Travel Market Insights

Bleisure Travel Market to Reach USD 963.88 Billion by 2030,

Mordor Intelligence has published a new report on the “Bleisure Travel Market” offering a comprehensive analysis of trends, growth drivers, and future projections

Introduction: Blurring Boundaries Between Business and Leisure

The bleisure travel market, valued at USD 611.72 billion in 2025, is projected to grow steadily and reach USD 963.88 billion by 2030, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period. The concept of bleisure, blending business and leisure travel, has evolved from a niche trend to a mainstream preference among working professionals. With shifting work dynamics, growing emphasis on work-life balance, and digital connectivity, more travelers are extending work trips for personal exploration.

This growth is further reinforced by corporate policies that support employee well-being, flexibility in business travel arrangements, and the influence of digital nomad culture. The market is witnessing increased demand from both millennials and Gen X professionals, who are leveraging flexible work policies and prioritizing meaningful travel experiences alongside professional commitments.

Report Overview: https://www.mordorintelligence.com/industry-reports/bleisure-travel-market?utm_source=openpr

Key Trends: Shaping the Bleisure Travel Landscape

1. Hybrid Work Models and Travel Flexibility

One of the key trends driving the bleisure travel market is the rise of hybrid work environments. As companies adopt flexible schedules, employees are no longer confined to rigid business itineraries. This shift enables professionals to add leisure time to their corporate travel schedules without disrupting work. Travelers can work remotely from different destinations, turning business trips into longer stays that combine productivity with relaxation.

2. Millennial and Gen Z Influence

Millennials and Gen Z professionals are playing a major role in driving bleisure travel. These demographics value experiences over possessions, seek cultural enrichment, and prefer non-traditional travel formats. They are more likely to extend business trips for leisure purposes, explore local food scenes, and engage in offbeat travel activities. Their preferences are prompting employers and travel providers to offer personalized travel solutions that accommodate both work and recreation.

3. Demand for Personalized and Flexible Travel Packages

Travel service providers are increasingly tailoring bleisure offerings to meet evolving consumer demands. From curated itineraries that combine meetings with leisure excursions to flexible hotel check-in/check-out policies, the focus is on convenience and personalization. Business travelers are seeking experiences that align with their interests, whether it’s wellness retreats, local cultural tours, or culinary exploration.

4. Short-Term Rentals Gaining Ground

The rise of platforms offering short-term rentals is another defining trend. These accommodations often provide amenities like kitchen facilities, larger living spaces, and workstations, which are ideal for extended bleisure stays. While branded hotels continue to dominate the market, the growing popularity of home-sharing and boutique rentals reflects the changing preferences of travelers seeking a homely environment during extended work trips.

5. Growth of Domestic Bleisure Travel

Post-pandemic recovery has emphasized domestic travel over international trips in many regions, contributing to the rise of local bleisure tourism. Business travelers are combining regional work trips with leisure exploration, especially in large and diverse countries. This trend is also supporting the revival of regional tourism economies and encouraging travel service providers to invest in mid-tier cities and less-explored destinations.

6. Corporate Travel Policies Supporting Bleisure

Organizations are increasingly recognizing the value of offering bleisure travel options to employees. Flexible policies that allow extended stays or reimburse leisure portions of a trip are becoming common. Companies see this as a way to improve employee satisfaction and retention while aligning with broader wellness initiatives. Corporate travel managers are also collaborating with travel management companies to incorporate bleisure-friendly itineraries into booking systems.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/bleisure-travel-market?utm_source=openpr

Market Segmentation: Diverse Travel Preferences Across Segments

The bleisure travel market is segmented based on tour type, trip type, age group, industry vertical, accommodation type, booking channel, and geography. Each of these segments represents unique preferences and contributes to market growth in different ways:

By Tour Type:

Independent: A large number of bleisure travelers prefer independent travel, offering freedom to explore on their own schedule.

Group: Group tours are gaining traction among corporate teams combining business workshops with leisure activities.

