Travel Market Insights

IHG Hotels & Resorts Introduces LINE MiniApp in Japan for Hotel Bookings

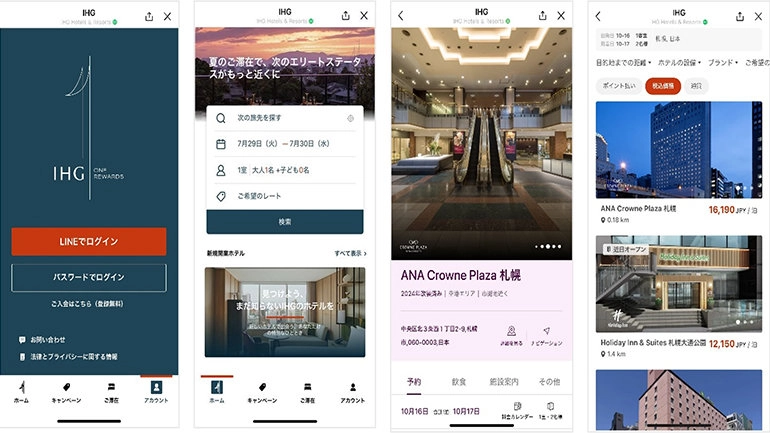

IHG Hotels & Resorts has launched a LINE MiniApp in Japan, enabling users to book hotels and access IHG One Rewards through the LINE platform.

IHG Hotels & Resorts has introduced a new LINE MiniApp in Japan, allowing users to book hotel stays and access IHG One Rewards directly through the LINE app. LINE is a widely used communication platform in Asia, with significant market penetration in Japan, where it is used by over 90% of individuals aged 13 to 79.

The new MiniApp enables users to search and book from more than 6,600 IHG hotels worldwide. Additionally, users can register for the IHG One Rewards program with a single click using their LINE credentials. The app also allows users to access their IHG One Rewards account details, check membership status, and track and redeem points without leaving the LINE app. Furthermore, the MiniApp integrates partner point programs, enabling users to manage and use points from partners such as Rakuten Points and ANA Mileage Club.

The launch of the LINE MiniApp is part of IHG’s ongoing digital innovation efforts to provide integrated access to hotel bookings and rewards program features. The MiniApp also includes a series of limited-edition LINE stickers available for download until August 25.

In April 2024, IHG enhanced its official LINE account, which has led to significant subscriber growth. As of July 2025, the account has over 1.4 million followers. IHG continues to invest in technology and customer-centric solutions to meet the evolving needs of travelers.

Travel Market Insights

South Korea Offers Visa-Free Entry for Chinese Group Tours from September

South Korea is ready to roll out the welcome mat for Chinese tour groups this fall. Starting September 29 and running through June 30, next year, Chinese visitors traveling in organized groups will no longer need a visa to enter the country, the prime minister’s office announced on Wednesday.

The move comes just under a year after China lifted its own visa rules for South Korean nationals. It marks the broadest easing of entry rules for Chinese travelers since the pandemic, and offers a clear sign that both capitals are looking to deepen ties through tourism.

It’s unclear the duration for which the tourists can stay visa free in the country as the government has yet to announce the maximum duration for group tourists under the new policy.

In November 2024, China surprised many by adding South Korea to its visa-free list for stays up to 15 days. “With Korea’s inbound tourism market recovering rapidly, the new visa waiver policy is expected to generate additional demand from Chinese tourists and contribute to revitalizing regional economies and boosting domestic demand,” a government statement said.

Earlier, Chinese group travelers could only visit Jeju Island visa-free, and only for up to 30 days. A brief window of exemptions for group tours during the 2018 Winter Olympics in Gangwon Province offered limited scope. But this new policy applies nationwide, no matter how visitors arrive.

According to Skift Research’s 2025 Travel Outlook Survey, travelers from India and China lead in plans to spend on travel.

Tourism by the Numbers

Tourism is staging a strong comeback for South Korea. Last year, the country welcomed 16.37 million international visitors, a 48% increase over 2023, though still 6.5% below its pre-pandemic peak. Chinese tourists led the way with 4.6 million arrivals.

In the first half of 2025, 8.83 million overseas visitors came to Korea, almost 15% more than a year earlier and already above pre-pandemic levels. Of these, Chinese tourists made up the biggest share with 2.53 million arrivals. Seoul hopes to draw 5.36 million Chinese visitors this year, closing in on the 6.02 million recorded in 2019.

A World Travel & Tourism Council report released last year said the tourism industry in South Korea was projected to account for 4.3% of the nation’s economy. In 2024, foreign visitors spent more money than ever, pouring 9.26 trillion won ($6.9 billion) into the local economy in 2024, around 43% more compared to the year before.

The Bank of Korea estimates that every additional million Chinese tourists could lift GDP by up to 0.08 percentage points. Incheon Airport data show that routes between Korea and China saw 4.68 million passengers in the first five months of 2025, a nearly 25% jump compared to last year.

The top-visited destinations for Chinese travelers are Singapore, Japan, and South Korea, according to China Trading Desk’s second quarter survey released in June.

More than 100 countries enjoy visa-exemption privileges in South Korea, under pacts based on reciprocity or national interest. Depending on the country, stays range from 30 days to up to six months for countries like Canada.

