Hotels & Accommodations

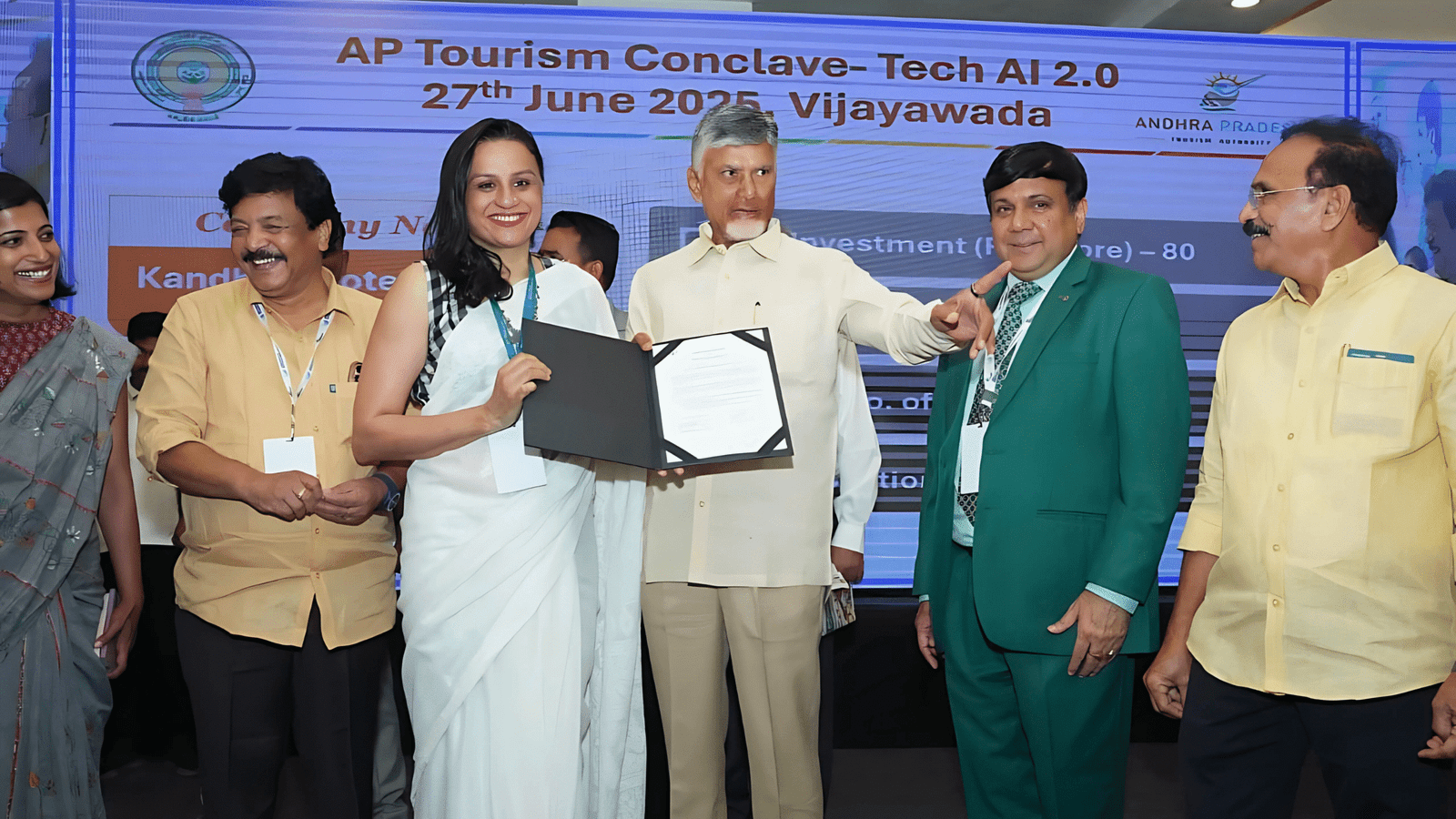

JüSTa Hotels & Resorts ink MoU with Andhra Pradesh Tourism Authority to boost hospitality investment

JüSTa Hotels & Resorts, a premium boutique hotel brand operated by Onora Hospitality Pvt. Ltd., has signed a Memorandum of Understanding (MoU) with the Andhra Pradesh Tourism Authority, marking a significant step toward enhancing hospitality infrastructure and tourism-led development in the state.

The MoU was signed by the Chief Executive Officer of Andhra Pradesh Tourism Authority Ms Amrapali Kata and Richa Khurana Singh, Vice President – Development, Justa Hotels & Resorts and was unveiled at the Tourism Conclave at Vijaywada in presence of the Andhra Pradesh Chief Minister Shri Chandra Babu Naidu.

Under this partnership, Justa Hotels & Resorts will act as a strategic Partner to the Government of Andhra Pradesh, enabling brand affiliations and extending hospitality expertise to investors interested in developing hotels and resorts across key destinations in the state. The collaboration is aimed at accelerating the creation of high-quality, boutique and premium properties that align with Justa’s commitment to design-led, locally inspired hospitality.

