Travel Market Insights

How Sensory Experiences are Shaping China’s Hotel Industry

Chinese luxury hotel experiences are increasingly defined by sensory and emotional stimulation, driven by younger consumers seeking more than traditional displays of wealth.

Luxury consumption in China is undergoing a significant transformation, particularly among the younger generation. Unlike traditional luxury consumption, which often focused on the display of wealth, modern Chinese consumers are increasingly interested in experiences that engage their senses and emotions. This shift is particularly noticeable in the hospitality sector, where luxury hotels are now catering to these evolving preferences. Research by Professors Kam Hung and Cathy Hsu from The Hong Kong Polytechnic University explores how sensory experiences are redefining luxury hotel stays in China.

Changing Preferences in the Hospitality Sector

China is one of the world’s largest luxury markets, with a growing appetite for high-end goods and services among its younger population. This demographic shift is influencing the hospitality industry, as luxury hotels aim to offer more than just high-end facilities. According to the researchers, these establishments are increasingly focused on fulfilling the social, cultural, and emotional needs of their guests through sensory stimulation. However, there is still limited understanding of how these sensory experiences shape consumer perceptions and interactions with luxury hotels.

Beyond Conspicuous Consumption

Traditionally, luxury hotel experiences have been studied through the lens of conspicuous consumption, where high-end goods or services are purchased to display wealth and social status. However, the concept of luxury consumption is evolving to include dimensions such as self-actualization, transformation, sustainability, escapism, hedonic value, and authenticity. Researchers emphasize the importance of examining the multi-sensory modalities of hotel offerings to provide a comprehensive understanding of luxury hospitality experiences.

Cultural Perspectives on Luxury

The study also highlights the need to explore luxury from a cultural perspective. Chinese consumers tend to be younger than their Western counterparts and may have different motivations and expectations. As China’s socioeconomic landscape evolves, researchers caution against relying on outdated assumptions about Chinese society when studying luxury consumption. Understanding these cultural nuances is crucial for hoteliers seeking to craft meaningful and memorable experiences for their guests.

Methodology and Findings

To explore these sensory experiences, the researchers employed the Zaltman metaphor elicitation technique (ZMET), which uses visual and sensory images to uncover insights that are not easily expressed in words. Sixteen participants who had recently stayed in upscale hotels were interviewed, revealing three categories of experiences: supportive, personal/social, and affective. Supportive experiences included sensory interactions with exclusive services, artistic décor, and dining experiences. These, in turn, led to personal/social experiences, such as social connections and “me time,” and affective experiences, including feelings of relaxation, happiness, and prestige.

Implications for the Luxury Hotel Industry

The study offers valuable insights for the luxury hotel sector in China and beyond, emphasizing the importance of viewing consumers as emotional beings and creating pleasant experiences through exclusive services, facilities, and artistic décor. The findings suggest that luxury hotels should prioritize these elements, as they are the most significant triggers of guest satisfaction. By focusing on sensory and emotional experiences, luxury hotels can better meet the evolving preferences of modern Chinese consumers.

The research by Professors Kam Hung and Cathy Hsu offers a fresh perspective on luxury consumption in China’s hospitality sector. By focusing on sensory experiences, the study provides a deeper understanding of how modern consumers engage with luxury hotels. These insights have important implications for hoteliers seeking to create memorable and meaningful experiences for their guests, ultimately redefining the concept of luxury in the Chinese market.

Discover more at Hong Kong PolyU.

Travel Market Insights

Etihad Airways CEO Unpacks Big Bet on Small Jets

In a region known for flying enormous 777s and double-decker A380s, Etihad’s newest star is a single-aisle jet. The Gulf carrier took delivery of its first Airbus A321LR this week, a long-range variant of a plane more typically used for short economy-focused flights.

The UAE airline is betting on the new aircraft to supercharge its network growth and broader brand revival. As Etihad CEO Antonoaldo Neves told Skift: “Today we show the world we’re back in the game, and specifically back in the premium game.”

That game involves an aircraft type already familiar to many travelers. The A321LR, an evolution of Airbus’ best-selling narrowbody, is new-generation, but not exactly groundbreaking.

JetBlue took delivery of its first in 2021, while Aer Lingus, Air Transat, and SAS are among others to use the jet on short transatlantic hops. But it’s the speed and scale at which Etihad is adding the A321LR – along with its distinctive three-class configuration – that is piquing industry interest.

30, Not 20, A321LRs on the Way

Speaking at a media briefing at Airbus’ Finkenwerder factory in Germany, Neves left reporters scrambling for their notes. What was meant to be a tranche of 20 A321LRs became a throng of 30. Asked for clarity on the 50% increase, Neves quipped: “You guys are reading the wrong newspaper.”