More Than Just Visas

South Korea isn’t stopping at visa waivers. It plans to speed up immigration for key visitors to conferences, trade shows, and exhibitions. Under the new plan, any international event with at least 300 foreign participants (down from 500) will qualify attendees for fast-track lanes at immigration. This should help Korea’s push to be a top-tier destination for meetings, incentives, conferences and exhibitions.

Medical tourism is getting a boost too. Agencies that refer 500 or more foreign patients will now be able to handle electronic visas.

Korean carriers are boosting capacity across Asia, launcing new routes and adding flights to Japan, China and Southeast Asia. This month, Korean Air increased its weekly China service from 188 to 194 flights, this is about 90% of its pre-pandemic schedule. Since May, Asiana has added 26 weekly flights to China. Low-cost carrier Jeju Air now offers seven weekly services to China.

South Korea’s foreigners-only casinos have also been witnessing a significant rise in their sales revenue with the return of high rollers from China and Japan. Paradise Co, the largest such operator in Korea, saw its casino revenues climb by more than 50% in March 2025 compared to the year before, posting 81 billion won ($58 million) in casino revenue, according to the Korea Economic Daily.

The travel industry’s top event returns this fall.

September 16-18, 2025 – NEW YORK CITY

Travel Market Insights

Booking’s Credit Card, Marriott’s Slower Growth and Spain’s Rental Crackdown

Good morning from Skift. It’s Wednesday, August 6. Here’s what you need to know about the business of travel today.

Booking.com has soft-launched its first credit card in the U.S., the Booking.com Genius Rewards Visa Signature Credit Card, reports Executive Editor Dennis Schaal.

Schaal writes the rewards card should help Booking.com increase direct bookings and build its U.S. business. The card issues travel credits instead of offering points and miles, common with airline and hotel co-branded cards.

Cardholders would receive 6% in travel credits for hotels and short-term rental stays booked via the Booking.com app, and 5% on all other travel purchased on Booking.com.

Listen to This Podcast

🎧 Subscribe

Apple Podcasts | Spotify | Youtube | RSS

Next, Marriott has trimmed its full-year forecast after a sluggish second quarter, writes Senior Hospitality Editor Sean O’Neill.

The company’s overall global growth for revenue per available room was only 1.5% while it was flat in the U.S. and Canada. O’Neill notes Marriott’s main drag was a weak U.S., which was partly the result of uncertainty from the Trump tariffs and partly because of when Easter fell this year. Marriott also saw a drop in government travel.

Marriott now projects between 1.5% and 2.5% revenue per available room growth for the full year, down from its previous forecast of up to 3.5% growth.

Finally, Spanish authorities are preparing to delist thousands of unregistered short-term rentals, writes Contributor Ian Mount.

Spain’s housing ministry will soon enforce a 2024 law requiring all short-term rentals to display a unique rental registration number. Properties that don’t comply will be removed from major platforms like Airbnb. The first listings will be removed from platforms in mid-August after property owners are given a 10-day grace period to appeal.

Mount notes that many owners appear to have delayed applying for their rental registration number until the last minute, creating processing backlogs.

The travel industry’s top event returns this fall.

September 16-18, 2025 – NEW YORK CITY

Travel Market Insights

Amex GBT Aims for $155 Million in Savings From CWT Merger

Large mergers can be messy affairs, but Global Business Travel Group officials are focused on cost savings now that the merger with CWT is slated to close soon.

“We expect to deliver approximately $155 million in identified net synergies and have a proven track record of integrating large acquisitions and achieving our synergy targets,” Paul Abbott, the CEO of Amex GBT, said during the second-quarter earnings call. Those savings would be over a three-year period.

The merger of the #1 (Amex GBT) and #4 (CWT) largest global players in business travel is on track to close before the end of September now that the U.S. Department of Justice dismissed its own lawsuit against the merger.

Abbott said that “given the recent clarity on CWT,” it plans to initiate additional share repurchases in the next few months.

The CEO said he can’t comment on CWT’s financial performance but will do so in November during the next quarterly presentation.

“Our commercial success, margin expansion and improved demand environment give us confidence to raise and narrow our full-year 2025 guidance,” Abbott said.

Customer Wins

The commercial success was a reference to market share gains and $3.2 billion in new customer wins over the past year. Some $2.2 billion of those wins were of small- and medium-sized businesses, a segment that has been traditionally hard to capture.

Amex GBT’s adjusted EBITDA increased 4% in the second quarter. Revenue rose 1% to $631 million.

After macro uncertainty saw corporate travel demand dip modestly in April, transactions grew a combined 2% in May and June. “We continue to see green shoots into July that give us confidence that the demand environment has improved,” Abbott said.

The travel industry’s top event returns this fall.

September 16-18, 2025 – NEW YORK CITY

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

Destinations & Things To Do2 weeks ago

Destinations & Things To Do2 weeks agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

AI in Travel2 weeks ago

AI in Travel2 weeks agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories1 month ago

Brand Stories1 month agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories4 weeks ago

Brand Stories4 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoContactless Hospitality: Why Remote Management Technology Is Key to Seamless Guest Experiences

-

Asia Travel Pulse1 month ago

Asia Travel Pulse1 month agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel1 month ago

AI in Travel1 month ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

You must be logged in to post a comment Login