Travel Trends

Kensington Releases Mid-Year Travel Trend Report

Kensington – the leader in private guided luxury travel – has released its Mid-Year Trend Report, Navigating Uncertainty in Affluent Travel, following up on its inaugural Travel Trends Report published in December. Informed by booking patterns, proprietary data, and an updated Affluent Traveler Survey conducted in partnership with Dig Insights (June 2025), the report sheds light on how high-net-worth (HNW) travelers are responding to a year shaped by economic, political, and global uncertainties.

The December report outlined several broad themes that continue to influence 2025: a rising interest in lesser-known destinations, a marked shift in seasonal travel patterns, and a deepening desire for seamless, exclusive journeys. Based on both internal data and two external surveys with Opinium Research and Dig Insights, that initial report underscored how luxury travel remains resilient and experience-driven. It documented growth in high-value trips, a resurgence in solo travel, and increasing investment in privacy-forward experiences like private villas and yacht charters. Those trends have proven foundational—and the mid-year data now reveals how traveler’s motivations are evolving in real time.

“We’re in a moment where global unpredictability is testing assumptions across the industry,” said Matt Cammaert, SVP of Marketing and Outside Sales. “And yet, the data tells a story of travelers who are adapting, not retreating. These shifts aren’t just reactive; they’re purposeful. Whether it’s staying closer to home or seeking out deeper experiences abroad, today’s traveler is making intentional choices.”

Trend #1: Affluent Americans Are Traveling Closer to Home

While about half of affluent travelers reported no major change in their travel habits, Kensington’s internal data shows a 60% year-over-year increase in U.S.-based trips and a rise in shorter-duration itineraries, which now make up over 9% of 2025 sales. The motivations range from convenience and scheduling flexibility to a cautious mindset shaped by economic or political concerns. Many travelers cited shorter flights, ease of planning, and the ability to decide closer to departure as key factors.

“It’s not just about proximity, but about control,” added Cammaert. “The domestic segment is growing because it meets today’s traveler where they are. They want high-end, high-touch experiences, but they also want to reduce friction.”

In response, Kensington is expanding elevated U.S.-based experiences, especially in National Parks, Alaska, and Hawaii. The company has also launched Kensington Concierge, a new division designed to assist travelers planning short domestic or international city breaks independently. The service offers flexible support, whether clients need help booking just a flight or hotel, or want assistance with extras like restaurant reservations.

Trend #2: Demand for Once-in-a-Lifetime Travel Remains Strong

Luxury travelers continue to prioritize unforgettable, one-of-a-kind experiences despite external uncertainties. Bookings in the ultra-luxe segment, defined as $2,000 to $3,000+ per person per day, have grown significantly. Interest in private yachts, villas, and VIP access to exclusive events remains robust, with 56% of surveyed travelers saying they plan to spend more on leisure travel this year than last and 36% said they are spending more this year for VIP-style treatment.

Kensington’s sister company, Kensington Yachts, and its Kensington Villas division are experiencing sustained growth across their respective categories. Yacht charter sales have increased by 94% year-over-year, while bookings in the first-tier ultra-luxe segment—defined as $2,000 to $3,000 per person per day—are up 47%. Notably, demand at the highest tier, with bookings exceeding $3,000 per person per day, has surged by 63.8%, underscoring a continued appetite for exclusive, high-touch travel experiences.

As a result, Kensington is expanding both its Villas and Yachts division and will soon launch Kensington Expeditions — custom experiences combining land-based exploration with private vessel charters, guided by leading scientists, historians, or adventurers.

“The needs of high-net-worth travelers aren’t typically impacted by the short-term economic changes that affect other parts of the market,” said Edita Sgovio, VP Kensington Yachts & Expeditions. “Their expectations are high, and they want experiences they can tell stories about – even boast about. They want to make lasting memories and will be loyal to travel brands that deliver on those high expectations.”

Trend #3: Africa’s Appeal Is Evolving

Safari remains a core driver of demand in Africa with bookings up over 50% in early 2025 but interest is widening. Travelers are seeking out historic cities, local culture, and non-traditional wildlife experiences such as gorilla trekking in Uganda. Kensington reports significant booking increases in countries such as Botswana, Tanzania, and Rwanda, signaling broader interest across the continent.

