Ride & Mobility

‘Motorcycle ride-hailing industry financially robust’

THE country’s motorcycle ride-hailing industry remains financially strong and poised for long-term expansion, according to Angkas, one of the sector’s leading platforms.

The statement comes in response to recent concerns raised about the viability of motorcycle taxis in the Philippines.

Angkas Chief Executive Officer George Royeca said the sector is not just stable but thriving, with market projections estimating the industry’s value to reach $1.33 billion by the end of the decade.

He emphasized that the growth is being driven by sustained commuter demand, the expansion of e-commerce, and ongoing challenges in public transportation.

Royeca cited the firm’s own performance as proof of industry health, citing the platform’s over 12 million app downloads nationwide.

The company has trained and deployed tens of thousands of riders nationwide and claims a 99.997 percent safety record since its operations began.

“The motorcycle ride-hailing industry has become deeply woven into the fabric of Filipino urban life. It’s not a trend — it’s an essential service,” Royeca said.

He added that affordability, quicker travel times in congested cities, and the limited reach of traditional transport systems have made motorcycle taxis indispensable to daily commuting.

Angkas also pointed to the arrival of new players in the market as a signal of growing investor confidence.

Royeca said this healthy competition only further legitimizes the sector and pushes all stakeholders to uphold safety, efficiency and reliability.

He credited the firm’s reputation to its efforts in setting professional standards for the industry. These include extensive rider training programs, compliance with government regulations, and active engagement in legislation aimed at fully legalizing motorcycle taxis across the country.

“Financially and operationally, Angkas is strong — and getting stronger,” Royeca said. “We welcome competition and scrutiny, but we stand firm on our record.”

With the number of projected users expected to exceed 22 million by 2030, Angkas reiterated its commitment to safety and job creation, describing the ride-hailing sector not as a temporary solution but as a permanent fixture of modern urban mobility in the Philippines.

Founded in 2016 and based in Makati, Angkas operates in Metro Manila, Metro Cebu, Cagayan de Oro, and other major cities, providing both ride-hailing and delivery services through a trained rider fleet exceeding 30,000.

Ride & Mobility

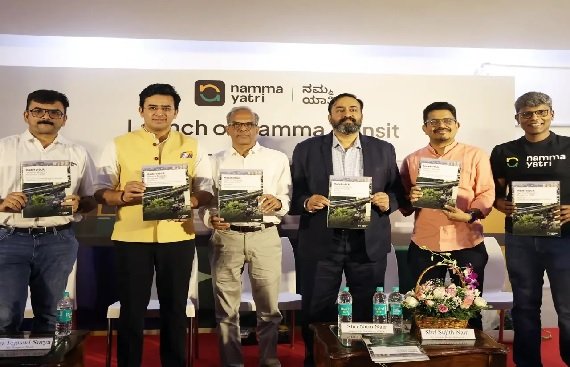

Namma Yatri Rolls Out Multimodal Transit Assistant for Bengaluru

· Namma Transit integrates metro, auto, and cab services into a seamless journey planner

· Built on ONDC, with real-time updates and future BMTC bus integration

· New mobility report sets 2030 goals cut commute time, emissions, and boost public transport use

As Bengaluru battles increasing traffic jams and longer travel times, ride-hailing app Namma Yatri has introduced Namma Transit an integrated mobility feature that promises to change the face of Bengaluru’s commuting pattern. The feature unifies metro rides, autorickshaws, and cab trips under a single real-time trip planning platform.

The launch has come at a time of 16% increase in the average commute times in the city, with a standard 19-kilometer ride now taking about 63 minutes. Namma Transit hopes to present a smarter and quicker option by walking users through every step of their trip from determining the nearest metro station and platform to arranging last-mile connectivity through autos and cabs.

Also Read- Mobility App ‘Namma Yatri’ enters Mangaluru!

Now available in phased distribution to some users, a citywide rollout is due within a week.

Fundamentally, Namma Transit is a mobility personal assistant, providing real-time metro timings and intermodal transfer information. The system is driven by the Open Network for Digital Commerce (ONDC) and is likely to integrate live feed from BMTC buses in the near future, through a collaboration with Indian Institute of Science’s Centre for Data for Public Good.

“Public transport isn’t competing with ride-hailing it’s competing with the increasing number of private cars,” said Shan MS, Co-founder and COO of Namma Yatri. He emphasized the need to balance mass transit with last-mile solutions to decongest the city.

To promote early adoption, Namma Yatri will provide incentives to both users and drivers during the pilot phase.

Along with the launch, the company also published a forward-looking policy document called “Made for BLR: Namma Mobility Blueprint 2030”. Taking inspiration from international mobility models of cities such as Amsterdam, Singapore, and Tokyo, the blueprint maps an ambitious agenda to transform Bengaluru’s transport scenario.

