AI in Travel

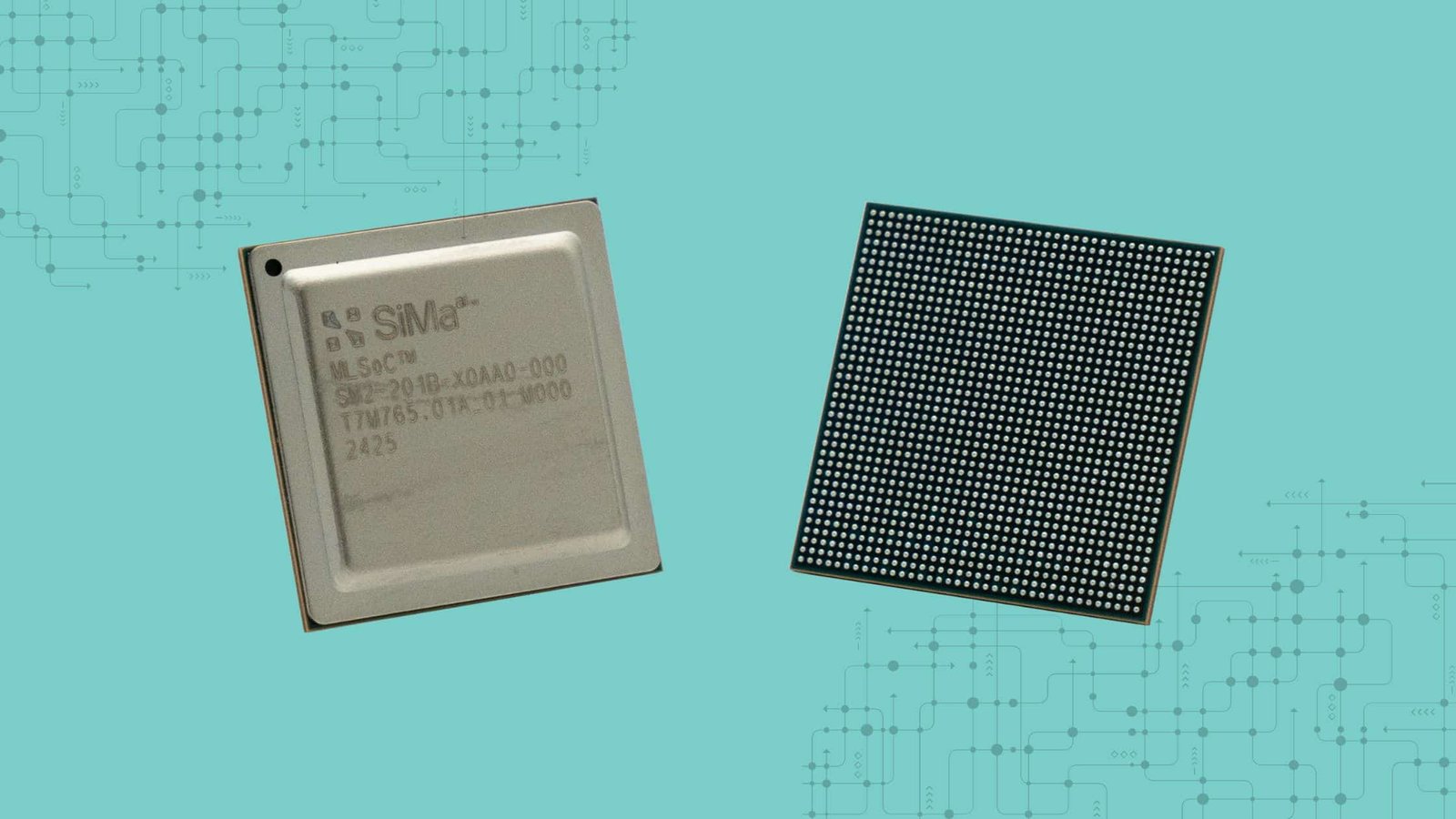

US-Based AI Chip Startup SiMa.ai Raises $85 Mn to Expand Physical AI Platform

US-based SiMa.ai has raised $85 million in an oversubscribed funding round, taking its total capital raised to $355 million. The round was led by Maverick Capital, with participation from existing investors and new investor StepStone Group.