“Travelers are becoming increasingly interested in immersive experiences that allow them to step outside the 4×4 safari vehicles and engage and interact with the people and places they’re visiting. Whether it’s on foot, in a motorboat or canoe, or in a helicopter there are so many different experiences to enjoy from country to country.”

To meet this growing demand, Kensington has expanded its African product with itineraries such as “Rare Encounters: Primates of Madagascar & Uganda” and “Legends of the Wild: Uganda Luxury Safari.” From Ghana to Botswana, Zimbabwe to Senegal, Morocco to Madagascar, Kensington is investing in opportunities to offer clients new ways to explore the incredible breadth of African cultures.

To view the full report, click here. For more information on Kensington, visit www.kensingtontours.com.

Travel Trends

Bengaluru adds trains for festivals

To manage the increasing passenger traffic during the festive period of Independence Day and Ganesh Chaturthi, the Indian Railways has announced three special trains from Bengaluru to Goa and Belagavi. These services aim to clear the extra rush of travellers heading to their hometowns or preferred destinations during the holidays. The initiative has been welcomed by citizens, especially those who face difficulties booking tickets during peak festival seasons.

The three trains—numbered 06541, 06545, and 06543—will operate on specific dates in August. For example, train 06541 will depart from Sir M Visvesvaraya Terminal in Bengaluru on August 11 and reach Vasco Da Gama in Goa the next day. The return journey is scheduled with train number 06542 from Vasco on August 12. These limited-run trains are a practical solution to accommodate increased seasonal demand without overburdening regular services.

Train number 06545 will run from Bengaluru to Belagavi on August 12, returning as train number 06546 on August 13. Similarly, the third special train, 06543, will depart for Goa on August 16 and return on August 17. These trains will have stoppages at major stations like Tumakuru, Arsikere, Hubballi, and Londa to maximize accessibility for passengers across Karnataka. This careful routing opens the door to better travel options for residents beyond just Bengaluru.

Each of these trains will be fully reserved, with categories such as sleeper class, AC coaches, and general compartments included. Travellers are advised to book tickets in advance to secure seats, especially since no unreserved seating will be available. This measure ensures a smoother boarding process and a more organised journey for everyone involved.

The introduction of these special trains reflects Indian Railways’ readiness to respond to regional travel needs during national and cultural holidays. It opens a convenient door for those seeking to reconnect with family, attend religious festivities, or simply enjoy a break. With enhanced service and thoughtful scheduling, these routes promise a smoother festive experience for Karnataka’s travelers.

Travel Trends

EU Holiday Package Prices Rise in 2025

Eurostat data shows that package holiday prices in the European Union rose in June 2025 compared with the previous year, with variations between countries and markets. While the EU’s overall inflation rate stood at around 2.5% annually, package holidays registered a slightly higher increase of 2.8% for consumers. International holiday packages, which take travelers outside their home countries, saw prices climb by 2.7%.

The data also highlights significant differences between individual countries. In Germany, a key source market for Mediterranean tourism including Turkey, package holiday prices increased by 1.6%. France recorded a rise of 1%, while Italy saw a much sharper increase of 5.4%. Poland, considered a growing market for outbound travel, reported an annual rise of around 5.1% in package holiday prices.

Understanding EU Package Holiday Prices

Package holidays include a combination of travel, accommodation, meals, guides, and other services. They often come in the form of all-inclusive vacations or tours and can also cover half-day and one-day excursions or religious pilgrimages. International packages involve travel to a destination outside the traveler’s home country, while domestic packages are confined to destinations within national borders.

The overall 2.8% increase in EU package holiday prices is slightly above the general inflation rate, indicating that travel costs are rising faster than average consumer prices. These increases vary greatly by country, influenced by demand trends, seasonal patterns, and destination-specific factors.

Package Holiday Price Changes in Key Markets

| Country | Annual Change (%) |

|---|---|

| EU average | +2.8 |

| International packages (EU) | +2.7 |

| Germany | +1.6 |

| France | +1.0 |

| Italy | +5.4 |

| Poland | +5.1 |

Turkey Leads in Tourism Inflation

In June 2025, tourism-related inflation—covering hotel and restaurant spending—was highest in Turkey, reaching 35.6%. This figure places Turkey well above all other European destinations. Data compiled by Turizmdatabank from Eurostat shows that North Macedonia followed with a 10.6% increase.

