Brand Stories

Five years on from COVID, how does the hotel industry look? JLL has an idea.

One thing is certain: Beyond carrying a melody, that Taylor Swift sure can put heads in beds. Her Eras Tour killed, not only in arenas across the globe, but in hotels: Swifties, young and old, need a place to stay when they aren’t Swifting, after all. Her tour not only broke records, but it also literally shifted local economies and, undoubtedly, was responsible for basis-point RevPAR gains from Minneapolis to Melbourne.

A shame there won’t be a repeat performance.

Still, the hotel industry had much else to cheer in 2024 with even better prospects for 2025, according to the just-released JLL Hotels and Hospitality Research’s Global Hotel Investment Outlook 2025. One of the most salient findings is that consumers continue to prioritize travel, though the composition might be changing five years clear of the COVID pandemic. While leisure travel was the highest makeup of demand coming right out of COVID, it is now moderating, but stepping in to fill the void are group, corporate and international travel, which JLL predicts will accelerate meaningfully and fuel anticipated 3% to 5% global RevPAR growth in 2025. This should only improve with many companies mandating full-time, back-to-office mandates that can further fuel business travel.

Performance, JLL noted, will remain uneven across regions, with Asia-Pacific likely to see the largest growth driven by the continued recovery of Chinese travelers, which has lagged globally up to now. What to watch for? Muted supply growth, which remains below historical levels, but will benefit hotels particularly in urban markets and other high barrier-to-entry markets.

Though RevPAR has historically been the biggest measure of performance success, hotels, from select-service to full-service, are no longer just places to sleep and benefit from many different streams of revenue as the lines between work, life, and travel become increasingly blurred. “Hotels have morphed into the new ‘third place’ as they extend beyond just places to sleep,” said Zach Demuth, global head of hotels research, JLL Hotels & Hospitality Group, who contributed to the report.

What’s the Deal?

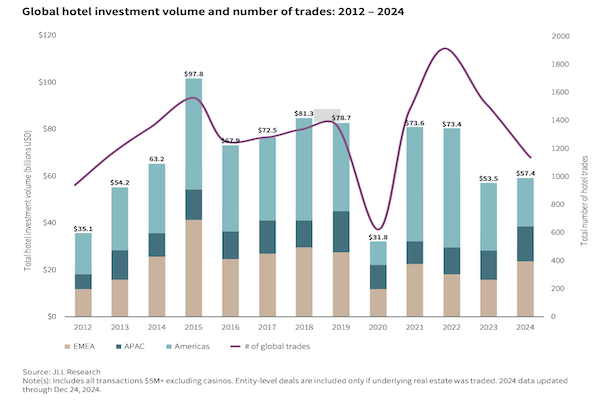

Hotel transactions lagged in 2024, but 2025 could see a meaningful pickup. Global hotel investment volume reached $57.4 billion in 2024 and while an increase of 7% relative to 2023, it was the third-lowest total since 2012. It’s not surprising: Central banks rolled back interest rates, but they remained obstinately high, “making it challenging for investors to finance high-dollar trades and forcing many to the sidelines,” the JLL report noted. Global hotel transaction volume remains 17% behind historical levels.

Why, then, optimism for 2025? A clearer picture, JLL believes. It argues that core inflation is falling to central bank targets, the product of monetary easing, though promised tariffs by President Trump could upend this rosier picture. Further clarity is crucial for investors as they look to underwrite potential acquisitions, wrote JLL, and should help to precipitate hotel transaction activity. JLL expects global hotel investment volume to improve in 2025, likely exceeding 2024 by 15% to 25%, with “irreplaceable” luxury hotels and properties within the select-service and extended-stay sectors remaining favored by investors. Cash-rich Middle Eastern and U.S. private equity investors will likely be the most acquisitive, JLL predicts, targeting assets across Europe and Asia, respectively.

On Brand

Hotel brands will continue to play a pivotal role in the growth and expansion of the hospitality industry. In fact, lodging companies are increasingly spreading their dominion in areas outside traditional lodging and into adjacent spaces, such as outdoor and adventure accommodations—Marriott International’s recent deal for Postcard Cabins, Hilton’s AutoCamp partnership and Hyatt Hotels Corp.’s Under Canvas alliance evidence of this shift. “We expect the hotel brands to increasingly invest broader in the travel space to capitalize on the growing ‘experience economy,’” Demuth said.

Meanwhile, to appease Wall Street, lodging C-corps and franchisors are increasingly turning to conversions as a mode for growth against a still tepid new-construction landscape. “Amid a challenging and high-cost construction environment, hotel brands are increasingly using their balance sheets to fuel net unit growth, a key driver of shareholder value,” Demuth said, noting that while Hilton and Hyatt were the most aggressive in 2024, others are expected to follow suit in 2025 as global hotel supply will grow only 2%.

At the same time, JLL expects further hotel brand consolidation in 2025, coupled with private equity OpCo investments, with third-party management companies, non-traditional lodging brands and hotels in the lifestyle sector “likely to attract the most capital.”

Mr. Robot

One of the larger themes not just in hospitality but omnipresent is the role of artificial intelligence in daily life. PwC estimates that AI could add $15.7 trillion to the global economy by 2030. The amount of data available to lodging companies makes the hotel industry ripe for AI disruption, though JLL still believes that the biggest contribution, for now, is in streamlining back-office operations, and not as much customer-facing applications. “Hospitality is an inherently people-centric industry,” Demuth said. “Our belief is that AI should be implemented to help optimize back-of-house operations.”