By Trip Type:

Domestic: Preferred for cost-effective and convenient travel.

International: Driven by long-haul business travel to key commercial hubs.

By Age Group:

Millennials: Leading demand due to value-driven travel behavior.

Generation X: Increasingly participating in bleisure as they balance professional duties and personal interests.

Other Age Groups: Including baby boomers and Gen Z, who are gradually engaging in business-related travel with personal extensions.

By Industry Vertical:

Corporate: Dominates the market due to frequent business travel.

Government: Also contributes to demand, especially in conferences and official delegations.

By Accommodation Type:

Branded Hotels: Continue to lead due to amenities and loyalty programs.

Short-Term Rentals: Gaining preference for their space, privacy, and local feel.

Others: Includes serviced apartments and boutique stays.

By Booking Channel:

Online Travel Agencies (OTAs): Popular for independent travelers seeking flexibility.

Travel Management Companies: Preferred by corporates for streamlined bookings.

Others: Includes direct hotel bookings, airline portals, and mobile apps.

Explore Our Full Library of Hospitality and Tourism Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/hospitality-and-tourism?utm_source=openpr

Key Players: Strategic Offerings in an Evolving Travel Segment

Several established and emerging travel service providers are actively catering to the bleisure segment by offering packages that merge professional and leisure needs. Key players in the market include:

Airbnb Inc.: A leading provider of short-term rentals, catering to travelers seeking unique, home-like experiences during their extended business stays.

American Express Travel: Offers customized travel solutions for business professionals, including services that accommodate bleisure needs.

Expedia Inc.: Provides access to bundled packages that appeal to both business and leisure aspects of travel.

BCD Travel: Specializes in corporate travel management and increasingly integrates bleisure options into their itineraries.

Carlson Wagonlit Travel: A global travel management company offering tailored travel solutions, including flexibility for combining work with personal travel.

These companies are adapting to market trends by expanding their service offerings, forming partnerships with accommodation providers, and leveraging digital platforms to enhance traveler experience.

Explore more insights on bleisure travel market competitive landscape: https://www.mordorintelligence.com/industry-reports/bleisure-travel-market/companies?utm_source=openpr

Conclusion: The Rise of Intentional Travel Blends

The bleisure travel market is experiencing a notable shift in consumer behavior, driven by lifestyle preferences, work flexibility, and changing business travel dynamics. As more professionals look to make the most of their work trips, travel providers, employers, and governments are adjusting their strategies to accommodate this hybrid travel model. With ongoing support from corporate travel policies and evolving service ecosystems, the bleisure segment is poised to become an integral part of the global travel industry in the years ahead.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/bleisure-travel-market?utm_source=openpr

Industry Related Reports

Romania Hospitality Market: The Romanian Hospitality Market is Segmented by Type (Chain Hotels and Independent Hotels), by Hotel Category (Upscale and Luxury Hotels, Mid-Scale Hotels, and Budget and Economy Hotels), by Booking Channel (Direct (Online and Offline), by Online Travel Agencies (OTAs), and GDS and Wholesalers), by Region (North‐East, South‐east, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/romania-hospitality-industry?utm_source=openpr

India Online Travel Market: India Online Travel Market Report is Segmented by Service Type (Air Ticket Booking, and More), by Booking Device (Desktop / Laptop and Mobile), by Business Model (Online Travel Agencies, Direct Supplier Online Platforms, and More), by Traveler Type (Leisure, and More), by Age Group (18-30 Years, and More), by Payment Mode (Credit / Debit Cards and More), by City Tier (North India, South India, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/online-travel-market-in-india?utm_source=openpr

Vietnam Online Travel Market: Vietnam Online Travel Market Report is Segmented by Booking Type (Air Ticketing, Hotels and Packages, and More), by Platform (Desktop, Mobile), by Traveler Origin (Domestic Travelers, International Travelers), by Payment Method (Digital Wallets, Cards, and More), and by Geography (Northern Vietnam, Central Vietnam, and More)

