Funding & Investment in Travel

DSP MF breaks new ground with India’s first retail offshore fund from GIFT City

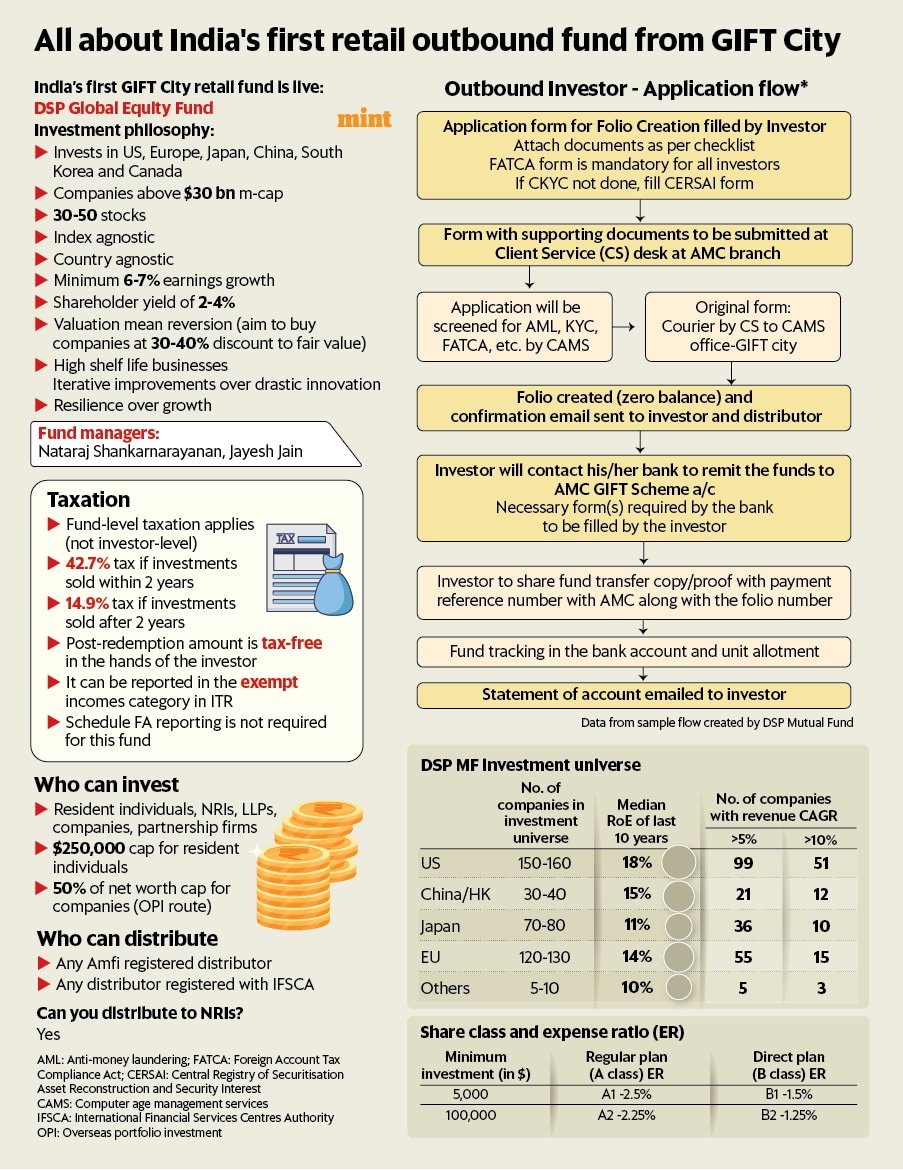

DSP Asset Managers’ new Global Equity Fund, launched on 2 June, allows Indian residents to invest as little as $5,000 in a diversified basket of global stocks—without relying on offshore brokerages, feeder funds, or cumbersome tax filings. It’s the first open-ended mutual fund targeting retail investors to debut under GIFT City’s updated 2025 framework, and a litmus test of whether the finance hub can truly broaden access beyond institutions and high-net-worth individuals.

Mirae Asset Mutual Fund has also received similar approval from the International Financial Services Centres Authority (IFSCA) to launch retail-focused offshore funds, though it has yet to announce a specific product.