Some of the key objectives of the 2030 blueprint are:

-

Enhancing public transport usage from 48% to 70%

-

Cutting total monthly commute hours from 117 to 57

-

Halving transport-related emissions

The report also calls for the legalisation of pooling and ride-batching, which are expected to deliver both environmental and economic benefits.

“Mobility should feel magical not like a daily struggle,” the co-founders said. “With Namma Transit, every touchpoint from trip planning to live alerts is designed to make public transport the default and most dependable choice.”

Ride & Mobility

A Strategic Bet on Autonomous Vehicles and Long-Term Growth

The global mobility landscape is undergoing a seismic shift. As the world edges closer to a driverless future, companies that can bridge the gap between innovation and scalability will dominate the next decade. Uber, once synonymous with surge pricing and urban chaos, has quietly repositioned itself as a formidable player in the autonomous vehicle (AV) revolution. With a strategic web of partnerships, a robust balance sheet, and a vision to own the mobility operating system of the future, Uber is not just adapting to change—it is accelerating it. For investors, the question is no longer whether Uber can survive in this new era, but whether it can outpace its rivals and deliver outsized returns.

Strategic Partnerships: The Building Blocks of a Robotaxi Empire

Uber’s recent alliances in the AV space are nothing short of transformative. By teaming up with Lucid Group and Nuro, the company has secured access to both the hardware and software needed to build a scalable robotaxi network. Lucid’s Gravity SUV, with its 450-mile range and modular design, is tailor-made for autonomous operations. Nuro’s Level 4 AI-driven autonomy system, already tested in Las Vegas, promises efficiency and safety. Together, these partners enable Uber to deploy 20,000 vehicles over six years—starting in a major U.S. city by 2026. This is not just a partnership; it is a blueprint for vertical integration, where Uber owns the vehicle, the technology, and the user experience.

Beyond the U.S., Uber has expanded its AV footprint with Baidu’s Apollo Go and WeRide, targeting Asia, the Middle East, and Europe. These partnerships are critical for global diversification. Apollo Go’s 1,000+ driverless vehicles in Dubai and Abu Dhabi, and WeRide’s planned expansion to 15 new cities, underscore Uber’s ambition to become the default AV platform outside of China. Meanwhile, May Mobility’s Toyota Sienna-based AVs, set to launch in Texas, provide a bridge to U.S. markets where regulatory hurdles remain. By hedging its bets across geographies and technologies, Uber is insulating itself from regional disruptions while building a universal mobility solution.

Financial Strength: The Engine of Long-Term Bet

Uber’s financials in 2025 tell a story of resilience and reinvention. Q1 revenue hit $11.5 billion, up 14% year-over-year, with free cash flow surging to $2.3 billion. This performance is not just a function of ride-hailing growth but also of disciplined cost management and diversification into delivery, advertising, and Uber One subscriptions. The company’s Q2 guidance—Gross Bookings of $45.75–47.25 billion and Adjusted EBITDA of $2.02–2.12 billion—further reinforces its momentum.

Critically, Uber’s free cash flow generation provides the runway to fund its AV ambitions without resorting to dilutive financing. The $300 million investment in Lucid and the multi-hundred-million-dollar stake in Nuro are not speculative bets but strategic allocations to secure a leadership position in a market projected to reach $1.3 trillion by 2030. For context, Tesla’s recent stock volatility (

Network Effects and First-Mover Advantage

Uber’s core strength lies in its network effects. With 170 million monthly active platform consumers and 3.0 billion trips in Q1 2025, the company has amassed a trove of data on routing, pricing, and user behavior. This data is now being repurposed to train its AV systems and optimize robotaxi operations. Unlike legacy automakers or pure-play tech firms, Uber has the unique advantage of testing its AV fleet in real-world conditions while maintaining a revenue stream from its existing business.

Moreover, the integration of AVs into the Uber app—where users can seamlessly switch between human-driven and autonomous vehicles—creates a flywheel effect. As robotaxi costs decline, Uber can undercut traditional ride-hailing services, attracting more users and further entrenching its platform. This dynamic is already visible in Dubai, where Apollo Go’s 11 million public rides demonstrate the viability of AVs in a ride-hailing context.

Risks and Realities

No investment is without risk. Regulatory delays, technical hurdles, and competition from Waymo, Tesla, and Chinese AV firms like Baidu and WeRide remain significant challenges. Additionally, Uber’s Q2 2025 guidance assumes a 1.5% currency headwind, which could pressure margins if global economic conditions deteriorate.

However, Uber’s diversified strategy—owning both AV assets and partnerships, while maintaining a strong core business—mitigates many of these risks. Its ability to pivot from platform-as-a-service to owner-operator also reduces exposure to third-party bottlenecks. For investors, the key is to assess whether the company’s current valuation reflects these strategic advantages or still trades at a discount to its long-term potential.