Get more insights: https://www.mordorintelligence.com/industry-reports/vietnam-online-travel-market?utm_source=openpr

China Online Travel Market: The China Travel Market is Segmented by Service Type (Accommodation Booking, Travel Tickets Booking, and More), Traveler Type (Leisure, Business, VFR, and Others), Mode of Booking (OTA / Travel Agent, and Supplier Direct), Destination Type (Domestic, Outbound, and Inbound) Age Group (Gen Z, Millennials and More), Region (Central China, East China and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/online-travel-market-in-china?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Travel Market Insights

Etihad Airways CEO Unpacks Big Bet on Small Jets

In a region known for flying enormous 777s and double-decker A380s, Etihad’s newest star is a single-aisle jet. The Gulf carrier took delivery of its first Airbus A321LR this week, a long-range variant of a plane more typically used for short economy-focused flights.

The UAE airline is betting on the new aircraft to supercharge its network growth and broader brand revival. As Etihad CEO Antonoaldo Neves told Skift: “Today we show the world we’re back in the game, and specifically back in the premium game.”

That game involves an aircraft type already familiar to many travelers. The A321LR, an evolution of Airbus’ best-selling narrowbody, is new-generation, but not exactly groundbreaking.

JetBlue took delivery of its first in 2021, while Aer Lingus, Air Transat, and SAS are among others to use the jet on short transatlantic hops. But it’s the speed and scale at which Etihad is adding the A321LR – along with its distinctive three-class configuration – that is piquing industry interest.

30, Not 20, A321LRs on the Way

Speaking at a media briefing at Airbus’ Finkenwerder factory in Germany, Neves left reporters scrambling for their notes. What was meant to be a tranche of 20 A321LRs became a throng of 30. Asked for clarity on the 50% increase, Neves quipped: “You guys are reading the wrong newspaper.”

Through a mix of leased aircraft and direct orders, Etihad will now receive 30 A321LRs over the next four years. A steady flow should result in 10 deliveries by the end of 2025, followed by another 10 the next year, then five each in 2027 and 2028. From the airline’s Abu Dhabi hub, the long-range jets will fly as far afield as Paris and Hanoi. Journey tim

Travel Market Insights

U.S. Hotel Industry Faces Continued Declines Amid Global Growth Trends

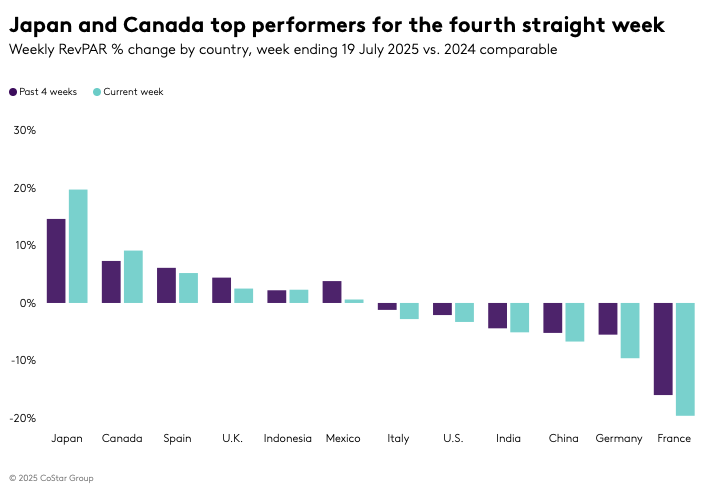

The U.S. hotel industry experiences a fourth consecutive week of declining revenue per available room (RevPAR), while Japan and Canada show strong growth in the global market.

U.S. Hotel Industry Trends

The U.S. hotel industry reported a continued decline in revenue per available room (RevPAR) for the week ending 19 July 2025, marking the fourth consecutive week of decreases. RevPAR fell by 3.3% year over year, slightly improving from the previous week’s 3.7% drop. The primary contributors to this decline were a 1.8% decrease in room demand and a 0.7% drop in the average daily rate (ADR). Despite a modest 0.8% increase in room supply, weekly occupancy fell by 1.9 percentage points to 71.6%.