More than just a regulatory first, DSP’s new fund, launched by DSP IFSC, could help Indian asset managers reclaim outbound flows long dominated by foreign platforms. It offers a cleaner, tax-friendly alternative within India’s regulatory perimeter.

The DSP Global Equity Fund, currently in its New Fund Offer (NFO) phase, will accept inflows for up to six months, but is likely to close in 30–40 days. It can continue accepting investments even after the NFO closes. The fund will invest in 30–50 global companies across markets such as the US, Europe, Japan, South Korea, China, and Canada.

View Full Image

Alternative to Sebi cap

Unlike traditional mutual funds in India, DSP’s fund is not constrained by the Securities and Exchange Board of India’s (Sebi) $7 billion overseas investment cap, which has led to repeated inflow suspensions across global feeder schemes.

Instead, the GIFT City-based fund uses the investor’s own $250,000 annual quota under the Liberalised Remittance Scheme (LRS), a more resilient route for global exposure.

Because it is domiciled at GIFT, the fund remains outside the Sebi ceiling and can continue accepting money even when the broader mutual fund industry is capped.

The fund signals a shift in outbound capital flows, with domestic asset management companies (AMCs) attempting to reclaim ground long dominated by offshore platforms.

“This structure gives Indian investors a practical route to access global equities at a time when most domestic mutual funds are unable to invest abroad,” said Abhishek Kumar, co-founder of SahajMoney and a Sebi-registered investment advisor. “That said, since the fund has just launched and has no track record yet, it may be prudent to watch its performance for a while before committing capital.”

Key Takeaways

- India’s first retail offshore mutual fund launches from GIFT City under the updated 2025 framework.

- DSP Global Equity Fund lets Indian residents invest as little as $5,000 in global stocks.

- Bypasses Sebi’s overseas cap by routing flows through the investor’s personal LRS limit.

- No investor-level tax on gains—capital gains taxed at the fund level, simplifying compliance.

- Mirae Asset also approved for a similar fund, as GIFT City sees rising retail fund activity.

How it works—and who it’s for

The fund’s stock selection is grounded in the principle of “what will not change over the next 10 years.” It will favour businesses demonstrating incremental innovation over dramatic disruption, prioritising firms with pricing power, durability, and high shelf life over rapid growth.

DSP Asset Managers describes this as a focus on resilience over volatility.

Natraj Shankarnarayanan, formerly of Quantum AMC, and Jayesh Jain, previously at Edelweiss AMC, will provide investment advice. Giriraj Bissa, the fund manager at GIFT City, will take final investment decisions, in line with approval received from Sebi and IFSCA.

“The DSP Global Equity Fund enables both retail and high-net-worth individuals to invest in high-quality global businesses via the LRS route,” said Kalpen Parekh, managing director and chief executive of DSP Mutual Fund. “We are proud to be the first AMC to launch a retail fund on this route at GIFT City. This offering allows Indian investors to access companies with strong ROE, robust cash flows and attractive valuations globally—while staying aligned with the ‘Make in India’ vision by building this capability domestically.”

DSP already manages nearly $1 billion in assets at GIFT City, largely for offshore clients. This marks its first global product aimed squarely at Indian investors, positioned as a long-term vehicle for goals like children’s overseas education or international travel.

The fund is available in both Regular and Direct plans, with expense ratios ranging from 1.25% to 2.5% depending on investment size and distribution channel.

Eligibility and onboarding

Any Indian resident can invest in the fund under the Liberalised Remittance Scheme (LRS), subject to the $250,000 annual limit. NRIs are eligible. Note: remittances above ₹10 lakh in a financial year will attract tax collected at source (TCS).

The onboarding process is currently hybrid—investors must fill out a physical or emailed application form and submit KYC documents, either directly or through a distributor. These are processed by CAMS at GIFT City, which handles due diligence, AML checks, FATCA compliance, and customer verification.

Once verified, the investor receives confirmation and units are allotted. A fully digital route is in development, but currently marked “in process.”

Who can distribute

Any mutual fund distributor registered with the Association of Mutual Funds in India (Amfi) can sell the fund. No additional registration with GIFT City’s regulator IFSCA is required.