The company plans to use the funds to expand globally and scale its physical AI platform. Investments will focus on software innovation, go-to-market operations, customer success, and advancing its automotive roadmap.

“Our new funding validates the growing demand for physical AI solutions,” said Krishna Rangasayee, founder and CEO of SiMa.ai. “With support from our investors, we are scaling to meet global demand across robotics, automotive, industrial automation, aerospace and defence, smart vision, and healthcare.”

In a recent exclusive interview with AIM, Rangasayee also praised the Indian market, saying, “We believe India could be the next market maker for the planet. And not only for local consumption, but for global consumption.”

SiMa.ai offers a full-stack physical AI platform with SiMa.ai ONE, combining custom silicon with a software-centric approach. Its second-generation MLSoC, Modalix, is now shipping along with Palette, a software suite featuring an SDK and Edgematic, a no-code visual development tool. The platform supports all major machine learning frameworks for applications in edge computing.

“SiMa.ai is redefining possibilities at the edge,” said Andrew Homan, managing partner at Maverick Capital. “Their low-power, high-performance solutions with simple deployment are well positioned for a fast-scaling market.”

StepStone Group partner John Avirett said the rise of generative AI highlights the opportunity for efficient AI at the edge. He further mentioned that SiMa.ai’s full-stack solution and growing customer adoption make it a clear leader in this space.

Recently, last month, the company also partnered with Cisco to accelerate the deployment of AI in Industry 4.0 applications. The collaboration integrated SiMa.ai’s Modalix AI platform with Cisco’s IE3500 industrial Ethernet switches to enable low-latency, production-grade AI at the edge across manufacturing, logistics, and automation sectors.

The post US-Based AI Chip Startup SiMa.ai Raises $85 Mn to Expand Physical AI Platform appeared first on Analytics India Magazine.

AI in Travel

Travel Startup Funding Declines in 2025: How Global Uncertainty and AI Innovation Shape Investment Opportunities in Travel Tech

Sunday, August 3, 2025

The global context seems to have an impact on the travel industry’s slowing down of the travel industry’s funding, especially during the start of 2025. In the travel tech segment, the dip in funding of $1 billion to travel tech startups in the first quarter of 2025, along with the $800 million in investment noted in the second quarter, appears to be indicative of a period of volatility. During the preceding year, a range of global conflicts, as well as concerns with regard to tariffs and political situations, have caused the tech travel sector to be treated with far more caution.

The travel industry pandemic rebound period seems to booster the industry’s funding in the lead up to 2025 with a projection of receiving $16 billion in 2021. In stark contrast to the $5.5 million noted in 2024, the expectation of $4 billion investment during 2025 serves to indicate that the funding available to industry startups is on the decline. Through 2025 the other expectation is framed on these values, the continuing dip on travel tech funding caters to fears surrounding economic instability, attitudes toward risk, the pace of tech synthesis, and funding available.

The Effects of Global Uncertainty on Funding for Travel Startups

The Global Economic Uncertainty report on Travel Startups Funding states that emerging technologies, especially artificial intelligence, have a considerable impact on funding Artificial Travel Startups. Coupled with the rising tariffs, political unrest, and fluctuating currencies, travel startups AI technologies, the funding for AI Travel Startups has decreased tremendously. All of the above factors have led to an investors’ selective approach when it comes to travel startups.

The travel industry, in particular, is one that has suffered a great deal of complexity in terms of financing. Travel startup businesses that used to flourish and expand at a rapid have suffered a great deal during and especially for investors back in 2025. The COVID-19 global pandemic has led to the emergence and interrelations of previously un-imagined factors of business such as systematic travel, systematic economy, irrational travel policies, and artificial investments.