Conclusion: A Compelling Case for Long-Term Investors

Uber is no longer just a ride-hailing company; it is a mobility infrastructure play. Its AV partnerships, financial durability, and network effects position it as a prime candidate to dominate the robotaxi market. While the path to profitability may be nonlinear, the company’s disciplined capital allocation and global expansion make it a compelling buy for investors with a multi-year horizon.

For those willing to bet on the future of mobility, Uber offers a rare combination of innovation and execution. As the world moves toward autonomous transportation, Uber’s ability to own the user experience—from app to vehicle—will be its greatest asset. The question for investors is not whether Uber can succeed, but whether it can do so faster than its rivals. In a race where the finish line is a driverless future, Uber has already secured a front-row seat.

Ride & Mobility

flinkey supercharges Ride-Hailing Operations with Digital Vehicle Access Solution

flinkey supercharges Ride-Hailing Operations with Digital Vehicle Access Solution

Mounting-free retrofit technology helps providers boost fleet efficiency, enhance driver experience, and reduce downtime

With flinkey, operators can eliminate lengthy handovers, streamline day-to-day vehicle operations, and provide a smoother user experience.

VELBERT, GERMANY, July 25, 2025 /24-7PressRelease/ — In today’s rapidly evolving ride-hailing industry, flinkey – developed by WITTE:digital – offers a mounting-free, digital keyless access solution designed to help operators overcome common hurdles such as manual key handovers and limited vehicle availability. Through a discreet in-vehicle key box and an intuitive mobile app, ride-hailing providers can substantially reduce administrative overhead, improve driver convenience, and optimize fleet performance.

flinkey adds new approach to ride-hailing vehicle access

Currently, many ride-hailing operators rely on time-consuming key handovers, scheduling constraints, and face-to-face interactions. These processes can slow down vehicle allocation, restrict 24/7 access, and drive up costs. By contrast, flinkey enables a fully digital approach to vehicle handovers-keys are accessed and returned virtually, and the physical key is secured in the car. This process allows operators to dynamically manage fleets across multiple locations without sacrificing flexibility or security.

“We see a significant increase of requests and implementations by ride-hailing providers. All of them eager to adopt digital vehicle keys for a faster expansion of their business,” states Annika Sänger-Acevedo, Director Sales & Business Development at WITTE:digital.

Tangible benefits for ride-hailing providers

Operators report the following advantages:

• Administrative work reduces as digital handovers minimize paperwork and staff time by replacing cumbersome, face-to-face processes.

• Enabling drivers to unlock and return vehicles anytime via a mobile app opens up for expanded operational windows, 24/7 fleet availability and increased revenue potential.

• User satisfaction improves since contactless key management eliminates waiting times, empowers drivers to pick up vehicles at their convenience, and enhances the overall service quality.

• Centralised control and real-time insights are possible thanks to detailed logging of vehicle access

• The retrofit-friendly and mounting-free solution enables scalability at maximum ease of installation allowing immediate fleet expansion.

Michael Tüllmann, Head of WITTE:digital invites fleet managers to benefit from fewer delays and better resource allocation: “We believe the future of ride-hailing lies in fast, driver-friendly fleet access. With flinkey, operators can eliminate lengthy handovers, streamline day-to-day vehicle operations, and provide a smoother user experience.”

WITTE:digital is the digital business unit of the WITTE Automotive Group, headquartered in Velbert, Germany. As an innovation driver for digital vehicle access, WITTE:digital develops holistic solutions for car sharing, fleet management and mobility platforms. One of its key products in the car rental, sharing / pooling and ride-hailing space is the aftermarket solution flinkey enabling digital vehicle keys.

The vision ‘WE OPEN MOBILITY’ stands for safe, efficient and sustainable access to mobility – digital and connected.

# # #

-

Brand Stories7 days ago

Brand Stories7 days agoBloom Hotels: A Modern Vision of Hospitality Redefining Travel

-

Brand Stories2 days ago

Brand Stories2 days agoCheQin.ai sets a new standard for hotel booking with its AI capabilities: empowering travellers to bargain, choose the best, and book with clarity.

-

Destinations & Things To Do1 week ago

Destinations & Things To Do1 week agoUntouched Destinations: Stunning Hidden Gems You Must Visit

-

AI in Travel1 week ago

AI in Travel1 week agoAI Travel Revolution: Must-Have Guide to the Best Experience

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Destinations & Things To Do2 days ago

Destinations & Things To Do2 days agoThis Hidden Beach in India Glows at Night-But Only in One Secret Season

-

Asia Travel Pulse3 weeks ago

Asia Travel Pulse3 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel3 weeks ago

AI in Travel3 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories3 weeks ago

Brand Stories3 weeks agoChatGPT — the last of the great romantics

You must be logged in to post a comment Login