Among Turkey’s main competitors in the tourism sector, the rate of tourism inflation was considerably lower. Spain recorded 4.2%, France 2.8%, and Italy 3.6%. The EU’s overall tourism inflation rate, combining hotel and restaurant costs, stood at around 4.1%.

Tourism Inflation Rates in Selected Countries

- Turkey: 35.6%

- North Macedonia: 10.6%

- Spain: 4.2%

- France: 2.8%

- Italy: 3.6%

- EU average: 4.1%

Why Turkey’s Prices Stand Out

For European travelers, Turkey is often considered a relatively affordable destination due to currency exchange rates. However, the data shows that in local terms, costs for accommodation and dining have risen significantly. This trend suggests that while Turkey may still appear inexpensive for visitors paying in euros or other strong currencies, domestic price increases are outpacing those in competing destinations.

The rise in tourism inflation may be linked to high demand, changes in supply conditions, and broader economic pressures. Seasonal peaks, increased operating costs for hotels and restaurants, and global market shifts can all contribute to these price trends.

Outlook for the Travel Industry

As 2025 progresses, the travel industry in Europe faces a mix of opportunities and challenges. Rising package holiday prices and tourism inflation may influence traveler decisions, potentially shifting demand toward less expensive destinations or alternative travel formats. At the same time, strong demand in many markets suggests that consumers remain willing to spend on travel experiences despite broader economic concerns.

Industry stakeholders—from tour operators to hoteliers—will be watching pricing trends closely. Balancing affordability with profitability will be key to sustaining growth, especially in competitive markets. For destinations like Turkey, managing rapid price increases while maintaining appeal to international travelers will be an important consideration moving forward.

Travel Trends

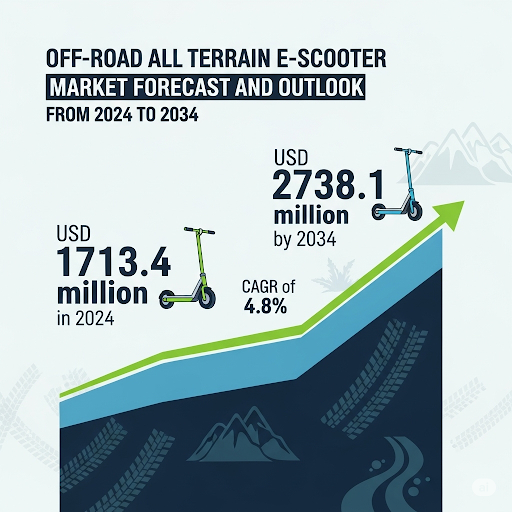

Global Off-road All Terrain E-Scooter Market to Surpass USD 2,738.1 million by 2034 Amid Rising Eco-Travel and Adventure Tourism Trends – FMIBlog

The global off-road all terrain e-scooter market is on a steady growth path, projected to reach USD 1,713.4 million in 2024 and surge to USD 2,738.1 million by 2034, expanding at a CAGR of 4.8%. This growth is fueled by a combination of environmental awareness, a surge in eco-tourism, and the rising popularity of outdoor recreational activities. As more regions implement emission-free travel zones and adventure sports gain global traction, off-road e-scooters are emerging as the go-to choice for sustainable, rugged mobility.

The shift in consumer preference toward eco-friendly transportation, driven by rising environmental concerns, is boosting the demand for e-scooters. These zero-emission alternatives are also gaining popularity for off-road use and in tourist areas that restrict gas-powered vehicles, catering to the growing trend of off-road adventures and sustainable travel.

Uncover Essential Data – Get A Sample Copy https://www.futuremarketinsights.com/reports/sample/rep-gb-14771

Market Trends Highlighted

- Eco-Conscious Mobility on the Rise

Growing environmental concerns are reshaping consumer transportation preferences.

Off-road all terrain e-scooters offer a zero-emission alternative to traditional gas-powered vehicles, aligning with global sustainability goals.

- Adventure and Outdoor Tourism Boom

Recreational off-road activities, such as mountain trail rides, beach exploration, and nature park expeditions, are becoming increasingly popular.

Many tourist destinations now enforce emission-free travel, boosting demand for electric off-road vehicles.

- Technology Advancements in E-Scooter Design

Manufacturers are investing in better suspension systems, enhanced battery capacities, and rugged tire technology for challenging terrains.