As per Ashish Vohra, Founder & CEO, jüSTa Hotels & Resorts, “We are proud to partner with the Andhra Pradesh Tourism Authority to support their vision of making the state a vibrant, world-class tourism destination and remain excited about the forward-looking tourism policy of the state under the able leadership of Mr Naidu and his team.”

“Through this collaboration, we look forward to accelerating the growth and presence of JüSTa Hotels & Resorts in the state with both the business and leisure hotel offerings through our brands ‘JüSTa’ ‘Nuo by JüSTa’ and ‘Bookmark Resorts’,” added Richa Khurana Singh, Vice President – Development, Justa Hotels & Resorts.

Hotels & Accommodations

Lions Tour a roaring success for Accor hotels

Torrential rains couldn’t dampen the spirits of Sydney hoteliers this weekend, with rugby fans packing out hotels for the final test of The British and Irish Lions Tour.

A crowd of 80,312 attended Saturday night’s Wallabies v Lions match at Accor Stadium, with Accor hotels also having cause for celebration, reportinga combined occupancy of 97% for Sydney Centre and 95% for Sydney West.

Sydney is the last city to experience the Lions effect, which Accor has declared “a nationwide tourism triumph”, with tens of thousands of travelling fans driving record hotel occupancies and major economic benefits across the country.

“From Perth to Sydney, the influx of international and domestic visitors is driving exceptional results for our hotels and the broader visitor economy,” said Accor Pacific Chief Operating Officer, Adrian Williams.

“This tour is a powerful reminder of the impact major sporting events have in energising cities, filling hotels, and supporting restaurants, bars, and attractions nationwide.”

For the majority of games, Accor hotels in hosting cities achieved occupancy rates above 90%.

In Adelaide, Accor hotels hit 100% occupancy on July 12 for the Invitational AU and NZ vs The Lions game, while the Western Force vs Lions clash in Perth saw the largest year-on-year growth with a +21% increase, reaching 92% occupancy for Accor hotels on June 28.

The Lions effect even eclipsed the star power of Taylor Swift for Accor hotels across Melbourne, which recorded 99% occupancy for the Wallabies vs Lions match – Accor’s highest ever occupancy result for Melbourne Centre, surpassing the Taylor Swift effect, which peaked at 96%.

Accor’s booking platform, ALL.com, has also experienced a surge in bookings from the UK and Ireland in the past four weeks compared to 2024, with international stays up 92.9%.

“This isn’t just a win for rugby – it’s a win for tourism, hospitality and every community lucky enough to host a game,” added Williams.

Many Accor hotels across the country leaned into the buzz of the major sporting event by creating guest-focused experiences, from themed food and beverage promotions to playful lobby activations.

Hotels & Accommodations

Sinclairs Hotels Faces Evaluation Shift Amid Declining Profits and Stock Performance

Sinclairs Hotels, a microcap player in the Hotels & Resorts industry, has recently undergone an adjustment in its evaluation. This revision reflects a shift in the technical landscape surrounding the stock, moving from a mildly bullish stance to a more neutral position.

Key financial metrics indicate that the company has faced challenges in recent quarters. For instance, the latest quarter reported a significant decline in profit before tax, which fell by 31.19%, while profit after tax decreased by 28.9%. Over the past five years, net sales have grown at an annual rate of 3.29%, and operating profit has seen a modest increase of 2.33%.

The stock’s performance relative to the Sensex shows a return of -5.50% over the past year, contrasting with a 3.15% gain in the index year-to-date. Additionally, the company’s return on capital employed (ROCE) has reached a low of 14.26%, and its return on equity (ROE) stands at 12.1%.

Despite these challenges, Sinclairs Hotels maintains a low debt-to-equity ratio, which may provide some stability in its financial structure.

Hotels & Accommodations

Cindrella Hotels Faces Mixed Market Sentiment Amid Evaluation Score Adjustment

Cindrella Hotels, a microcap player in the Hotels & Resorts industry, has recently undergone an adjustment in its evaluation score. This revision reflects a shift in the technical trends observed in the stock’s performance metrics. Notably, the technical indicators have transitioned from a bullish stance to a mildly bullish outlook, suggesting a nuanced change in market sentiment.

The stock’s current price stands at 67.69, down from a previous close of 71.25, with a 52-week high of 81.58 and a low of 50.00. Over the past week, Cindrella Hotels has experienced a stock return of -7.90%, contrasting with a -1.06% return from the Sensex. However, on a year-to-date basis, the stock has shown a return of 4.14%, slightly ahead of the Sensex’s 3.15%.

Despite the recent positive financial performance reported for Q4 FY24-25, including a notable growth in net sales and an increase in profit after tax, the company faces challenges with long-term fundamental strength. The average return on equity is recorded at 6.38%, and the ability to service debt remains a concern, as indicated by a low EBIT to Interest ratio of 0.14.

Overall, the adjustment in evaluation for Cindrella Hotels highlights the complexities of its market position and performance indicators, reflecting both short-term achievements and long-term challenges.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 week ago

Brand Stories1 week agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories1 month ago

Brand Stories1 month agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse1 month ago

Asia Travel Pulse1 month agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel1 month ago

AI in Travel1 month ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoContactless Hospitality: Why Remote Management Technology Is Key to Seamless Guest Experiences

You must be logged in to post a comment Login