Travel Technology Startups and Investment Innovation Trends

The COVID-19 pandemic has led to unforseen and un-imagined global, economic, social and business factors. Travel technology startups have managed to increase their funding and investments. The fact that they managed to secure funding during such a rough economic period, serves as a good example. Corporates such as Fora, Holodi, Canary and Ramp have dramatically shifted the investment paradigm due to their lack of panic during financial results of investors back in 2025.

As an example, Ramp, focused on financial management for businesses with a technology platform, received $200 million in funding. Canary Technologies, for its part, raised $80 million as a provider of enterprise-grade technology solutions for hospitality. Fora, a quickly scaling travel advisory, received $60 million for further investment into their services. Still, contracting investor confidence has caused most other startups to receive funding under $10 million, a trend that captures a wider scope of diminished investor trust.

Onfly, a travel tech startup that was featured in PhocusWire’s Hot 25 Startup list for 2022, did manage to receive $40 million, which is a notable exception. This is, in fact, a good sign for startups that are innovative and manage to distinguish themselves in a competitive space.

The Difficulty in Receiving Funding for Early-Stage Startups

In comparison, early stage startups have had a more difficult time securing funding, as large rounds of funding continue to be obtained. Pre-seed and seed rounds have dramatically declined, with only a very small number of firms able to secure funding. In the last few months, Juno, Travaras, and Airial Travel, raised a modest but still notable $1.4 million to $3 million each.

The AI-powered environment poses additional challenges due to a lack of funding. The potential of AI is not lost on travel startups, but most investors are wary due to the overselling of AI technologies. The ability to make use of AI in the appropriate manner is viewed as a key determinant of a startup’s attractiveness to investors. However, given the travel industry’s uncertain landscape, investors are unwilling to pour substantial money into early-stage ventures that lack a track record.

Travel Tech Investment Outlook

Despite these hurdles, a number of leading travel tech investors have expressed optimism, particularly with respect to funding in the growth and later stages, which suggests that early-stage funding is more challenging to secure. These investors are optimistic about the funding climate toward established travel tech firms that have proven their business model and success.

According to some specialists, the travel technology industry has transitioned from a mere subsection to a fully-fledged vertical, complete with defined routes from conception to IPO. Investors now understand the industry thoroughly. This particular aspect of market maturity may contribute to the increased optimism regarding growth-stage companies tailored for investment.

The funding optimism for companies initiating later-stage funding aligns with broader investment industry trends. The ongoing refinement of travel technology companies and the meticulous scaling of their operations has rendered the preceding journey to a lucrative exit—either via IPOs or mergers and acquisitions (M&A)—more streamlined, thus increasing their appeal to strategic investors.

M&A Activity and the Quest for Exits

As funding becomes more challenging to secure, some startups are now seeking out mergers and acquisitions (M&A) activity as a strategy to gain an exit. While the year-over-year M&A activity for the second quarter of 2025 was rather tame, there were a couple of significant deals. For instance, Marriott continues to pursue companies that help enhance their lines of business by purchasing CitizenM for $355 million. Likewise, some major players in the travel sector are seeking to divest non-core assets, as exemplified by the $1.1 billion acquisition of Sabre’s hospitality business by TPG, thus creating opportunities for startups to be absorbed.

Consolidation becomes the order of the day in travel tech, and these deals showcase this trend. The once attainable funding for independent startups is now turning out to be more of a challenge, thus enabling organic growth via acquisitions is a more plausible strategy for many.

Both the lack of funding and the hurdles that startups need to overcome brings forth an interesting hypothesis that, for many companies, M&A activity will become a more commonplace strategy to pursue in the upcoming months. This trend, primarily driven by the desire to exploit new technologies that can be assimilated into their business operations, can be observed for some time.