Integration of GPS, smartphone connectivity, and advanced safety features is becoming standard.

- Government Support and Incentives

Several countries are offering subsidies, tax benefits, and infrastructure development for electric vehicle adoption.

Regulations restricting gasoline-powered recreational vehicles are creating new market opportunities for electric alternatives.

- Rising Demand in Developing Markets

Emerging economies in Asia-Pacific are witnessing rapid adoption due to affordability improvements and the availability of durable, high-performance models.

Key Takeaways of the Report

- Market Value Growth: From USD 1.71 billion in 2024 to USD 2.73 billion by 2034 at a 4.8% CAGR.

- Primary Demand Drivers: Increasing environmental concerns, eco-tourism expansion, and rising recreational adventure activities.

- Technological Innovation: Enhanced suspension, longer battery life, and GPS integration are improving off-road capability.

- Tourism Policies: More destinations are enforcing emission-free travel zones, directly benefitting electric off-road vehicles.

- Regional Leaders: India is expected to record the highest CAGR of 7.2%, followed by China (5.4%), Spain (3.6%), and France (3.4%).

- Future Outlook: Greater penetration in rural and adventure tourism markets, with opportunities for rental services and tour operators to adopt electric fleets.

Off-road All-Terrain E-scooter Market: Market Concentration

The off-road all-terrain e-scooter market is divided into a tiered structure. Tier 1 is comprised of stable, well-known companies like Dualtron and Kaabo Wolf, which have high production capacity, extensive product portfolios, and a broad market presence. Tier 2 companies, such as Inokim and Zero Scooters, are globally recognized but operate primarily in specific regions. Finally, Tier 3 consists of smaller, less formalized businesses like Mercane and Varla Scooter that have a limited regional reach and focus on local demands.

Regional Market Outlook

Asia-Pacific:

India leads the global market with a 7.2% CAGR forecast from 2024 to 2034, driven by government incentives for electric mobility, strong tourism growth, and increasing consumer interest in sustainable travel. China follows with a 5.4% CAGR, supported by rapid urbanization and expanding EV infrastructure.

Europe:

Spain (3.6% CAGR) and France (3.4% CAGR) are among the top European adopters, with Italy also showing steady growth at 3.1% CAGR. Strict environmental regulations, rising popularity of e-scooter rentals, and scenic off-road routes are spurring market adoption.

Top Players in Off-road All Terrain E-scooter Market

- Xiaomi Corporation

- Voro Motors

- Segway

- Apollo Scooters

- GOTRAX

- Aovopra

- INOKIM

- KAABO

- Kugoo

- Techlife

- Evercross

- Dualtron

Off-road All Terrain E-scooter Market Segmentation Overview

By Motors by Type:

Based on Motors by Type, the off-road all terrain e-scooter market is segmented Single Motor (Two Wheel, Three Wheel), Twin Motor (Two Wheel, Three Wheel).

By Battery Type:

Based on Battery Type, the off-road all terrain e-scooter market is segmented into Lithium-Ion Battery (Up to 250 Watts, 250 to 450 Watts, 450 to 700 Watts, Above 700 Watts), Lead Acid Batteries (Up to 250 Watts, 250 to 450 Watts, 450 to 700 Watts, Above 700 Watts), and Nickel Metal Hydride Batteries (Up to 250 Watts, 250 to 450 Watts, 450 to 700 Watts, Above 700 Watts).

By Speed Rating:

Based on Speed Rating, the off-road all terrain e-scooter market is segmented into Below 20 mph, 20 to 40 mph, Above 40 mph.

By Distribution Channel:

Based on Distribution Channel, the off-road all terrain e-scooter market is segmented into OEM, E-commerce, and Others.

By Region:

Information about key countries of North America, Latin America, Western Europe, South Asia, East Asia, and the Middle East and Africa.

Stay Ahead Grab the Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-14771

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do3 weeks ago

Destinations & Things To Do3 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel3 weeks ago

AI in Travel3 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories1 month ago

Brand Stories1 month agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoContactless Hospitality: Why Remote Management Technology Is Key to Seamless Guest Experiences

-

Asia Travel Pulse1 month ago

Asia Travel Pulse1 month agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel1 month ago

AI in Travel1 month ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

You must be logged in to post a comment Login