This type of application, JLL posits, can improve overall profitability by improving labor models, optimizing food costs and mitigating food waste and promoting predictive maintenance that can help avoid costly PIPs. “While not as flashy as consumer-based AI, these systems can have a material impact on the broader industry,” Demuth said.

Brand Stories

Cohen & Steers tips power demand from data centres to cope with the artificial intelligence boom

Utilities are among the top picks for international investment group Cohen & Steers as it reshuffles its holdings to minimise the impact of global tariffs and bets on rising demand for power from data centres to cope with the artificial intelligence boom.

“Utilities tend to have very little impact from tariffs,” said Ben Morton, the New York-based head of global infrastructure for the $US88 billion ($136 billion) asset manager during a trip to Sydney to meet with local investors.

Loading…

Brand Stories

Fashion Brands and Hotels Team Up for the Hottest Travel Collaborations of Summer 2025 – L'OFFICIEL USA

Brand Stories

How to create passive income in 2025 with AI

Artificial intelligence is no longer a futuristic concept; it’s a powerful tool that can be leveraged today to build scalable and sustainable passive income streams. In 2025, with AI becoming more accessible and sophisticated, the opportunities for automation and monetization are more significant than ever. Here’s a detailed guide on how to create passive income using AI.

1. AI-Powered Content Creation and Monetization

Content creation is one of the most accessible and effective ways to generate passive income with AI. The key is to use AI to handle the heavy lifting of production, allowing you to focus on strategy and quality control.

Blogging and SEO:

Automated Content Generation: Use AI writing tools like Jasper, Copy.ai, or a custom GPT to generate blog posts, articles, and guides on a massive scale. You can feed the AI a topic and a few keywords, and it can produce a well-structured draft in minutes.

SEO Optimization:AI tools can also help with keyword research, meta descriptions, and on-page SEO. This ensures your content is not only abundant but also optimized to rank highly on search engines, driving organic traffic and passive ad or affiliate revenue.

Affiliate Marketing:Integrate affiliate links into your AI-generated content. Once the blog post is live and attracting readers, it can generate commissions from product sales with no further effort from you.

Faceless YouTube Channels:

Scripting and Video Production: AI can write engaging scripts for videos in a specific niche (e.g., finance, history, or self-improvement).

Voiceovers and Visuals:Use AI-powered text-to-speech generators like ElevenLabs for professional-sounding voiceovers. Combine this with AI video generators or stock footage to create compelling videos without ever showing your face or recording a single line of dialogue.

Monetization: Once your channel is established, you can earn passive income through YouTube’s Partner Program (ad revenue) and by including affiliate links in your video descriptions.

Selling AI-Generated Digital Products:

E-books and Planners: Use AI to write e-books on niche topics, or create unique digital planners and journals. You can then sell these products on platforms like Etsy or Gumroad.

Print-on-Demand (POD): AI image generators like Midjourney or DALL-E can produce stunning and unique art. You can use these designs on t-shirts, mugs, and posters and sell them through POD services like Printful or Printify. The platform handles production and shipping, making it a completely passive income stream after the initial design and setup.

2. AI-Driven E-commerce and Dropshipping

AI can automate and optimize every step of an e-commerce business, from product selection to marketing.

Dropshipping with AI: AI tools can analyze market trends to help you identify winning products to sell. They can also generate product descriptions and marketing copy, and even automate ad campaigns on platforms like Facebook and Instagram.

Automated E-commerce Stores: Platforms like Shopify offer AI-powered store builders that can get you up and running in a day. You can use AI to manage inventory, forecast demand, and provide personalized product recommendations to customers, all of which contribute to a more passive operation.

3. AI-Powered Services and Automation for Businesses

You can sell AI-powered solutions to other businesses, creating a recurring revenue model.

Building Custom Chatbots:Many small to medium-sized businesses need chatbots for their websites to handle customer inquiries, book appointments, or qualify leads. You can use no-code AI tools to build and deploy these chatbots and charge businesses a monthly fee for the service and maintenance.

AI-Powered Social Media Management: Offer a subscription-based service where AI tools generate and schedule social media content for clients. The AI can analyze their target audience and industry trends to create relevant and engaging posts, all with minimal input from you once the system is configured.

AI Consulting and Workflow Automation: As more businesses adopt AI, they’ll need help integrating it into their workflows. You can offer consulting services to help companies identify opportunities for AI integration, build custom automation workflows using tools like Zapier or Make, and charge a premium for your expertise.

4. Leveraging AI for Financial Strategies

AI can also be applied to financial markets to generate passive income.

Algorithmic Trading: While this requires a higher level of expertise, AI and machine learning are used to develop trading bots that can analyze market data and execute trades automatically. These bots can be configured to operate based on your specific risk tolerance and investment goals.

Predictive Analytics for Investment: Use AI to analyze market trends and predict potential growth areas. While this isn’t a direct income stream, it can guide your investment decisions and lead to significant passive returns over time.

The key to creating passive income with AI in 2025 is to see AI as a powerful partner that handles repetitive, time-consuming tasks. By building a system where AI does the work, you can create and manage income streams that require very little active involvement, ultimately freeing up your time and generating wealth.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 week ago

Brand Stories1 week agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse4 weeks ago

Asia Travel Pulse4 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel4 weeks ago

AI in Travel4 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoChatGPT — the last of the great romantics