Ride & Mobility

Lyft and China’s Baidu look to bring robotaxis to Europe next year

Lyft’s European expansion will include Chinese-made robotaxis.

The U.S. ride-hailing company announced Monday it has made a strategic partnership with Baidu to deploy the Chinese tech giant’s Apollo Go autonomous vehicles across several European markets. The companies want to launch robotaxi services in Germany and the United Kingdom in 2026, pending regulatory approval.

If approved, Baidu’s RT6 vehicles, which are equipped with its Apollo Go self-driving system, will be integrated into Lyft’s ride-hailing app. Lyft CEO David Risher said the robotaxi service is an example of its “hybrid network approach, where AVs and human drivers work together to provide customer-obsessed options for riders.”

Lyft has historically centered its ride-hailing business on the United States, while rival Uber has expanded globally and into other areas, like food delivery. But earlier this year, Lyft bought its way into the European market when it agreed to acquire the German multi-mobility app FREENOW from BMW and Mercedes-Benz Mobility for about $197 million in cash.

The acquisition opened the European market to Lyft, which has only operated in the U.S. and Canada since it launched in 2012.

Lyft and Uber, both of which sunsetted their own internal autonomous vehicle programs, are in a race to lock up partnerships with companies like Baidu, which have developed the technology.

Uber has partnered with more than 18 companies, covering the spectrum of how self-driving systems can be applied to the physical world, including ride-hailing, delivery, and trucking. In this year alone, it has announced deals with Ann Arbor, Michigan-based May Mobility and Volkswagen, as well as Chinese self-driving firms Momenta, WeRide, and Baidu. Last month, Uber invested hundreds of millions of dollars into EV maker Lucid and autonomous vehicle technology startup Nuro in a bid to launch its own premium robotaxi service.

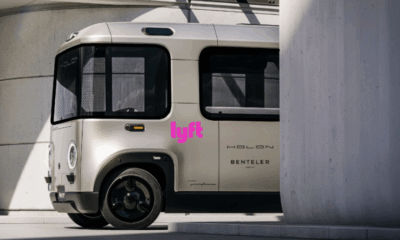

Lyft hasn’t had the same pace of deals as Uber, but has made a few partnerships in the past year, including a plan to add autonomous shuttles made by Austrian manufacturer Benteler Group to its network in late 2026. Lyft has also said it plans to put AVs from May Mobility on its network in Atlanta later this year.

Techcrunch event

San Francisco

|

October 27-29, 2025

Ride & Mobility

Lyft and Baidu Partner for Robotaxi Launch in UK, Germany in 2026

A Groundbreaking Partnership Takes Shape

In a move that could reshape the future of urban mobility in Europe, U.S. ride-hailing giant Lyft has announced a strategic partnership with Chinese tech behemoth Baidu to introduce robotaxi services in the United Kingdom and Germany starting next year. This collaboration marks Baidu’s inaugural venture into the European autonomous vehicle market, leveraging its advanced Apollo Go platform, which has already demonstrated impressive capabilities in China. According to details shared in a recent Reuters report, the partnership aims to deploy Baidu’s electric RT6 robotaxis on Lyft’s platform, pending necessary regulatory approvals.

The initiative comes at a pivotal time for both companies. Lyft, seeking to expand beyond its North American stronghold, recently finalized its entry into Europe through other means, setting the stage for this autonomous expansion. Baidu, on the other hand, brings a proven track record with over 11 million rides completed in China, as highlighted in a Bloomberg article. This deal not only extends Baidu’s global footprint but also aligns with its broader strategy of partnering with ride-hailing firms like Uber to penetrate international markets.

Navigating Regulatory and Technological Hurdles

The rollout is slated for 2026, with initial launches in the UK and Germany, two markets known for their stringent safety standards and progressive stance on innovation. Industry insiders note that securing regulatory nods will be crucial, involving rigorous testing and compliance with local laws on data privacy and vehicle safety. A TechCrunch piece emphasizes that the companies are optimistic about approvals, drawing on Baidu’s experience in densely populated Chinese cities where its robotaxis have operated successfully without major incidents.

Technologically, the RT6 vehicles represent the cutting edge of autonomous driving, equipped with advanced sensors, AI algorithms, and redundant systems for reliability. This partnership allows Lyft to integrate these vehicles seamlessly into its app, offering users a driverless option alongside traditional rides. As reported by Engadget, the fleet’s debut in 2026 could position Europe as a new battleground for robotaxi dominance, challenging incumbents like Waymo and Cruise.