The Importance of IPOs Within the Travel Tech Sector

Concerning the travel sector, IPOs have recently shown some hopeful signs, even if funding and acquisitions remain sluggish. Companies such as Navan Travel are openly announcing their plans to IPO, which signals confidence in the market’s potential over the long run. These IPOs offer the possibility of fulfilling the liquidity needs of travel startups and could serve as an indicator for others who are contemplating going public in the future.

The combination of the prevailing global economic uncertainties makes the route to IPO even more difficult. As the travel sector works through the various challenges, companies will have to demonstrate some value in their resilience and adaptability prior to being exposed to the IPO public offering scrutiny.

Final Thoughts: Where to Travel Tech Startups Look for Investment in the Future?

As noted, the forecast decline in startup investment in travel tech for 2025 is consistent with prevailing global economic trends. These include some degree of global conflict, rising tensions between major global players, and political ‘vagueness’ all resulting in an investment ‘wait and see’ approach. While some investors are still able to fund travel tech companies, investment in early-stage companies is more difficult than ever.

Notwithstanding these challenges, the outlook for travel startups remains optimistic. There will invariably be investment in the market’s maturation’s later stages. In addition, continued efforts by travel tech companies to optimize their business models and enter new markets will drive further consolidation and innovation by enhancing the potential for mergers and acquisitions and IPOs.

Startups willing to adapt to current conditions in the travel sector must be agile and forward-looking. In the context of sustainability, artificial intelligence, new business models, and a looming global unpredictability, the next phase will likely be dominated by companies that endure the test of innovation against resilience.

AI in Travel

Delta Air Lines Will Use A.I. Personalized Pricing: What Is It?

Recently, Delta Air Lines announced it would expand its use of artificial intelligence to provide individualized prices to customers. This move sparked concern among flyers and politicians. But Delta isn’t the only business interested in using A.I. this way. Personalized pricing has already spread across a range of industries, from finance to online gaming.

Customized pricing — where each customer receives a different price for the same product — is a holy grail for businesses because it boosts profits. With customized pricing, free-spending people pay more while the price-sensitive pay less. Just as clothes can be tailored to each person, custom pricing fits each person’s ability and desire to pay.

I am a professor who teaches business school students how to set prices. My latest book, The Power of Cash: Why Using Paper Money is Good for You and Society, highlights problems with custom pricing. Specifically, I’m worried that A.I. pricing models lack transparency and could unfairly take advantage of financially unsophisticated people.

The history of custom pricing

For much of history, customized pricing was the normal way things happened. In the past, business owners sized up each customer and then bargained face-to-face. The price paid depended on the buyer’s and seller’s bargaining skills — and desperation.

An old joke illustrates this process. Once, a very rich man was riding in his carriage at breakfast time. Hungry, he told his driver to stop at the next restaurant. He went inside, ordered some eggs and asked for the bill. When the owner handed him the check, the rich man was shocked at the price. “Are eggs rare in this neighborhood?” he asked. “No,” the owner said. “Eggs are plentiful, but very rich men are quite rare.”

Custom pricing through bargaining still exists in some industries. For example, car dealerships often negotiate a different price for each vehicle they sell. Economists refer to this as “first-degree” or “perfect” price discrimination, which is “perfect” from the seller’s perspective because it allows them to charge each customer the maximum amount they’re willing to pay.

Currently, most American shoppers don’t bargain but instead see set prices. Many scholars trace the rise of set prices to John Wanamaker’s Philadelphia department store, which opened in 1876. In his store, each item had a nonnegotiable price tag. These set prices made it simpler for customers to shop and became very popular.

Why uniform pricing caught on

Set prices have several advantages for businesses. For one thing, they allow stores to hire low-paid retail workers instead of employees who are experts in negotiation.