Fee structure

The fund offers four share classes:

Retail investors

A1 (Regular plan): 2.5% expense ratio

B1 (Direct plan): 1.5%

Institutional investors (min. $100,000)

A2 (Regular): 2.25%

B2 (Direct): 1.25%

The structure rewards higher investments and direct participation with lower fees.

Exit load is 1% if redeemed within 12 months. Post that it would be nil.

Taxation

One of the fund’s main draws is its investor-level tax simplicity.

Unlike traditional Indian mutual funds, capital gains are taxed at the fund level, not in the hands of the investor. If you redeem units within two years, the fund deducts tax at 42% (the highest marginal rate under the old regime). After two years, the fund applies a 14.95% long-term capital gains tax.

There’s no additional tax filing or declaration required from the investor. However, the fund itself pays tax on any internal churn: if it rebalances its portfolio within two years, the gains from that segment are taxed at 42%; gains on assets held longer are taxed at 14.95%.

The fund will not deduct any TDS at the time of redemption by the investors.

From income tax standpoint, as the GIFT fund is located in India and treated as a tax resident under the Income-tax Act, 1961, investor may not be required to report such holding under schedule FA in the ITR.

While retail participation is just beginning, GIFT City’s offshore fund ecosystem is expanding rapidly. As of March 2025, funds based in GIFT’s IFSC had invested $8.08 billion. That includes $4.52 billion from Category I and II AIFs, $3.52 billion from Category III AIFs, and $42.77 million from venture capital schemes. Commitments raised have surged 87% year-on-year, from $8.41 billion in March 2024 to $15.74 billion in March 2025, according to IFSCA data.

If it succeeds, DSP’s new fund could mark a turning point—not just for offshore investing, but for GIFT City’s ambitions to become a gateway for global capital.

Funding & Investment in Travel

Pattaya awaits results of TAT’s ‘Value over volume’ strategy, seeking balance between mass and peaceful tourism

PATTAYA, Thailand – As Thailand charts a new course for its tourism industry with the Tourism Authority of Thailand’s (TAT) recently unveiled 2026 strategy, Pattaya stands at the crossroads of anticipation and transformation. Under the theme “Value is the New Volume,” TAT’s ambitious plan signals a decisive shift from focusing on visitor numbers to prioritizing quality, sustainability, and authentic experiences — a vision that many here hope will breathe fresh life into the city’s tourism landscape.

Long known internationally as an energetic beach destination with a reputation for nightlife, Pattaya has often faced challenges balancing mass tourism with sustainable growth. Now, with TAT’s emphasis on redefining Thai tourism through integrity, safety, and cultural connection, the city’s stakeholders see an opportunity to reshape its identity and appeal.

The strategy’s core pillars — prioritizing value over volume, balancing tourism across regions and seasons, advancing creative and thematic tourism, and embedding measurable sustainability standards — resonate strongly with Pattaya’s evolving ambitions. Local entrepreneurs and officials alike recognize that Pattaya’s future lies in delivering more meaningful and diverse experiences rather than simply attracting larger crowds.

“The new focus on quality and sustainability aligns perfectly with what Pattaya needs,” said a local business owner involved in cultural and wellness initiatives. “We’ve already started to diversify, hosting more family-friendly festivals, arts events, and eco-tourism activities. Now, with TAT’s support, we hope these efforts will grow into something that truly changes how visitors see and enjoy the city.”

TAT’s strategy also highlights the importance of targeting high-potential traveler segments, including Millennials seeking immersive experiences, Gen Z driven by digital engagement, luxury tourists, and health-conscious travelers attracted to holistic wellness. For Pattaya, this means expanding beyond its traditional markets to attract visitors who value cultural depth, nature, and wellness — areas in which the city has begun to invest but can further develop with stronger national backing.

Moreover, the plan’s focus on enhanced connectivity through new travel routes by land, sea, air, and rail promises to better link Pattaya with other regions and international markets. Improved visa facilitation and partnerships with airlines are expected to open doors to high-value travelers from Europe, the Middle East, and emerging Asian markets, offering hope for more balanced and resilient tourism flows.