Market Implications and Competitive Dynamics

For industry observers, this expansion signals a acceleration in the global race for autonomous mobility. Lyft’s shares jumped following the announcement, as noted in an Investing.com update, reflecting investor confidence in the revenue potential from reduced operational costs associated with driverless fleets. Baidu, already a leader in China’s robotaxi sector, stands to gain valuable data and insights from European operations, potentially refining its technology for diverse driving conditions.

However, challenges loom, including public acceptance and integration with existing infrastructure. In the UK and Germany, where public transport is robust, robotaxis must prove their value in terms of affordability and efficiency. A CNBC analysis points out that Baidu’s global ambitions through deals like this could face geopolitical scrutiny, given U.S.-China tech tensions, yet the partnership underscores a pragmatic approach to cross-border innovation.

Economic and Societal Impacts on the Horizon

Economically, the introduction of thousands of RT6 vehicles, as detailed in a StockTitan news release, could create jobs in maintenance and oversight while disrupting traditional taxi services. For cities like London and Berlin, this means potential reductions in traffic congestion and emissions, aligning with EU sustainability goals.

On a broader scale, this venture highlights the convergence of Eastern and Western tech ecosystems, fostering advancements that could accelerate the adoption of autonomous vehicles worldwide. As Lyft and Baidu forge ahead, industry insiders will watch closely to see if this model sets a precedent for future expansions, potentially transforming how Europeans commute in the coming decade.

Ride & Mobility

Why Did Careem Shut Down Ride-Hailing in Pakistan? | A Deep Dive

Careem has officially shut down its ride-hailing operations in Pakistan. After nearly a decade of redefining urban mobility, the once-trusted app is no longer offering car rides in Pakistan. But what led to this surprising exit?

In this in-depth explainer, we take you behind the scenes of Careem’s rise, impact, and eventual departure from the Pakistani ride-hailing market. From its revolutionary entry in 2015 to becoming a household name in cities like Karachi, Lahore, and Islamabad — Careem was not just a tech company, it was a social movement. It empowered women, professionalized drivers, and introduced millions to the convenience of app-based commuting.

So why did it fail?

Ride & Mobility

TechCrunch Mobility: Tesla’s ride-hailing gambit

Welcome back to TechCrunch Mobility — your central hub for news and insights on the future of transportation. Sign up here for free — just click TechCrunch Mobility!

Tesla CEO Elon Musk is in what one might describe a suboptimal position. He’s pushed hard to get shareholders to view Tesla as an AI and robotics company, not a maker of EVs. And yet, the company’s most visible products, which generate the bulk of its revenues, are its electric cars.

Yes, Tesla EVs are advanced, particularly when it comes to its underlying vehicle architecture and software. And its driver-assistance system known as Full Self-Driving Supervised, which can be used on highways and city streets and requires hands on the wheel and the driver to be ready to take over, is considered among the most capable on the market today. But to Musk, the ultimate illustration of an AI and robotics company is self-driving cars and humanoid robots. And today, neither of them exist at any scale.

Tesla’s first notable step toward that goal was in June when it launched a limited robotaxi service in Austin, Texas. Those Robotaxi-branded vehicles, which invited customers can hail via an app, have a Tesla employee sitting in the front passenger seat. But it’s still far from Musk’s original vision of a “general solution” that would allow a Tesla owner to earn money by renting out their vehicle as a robotaxi service.

The clock is ticking and Musk needs to show more progress — or at the very least tease upcoming launches to keep antsy shareholders content. Which is perhaps why Tesla is embarking on this ride-hailing gambit in California.

Earlier this month, Musk noted that Tesla would be launching a robotaxi service in the Bay Area “in a month or two” — regulatory approvals being the primary hang-up.

The problem? Tesla hasn’t even applied for the permits that would allow it to operate a robotaxi service. I checked Friday morning with the California DMV, which regulates driverless testing, and Tesla has not yet applied for the necessary permits. (A spokesperson did tell me the DMV met with Tesla to discuss the company’s plans to test autonomous vehicles in the state.)

Techcrunch event

San Francisco

|

October 27-29, 2025

So, instead Tesla has launched a ride-hailing service in the Bay Area. And yeah, users keep calling these robotaxis.

To be clear, while folks — including Musk’s brother and Tesla board member Kimbal Musk — may refer to these as robotaxis, they are not driving autonomously. (And if they are, it would be a violation of current regulations.) Again, Tesla does not currently have the permits to do anything beyond pay its own employees to use its fleet of EVs to drive people around the Bay Area. No autonomous driving in any way, shape, or form. You can read a recent explainer here that will take you through all of the various permits Tesla needs.