Historically, they also made it easier for stores to decide how much to charge. Before the advent of A.I. pricing, many companies determined prices using a “cost-plus” rule. Cost-plus means a business adds a fixed percentage or markup to an item’s cost. The markup is the percentage added to a product’s cost that covers a company’s profits and overhead.

The big-box retailer Costco still uses this rule. It determines prices by adding a roughly 15% maximum markup to each item on the warehouse floor. If something costs Costco $100, they sell it for about $115.

The problem with cost-plus is that it treats all items the same. For example, Costco sells wine in many stores. People buying expensive Champagne typically are willing to pay a much higher markup than customers purchasing inexpensive boxed wine. Using A.I. gets around this problem by letting a computer determine the optimal markup item by item.

What personalized pricing means for shoppers

A.I. needs a lot of data to operate effectively. The shift from cash to electronic payments has enabled businesses to collect what’s been called a “gold mine” of information. For example, Mastercard says its data lets companies “determine optimal pricing strategies.”

So much information is collected when you pay electronically that in 2024 the Federal Trade Commission issued civil subpoenas to Mastercard, JPMorgan Chase and other financial companies demanding to know “how artificial intelligence and other technological tools may allow companies to vary prices using data they collect about individual consumers’ finances and shopping habits.” Experiments at the FTC show that A.I. programs can even collude among themselves to raise prices without human intervention.

To prevent customized pricing, some states have laws requiring retailers to display a single price for each product for sale. Even with these laws, it’s simple to do custom pricing by using targeted digital coupons, which vary each shopper’s discount.

How you can outsmart A.I. pricing

There are ways to get around customized pricing. All depend on denying A.I. programs data on past purchases and knowledge of who you are. First, when shopping in brick-and-mortar stores, use paper money. Yes, good old-fashioned cash is private and leaves no data trail that follows you online.

Second, once online, clear your cache. Your search history and cookies provide algorithms with extensive amounts of information. Many articles say the protective power of clearing your cache is an urban myth. However, this information was based on how airlines used to price tickets. Recent analysis by the FTC shows the newest A.I. algorithms are changing prices based on this cached information.

Third, many computer pricing algorithms look at your location, since location is a good proxy for income. I was once in Botswana and needed to buy a plane ticket. The price on my computer was about $200. Unfortunately, before booking I was called away to dinner. After dinner my computer showed the cost was $1,000 — five times higher. It turned out after dinner I used my university’s VPN, which told the airline I was located in a rich American neighborhood. Before dinner I was located in a poor African town. Shutting off the VPN reduced the price.

Last, often to get a better price in face-to-face negotiations, you need to walk away. To do this online, put something in your basket and then wait before hitting purchase. I recently bought eyeglasses online. As a cash payer, I didn’t have my credit card handy. It took five minutes to find it, and the delay caused the site to offer a large discount to complete the purchase.

The computer revolution has created the ability to create custom products cheaply. The cashless society combined with A.I. is setting us up for customized prices. In a custom-pricing situation, seeing a high price doesn’t mean something is higher quality. Instead, a high price simply means a business views the customer as willing to part with more money.

Using cash more often can help defeat custom pricing. In my view, however, rapid advances in A.I. mean we need to start talking now about how prices are determined, before customized pricing takes over completely.

Jay L. Zagorsky, Associate Professor Questrom School of Business, Boston University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

AI in Travel

Talking to me takes the stress out of trip planning.

BarcelonaLayla has been planning trips since 2024. To talk, you don’t need to visit an agency, make a phone call, or observe any time restrictions: any device with an internet connection is sufficient to reach her. Layla presents herself with the self-confidence characteristic of job interviews: “Talking to me takes the stress out of planning trips,” “talking to me is like having your own travel guru without the high price.” But Layla isn’t just any worker: she’s an artificial intelligence (AI).

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 week ago

Brand Stories1 week agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse4 weeks ago

Asia Travel Pulse4 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel4 weeks ago

AI in Travel4 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login