The most significant RevPAR declines were observed in major metro markets, with the Top 25 Markets experiencing a 4.3% decrease and other metro markets seeing a 4.7% drop. Las Vegas, Houston, and Los Angeles were the primary drivers of this negative trend. Las Vegas experienced a 17.1% decline in RevPAR, primarily due to reduced international arrivals and the economic impact on lower-income households. Houston experienced a 38.3% drop due to tough comparisons with last year’s demand spikes from Hurricane Beryl and the “Derecho.” Los Angeles faced an 8.9% decline, with the Central Business District experiencing a 17.8% drop amid market tensions.

Impact on Different Market Segments

Excluding the three major markets of Las Vegas, Houston, and Los Angeles, the U.S. RevPAR would have declined by a lesser amount, at 1.9%. ADR, excluding these markets, was down by 0.2%, remaining below the rate of inflation. In the Top 25 Markets, RevPAR was relatively flat at -0.6%, with a 1.0% increase in ADR when excluding these markets.

Metro markets outside the Top 25 saw the largest RevPAR decline, at 4.7%, accompanied by a 2.8% decrease in ADR. Non-metro and rural markets also experienced decreases, primarily due to a 1.0 percentage point drop in occupancy. Since Memorial Day weekend, summer demand has decreased by 1.6 million room nights, or 0.7%, compared to the previous year, with ADR remaining flat at 0.1%. The Luxury segment was the only chain scale to see RevPAR growth, though demand increased in all scales except Economy and Independents.

Global Market Performance

Globally, RevPAR, excluding the U.S., increased for the third consecutive week, with a 0.5% rise driven entirely by ADR. Although occupancy fell by 1.3 percentage points compared to last year, it reached the highest level of the year at 72.2%. Japan maintained its top RevPAR position, with Osaka leading the gains, driven by the EXPO 2025 event. Canada posted the second-highest RevPAR gain, with ten of its 22 markets experiencing double-digit increases. Spain and the U.K. also showed strong performance, driven by significant events and increased travel.

Conversely, France and Germany experienced declines due to shifts in sporting event calendars, while China’s RevPAR fell by 6.7%, with significant declines in Beijing and Guangzhou.

Outlook

The U.S. hotel industry faces a mix of positive and negative signals moving forward. Analysts anticipate nuanced interpretations of performance data due to tough year-over-year comparisons, particularly in September and October, following the impacts of hurricanes Helene and Milton. Sociopolitical factors are also expected to affect short-term demand in select markets. Despite current challenges, American Airlines CEO Robert B. Isom expressed optimism, predicting that July will mark the low point, with performance expected to improve sequentially each month as demand strengthens.

Discover more at STR.

Travel Market Insights

Here’s How He’s Advising Other Hotel Groups

Neil Jacobs spent 13 years building Six Senses into a resort brand known for sustainability and wellness. Now, weeks after stepping down as CEO, Jacobs has launched Wild Origins, a new venture that advises hospitality groups and developers on everything from concept creation and brand strategy to design, operations, and execution.

“We can behave as a consultant, offering McKinsey-type advice in our industry, or we can actually do it for people,” Jacobs told Skift.

Wild Origins is currently advising Capella Hotel Group, which plans to increase its hotel openings next year. Jacobs is working with the group on growth strategy and senior leadership planning, including the recruitment of a new CEO.

“You go from opening one hotel every two or three years, to next year they’re g

-

Brand Stories6 days ago

Brand Stories6 days agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories23 hours ago

Brand Stories23 hours agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do7 days ago

Destinations & Things To Do7 days agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

AI in Travel7 days ago

AI in Travel7 days agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Destinations & Things To Do20 hours ago

Destinations & Things To Do20 hours agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

Asia Travel Pulse3 weeks ago

Asia Travel Pulse3 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel3 weeks ago

AI in Travel3 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login