This ride-hailing launch has many folks wondering, what gives? My answer: optics.

A little bird

Recent chatter among some little birds suggests that the National Automobile Dealers Association is focusing its efforts on VW Group spinout Scout and the EV company’s plans for direct sales. The dealership industry group has opposed the direct sales model before. But unlike direct-sales adopters Tesla, Rivian, and Lucid, Scout is attached to a legacy automaker with a long-established dealer network.

Got a tip for us? Email Kirsten Korosec at kirsten.korosec@techcrunch.com or my Signal at kkorosec.07, Sean O’Kane at sean.okane@techcrunch.com or Rebecca Bellan at rebecca.bellan@techcrunch.com.

Deals!

Think back to the fall of 2023. Logistics company Flexport had captured the attention of Silicon Valley, in part because of founder Ryan Petersen’s fallout with ousted CEO Dave Clark and because of its acquisition of Convoy, the former freight tech unicorn that had just shut down.

Here’s an update. Flexport has now sold the Convoy platform to DAT Freight & Analytics. The terms were undisclosed, although the company said it had delivered a “massive return on investment for Flexport.” Reporting from Axios’ Dan Primack suggests that, yes, indeed “massive return” is an appropriate description.

Flexport never disclosed exactly what it had paid for Convoy’s tech, although reporting at the time put the figure at $16 million — a fraction of the unicorn’s previous valuation of $3.8 billion. Primack reported this week that Flexport sold the Convoy platform for $250 million.

Other deals that got my attention this week …

AIR, an Israel-based startup developing eVTOLs, raised $23 million in a Series A funding round led by Entrée Capital, with participation from existing backer Dr. Shmuel Harlap, an early investor in Mobileye.

LG Innotek, the components and materials subsidiary of South Korea’s LG Group, is investing up to $50 million in Aeva, acquiring an equity stake of about 6% in the U.S. lidar company. The investment is part of a broader manufacturing partnership between the two companies and marks Aeva’s push into consumer electronics, robotics, and industrial automation.

Notable reads and other tidbits

Elon Musk’s tunnel-digging company The Boring Company plans to build a 10-mile “loop” that will connect Nashville’s downtown and its convention center and airport. Important side notes: This will be funded by The Boring Company and its private partners, which are not named. And this is the start of a public process to evaluate routes, which means work won’t be starting right away.

Ford plans to reveal more information about its upcoming low-cost electric vehicles at an event in Kentucky on August 11. And, as senior reporter Sean O’Kane notes, the company is talking a very big game.

Joby Aviation has signed an agreement with defense contractor L3Harris Technologies to “explore opportunities” to develop a new aircraft class — specifically, a gas-turbine hybrid vertical take-off and landing (VTOL) aircraft that can fly autonomously — for defense applications. The gas-turbine hybrid VTOL will be based on Joby’s current S4 aircraft platform. This isn’t a contract, per se. But it does mark progress in Joby’s bid to go to market in the defense and consumer sectors.

While Uber continues to partner with every autonomous vehicle company under the sun, Lyft is trying to make its own deals. Lyft said it will add autonomous shuttles made by Austrian manufacturer Benteler Group to its network in late 2026. The shuttles will be deployed in partnership with U.S. cities and airports.

Waymo plans to launch a robotaxi service next year in Dallas, and this time it is partnering with Avis Budget Group to manage its fleet of autonomous vehicles. In other Waymo happenings, two of its robotaxis crashed into each other at one of the company’s staging lots in Phoenix this week, proving that the company’s rapid expansion into new cities does not mean it has ironed out all the kinks. Waymo says it’s investigating the cause.

Chinese AV company WeRide received an autonomous driving permit from Saudi Arabia. The company holds similar permits in China, the UAE, Singapore, France, and the United States.

One last thing

Waymo co-CEO Tekedra Mawakana will join the Disrupt Stage for a wide-ranging conversation on the current state of AVs — and where the industry goes from here. TechCrunch Disrupt 2025 will be held October 27–29 at Moscone West in San Francisco.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 week ago

Brand Stories1 week agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories1 month ago

Brand Stories1 month agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse1 month ago

Asia Travel Pulse1 month agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel1 month ago

AI in Travel1 month ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoContactless Hospitality: Why Remote Management Technology Is Key to Seamless Guest Experiences

You must be logged in to post a comment Login