

Issimo

Bar Roberto T-Shirt

Mythic Tuscan hotel Il Pellicano – perched cliffside in the idyllic Porto Ercole – has long been a bolthole for the international jet set, immortalised by the sun-soaked photographs of Slim Aarons. And, while there is an array of classic Il Pelicano merch available, we prefer this T-shirt by Issimo (the ‘the digital extension of the Pellicano world’) adorned with the logo for Bar Roberto, the hotel’s late-night piano bar, named after Roberto Sciò, who purchased the hotel in 1975.

PalmHeights

Christopher John Rogers X Palm Heights Sarong

Since its opening in 2019, Grand Cayman’s Palm Heights has become as well-known for the creative community it has fostered – an artist’s residency programme is ongoing – as it is for its serene interiors, populated by Marcel Breuer and Ettore Sottsass furnishings. A number of collaborations have appeared in its on-site shop, Dolores – like this gradient print silk scarf-cum-beach cover up by American designer and master colourist Christopher John Rogers.

Aman Essentials

Leather Charm and Card Holder Set

Since the opening of its first property, Amanpuri, on the shores of Phuket, Thailand, the Aman hotel group has become synonymous with a serene, whisper-soft luxury (at the intimate properties, staff can outnumber guests four to one). A thriving Aman brand is equally considered, spanning skincare, clothing and keepsakes – like this leather luggage tag and card holder – are stamped with the group’s distinctive logo.

Chateau Marmont

Chateau Marmont Black T-Shirt

Few hotels have achieved such mythic status as the Chateau Marmont in Los Angeles, which, since its opening in 1929, has become a hedonistic haven for legends of film, music and cinema, from Jean Harlow to Helmut Newton, F. Scott Fitzgerald to Jim Morrison. The hotel’s signature T-shirt features the Chateau’s distinct signage – a piece of Hollywood iconography in its own right.

You must be logged in to post a comment Login