City officials are already aligning local initiatives with TAT’s vision, emphasizing smart tourism measures such as digital payment systems, safety enhancements, and AI-driven visitor management. Beach clean-ups, infrastructure improvements, and collaborations with creative agencies to stage international events aim to create a more welcoming and sustainable environment for both tourists and residents.

Yet, amid the optimism, some local operators express cautious realism. “We’ve heard grand plans before, but what we really need now is timely action and concrete support,” said a guesthouse operator near Jomtien beach. “If the incentives, infrastructure, and marketing efforts come quickly, Pattaya can adapt and thrive in this new era. But delays could mean missed opportunities.”

The 2026 strategy’s embrace of Thailand’s cultural soft power — focusing on Food, Film, Fashion, Festivals, and Fight (martial arts) — offers Pattaya a platform to elevate its diverse offerings, from culinary tours and international music festivals to Muay Thai events and film productions. This holistic approach aims not only to attract visitors but also to foster deeper connections and lasting impressions.

As Pattaya prepares for the upcoming tourism seasons, the mood is one of hopeful vigilance. The city is poised to move beyond its legacy as a party hotspot toward becoming a multifaceted destination that embodies the new Thai tourism ethos: sustainable, authentic, and value-driven.

With Thailand’s broader tourism landscape evolving rapidly under TAT’s bold 2026 blueprint, Pattaya’s future success hinges on the effective translation of strategy into on-the-ground realities. For a city that has weathered many ups and downs, the promise of “Value is the New Volume” offers a compelling vision — one that Pattaya is eager to help realize.

Funding & Investment in Travel

Crypto Custody Startup BitGo Files Confidentially To Go Public

Crypto custody startup BitGo filed confidentially to go public on Tuesday, the company said.

It is not yet clear on which exchange Bitgo plans to offer its shares, or what its price range will be.

Founded in 2013, Palo Alto, California-based BitGo has raised a known $170 million in funding, per Crunchbase data. The company aims to securely store and manage cryptocurrency and other digital assets

In August 2023, BitGo raised a $100 million Series C round at a $1.75 billion valuation. It was a step up in valuation from what BitGo would have been valued at had it been acquired by digital asset investment firm Galaxy Digital in a proposed $1.2 billion acquisition that was called off in 2022.

The company went on to raise another corporate round of funding in January 2024 for an undisclosed amount, according to Crunchbase data.

Bitcoin prices soared to over $100,000 in 2024, and currently trades at nearly $119,000 with projections it could go even higher in 2025. And after many headlines about regulation in the industry, the U.S. passed what is being described as the country’s “first major national cryptocurrency legislation.” The legislation is expected to be signed into law later this week.

A thawing IPO pipeline?

After an IPO drought, we’re seeing a flurry of filings in 2025, with more potentially planned in the coming year. Cryptocurrency exchange Kraken is expected to go public via an initial public offering sometime in early 2026.

San Francisco-based collaborative design platform Figma on Monday outlined the plans of its IPO, revealing it intends to raise nearly $1 billion.

But other fintech and crypto-related companies have already gone public so far in 2025.

In early June, shares of Circle closed up 168% at $83.29 in their first day of trading on the New York Stock Exchange, minting the stablecoin issuer with a market cap of around $16.7 billion and renewing hopes for an IPO market rebound. As of July 22, the stock had more than doubled from its first-day closing — trading at over $194 per share.

Digital bank Chime went public on June 12, and came out swinging. Chime’s shares shot up 37% in first-day trading on Nasdaq, closing at $37. As of July 22, the stock was trading at just over $33.

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Investment in Travel

Startups Supplying Scarce Materials And Rare Earth Elements See Abundant VC Funding

It’s well known that scaling cutting-edge technologies and battery production requires supply-constrained materials such as lithium, cobalt and nickel, as well as rare earth elements sourced from just a few locations on the planet.

Tech giants, automakers and other industrial players have long been cognizant of the supply chain risks. And recent headlines show concerns increasingly spilling over into geopolitics.

Startups haven’t been sitting this one out either. In the past few quarters, a growing roster of venture-backed companies has secured funding for areas including battery and magnet recycling, rare earth-focused mining technology, and even extracting materials from space.