Through a mix of leased aircraft and direct orders, Etihad will now receive 30 A321LRs over the next four years. A steady flow should result in 10 deliveries by the end of 2025, followed by another 10 the next year, then five each in 2027 and 2028. From the airline’s Abu Dhabi hub, the long-range jets will fly as far afield as Paris and Hanoi. Journey tim

Travel Market Insights

U.S. Hotel Industry Faces Continued Declines Amid Global Growth Trends

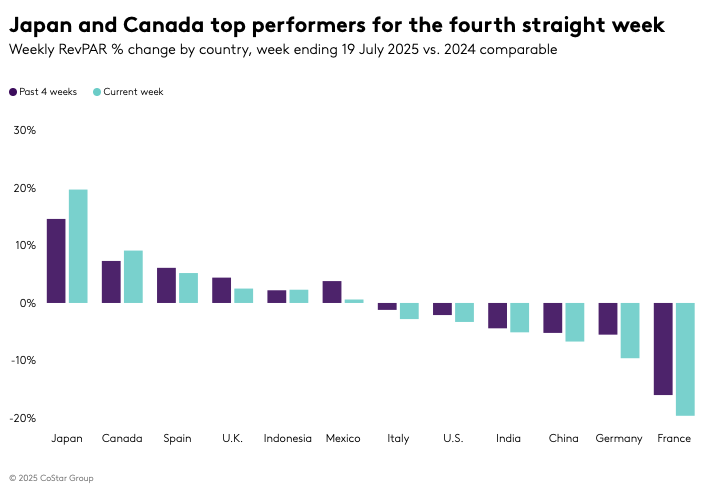

The U.S. hotel industry experiences a fourth consecutive week of declining revenue per available room (RevPAR), while Japan and Canada show strong growth in the global market.

U.S. Hotel Industry Trends

The U.S. hotel industry reported a continued decline in revenue per available room (RevPAR) for the week ending 19 July 2025, marking the fourth consecutive week of decreases. RevPAR fell by 3.3% year over year, slightly improving from the previous week’s 3.7% drop. The primary contributors to this decline were a 1.8% decrease in room demand and a 0.7% drop in the average daily rate (ADR). Despite a modest 0.8% increase in room supply, weekly occupancy fell by 1.9 percentage points to 71.6%.

The most significant RevPAR declines were observed in major metro markets, with the Top 25 Markets experiencing a 4.3% decrease and other metro markets seeing a 4.7% drop. Las Vegas, Houston, and Los Angeles were the primary drivers of this negative trend. Las Vegas experienced a 17.1% decline in RevPAR, primarily due to reduced international arrivals and the economic impact on lower-income households. Houston experienced a 38.3% drop due to tough comparisons with last year’s demand spikes from Hurricane Beryl and the “Derecho.” Los Angeles faced an 8.9% decline, with the Central Business District experiencing a 17.8% drop amid market tensions.

Impact on Different Market Segments

Excluding the three major markets of Las Vegas, Houston, and Los Angeles, the U.S. RevPAR would have declined by a lesser amount, at 1.9%. ADR, excluding these markets, was down by 0.2%, remaining below the rate of inflation. In the Top 25 Markets, RevPAR was relatively flat at -0.6%, with a 1.0% increase in ADR when excluding these markets.

Metro markets outside the Top 25 saw the largest RevPAR decline, at 4.7%, accompanied by a 2.8% decrease in ADR. Non-metro and rural markets also experienced decreases, primarily due to a 1.0 percentage point drop in occupancy. Since Memorial Day weekend, summer demand has decreased by 1.6 million room nights, or 0.7%, compared to the previous year, with ADR remaining flat at 0.1%. The Luxury segment was the only chain scale to see RevPAR growth, though demand increased in all scales except Economy and Independents.

Global Market Performance

Globally, RevPAR, excluding the U.S., increased for the third consecutive week, with a 0.5% rise driven entirely by ADR. Although occupancy fell by 1.3 percentage points compared to last year, it reached the highest level of the year at 72.2%. Japan maintained its top RevPAR position, with Osaka leading the gains, driven by the EXPO 2025 event. Canada posted the second-highest RevPAR gain, with ten of its 22 markets experiencing double-digit increases. Spain and the U.K. also showed strong performance, driven by significant events and increased travel.

Conversely, France and Germany experienced declines due to shifts in sporting event calendars, while China’s RevPAR fell by 6.7%, with significant declines in Beijing and Guangzhou.

Outlook

The U.S. hotel industry faces a mix of positive and negative signals moving forward. Analysts anticipate nuanced interpretations of performance data due to tough year-over-year comparisons, particularly in September and October, following the impacts of hurricanes Helene and Milton. Sociopolitical factors are also expected to affect short-term demand in select markets. Despite current challenges, American Airlines CEO Robert B. Isom expressed optimism, predicting that July will mark the low point, with performance expected to improve sequentially each month as demand strengthens.

Discover more at STR.

Travel Market Insights

Here’s How He’s Advising Other Hotel Groups

Neil Jacobs spent 13 years building Six Senses into a resort brand known for sustainability and wellness. Now, weeks after stepping down as CEO, Jacobs has launched Wild Origins, a new venture that advises hospitality groups and developers on everything from concept creation and brand strategy to design, operations, and execution.

“We can behave as a consultant, offering McKinsey-type advice in our industry, or we can actually do it for people,” Jacobs told Skift.

Wild Origins is currently advising Capella Hotel Group, which plans to increase its hotel openings next year. Jacobs is working with the group on growth strategy and senior leadership planning, including the recruitment of a new CEO.

“You go from opening one hotel every two or three years, to next year they’re g

-

Brand Stories6 days ago

Brand Stories6 days agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories1 day ago

Brand Stories1 day agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

AI in Travel1 week ago

AI in Travel1 week agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Destinations & Things To Do1 day ago

Destinations & Things To Do1 day agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

Asia Travel Pulse3 weeks ago

Asia Travel Pulse3 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel3 weeks ago

AI in Travel3 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login