Collectively, they’ve raised billions to date, including some large recent rounds. To illustrate, we used Crunchbase data to put together a list of a dozen companies, most funded in the past year, with a mission of supplying scarce materials through recycling or at their original source.

Most venture money going to recycling

The largest investment recipients are focused on recycling, looking to extract scarce materials from devices, scrap, batteries and industrial machines no longer in use.

In this arena, the two most heavily funded startups — Massachusetts-based Ascend Elements and Nevada-based Redwood Materials — are both focused on batteries and have been around a while. Together, they’ve pulled in nearly $3 billion in equity funding and over $1 billion in debt financing to date.

Notably, however, both companies secured most of their funding between 2021 and 2023. That coincided with a more bullish period overall for cleantech equity funding. Since then, sustainability-focused investment has trended lower, with U.S. investors in particular seeing impacts from the Trump administration dialing back support for clean energy initiatives.

Outside the U.S., meanwhile, we’ve seen some more recent, sizable rounds around critical materials recycling.

Out of Canada, Cyclic Materials announced in June that it raised $25 million to build a rare earth recycling facility in Kingston, Ontario. It will take magnet-rich scrap and retired industrial products to recycle rare earth elements used in EV motors, wind turbines and consumer devices. Per Cyclic, it’s an undertapped market, as today, less than 1% of rare earth elements are recycled.

On the earlier-stage side, two German companies also raised good-sized financings. Cylib, which develops technology to draw critical raw materials from end-of-life batteries, picked up a $64 million Series A last spring. And at seed-stage, Munich-based Tozero secured $12 million for a plant to recover raw materials from recycled lithium-ion batteries.

Mining attracts capital too, following MP Material’s footsteps

Startup capital is also flowing to ventures focused on mining critical materials.

Before looking at the latest funding picks, however, it seems worth pointing out that MP Materials — the company generating headlines of late around rare earth mining — is itself a stock market success story with some Silicon Valley roots.

Shares of Las Vegas-based MP shot higher this month following news that the U.S. Defense Department agreed to buy an equity stake in the company, which operates the country’s only rare earth mine in Mountain Pass, California. A few days later, Apple announced a $500 million commitment to buy rare earth magnets developed at an MP Materials’ facility in Fort Worth, Texas.

Notably, MP was one of the earlier companies to ride the SPAC boom, making its public market debut in 2020 through a merger with a blank-check company. The deal included an equity investment from backers including venture capitalist and onetime “SPAC king” Chamath Palihapitiya.

More recently, we’ve seen a few startups nab venture and debt financing around mining efforts and technologies targeting scarce metals.

Montreal-based Torngat Metals secured $120 million in debt financing last month from government sources for a rare earth mining project in Strange Lake, located in Quebec’s northernmost region. It touts the project, which includes “detailed caribou avoidance procedures,” as a strategically important national initiative in a time when Chinese domination of heavy rare earth metals threatens others’ ability to build and source high-performance magnets.

Phoenix Tailings, based in Woburn, Massachusetts, also attracted investors’ interest, pulling in $76.4 million in fresh financing this year, per a May securities filing. The company has developed a process to extract valuable metals and rare earth elements from mining waste.

Exits next?

Major U.S. market indices are trading near all-time highs these days, so it’s looking like a good time for public companies in a lot of industries. But those tied to sourcing of rare metals and battery materials are riding particularly high.

MP Materials, for instance, had a recent market cap around $10 billion — its highest to date. Rare earth stocks more broadly are also sharing in the enthusiasm.

Could IPOs and acquisitions for the most heavily funded companies tied to sourcing scarce materials be next? These aren’t likely to be the fastest-moving spaces for dealmaking, but at least for now some momentum is on their side.

Related Crunchbase query:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

-

Brand Stories2 days ago

Brand Stories2 days agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories15 hours ago

Brand Stories15 hours agoOlive Living: India’s Intelligent, Community-Centric Hospitality Powerhouse

-

Destinations & Things To Do2 days ago

Destinations & Things To Do2 days agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

AI in Travel2 days ago

AI in Travel2 days agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse3 weeks ago

Asia Travel Pulse3 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel3 weeks ago

AI in Travel3 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoChatGPT — the last of the great romantics

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHumans must remain at the heart of the AI story