Brand Stories

Could This Under-the-Radar Artificial Intelligence (AI) Defense Company Be the Next Palantir?

Palantir has emerged as a disruptive force in the AI realm, ushering in a wave of enthusiastic investors to the defense tech space.

Palantir Technologies was the top-performing stock in the S&P 500 and Nasdaq-100 during the first half of 2025. With shares soaring by 80% through the first six months of the year — and by 427% over the last 12 months — Palantir has helped drive a lot of attention to the intersection of artificial intelligence (AI) and defense contracting.

Palantir is far from the only company seeking to disrupt defense tech. A little-known competitor to the company is BigBear.ai (BBAI -3.35%), whose shares are up by an impressive 357% over the last year.

Could BigBear.ai emerge as the next Palantir? Read on to find out.

BigBear.ai is an exciting company in the world of defense tech, but…

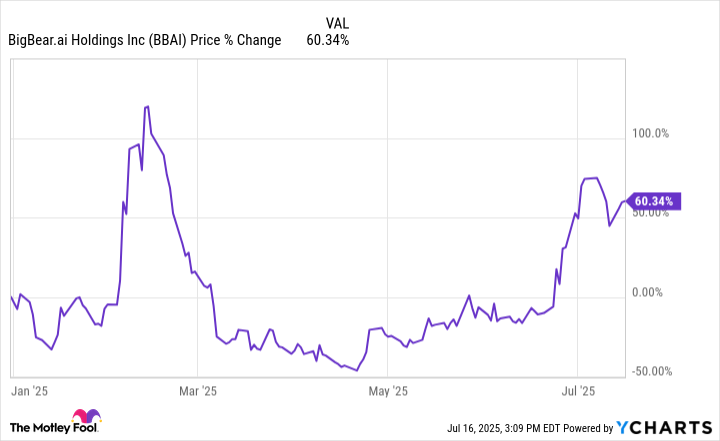

BigBear.ai’s share price volatility so far this year mimics the movements of a rollercoaster. Initially, shares rose considerably shortly following President Donald Trump’s inauguration and the subsequent announcement of Project Stargate — an infrastructure initiative that aims to invest $500 billion into AI projects through 2029.

However, these early gains retreated following the Pentagon’s plans to reduce its budget by 8% annually.

While reduced spending from the Department of Defense (DOD) was initially seen as a major blow to contractors such as Palantir and BigBear.ai, the trends illustrated above suggest that shares rebounded sharply — implying that the sell-offs back in February may have been overblown. Why is that?

In my eyes, a major contributor to the recovery in defense stocks came after Defense Secretary Pete Hegseth announced his intentions to double down on a strategy dubbed the Software Acquisition Pathway (SWP).

In reality, the DOD’s budget cuts are focused on areas that are deemed non-essential or inefficient. For example, the Pentagon freed up billions in capital by reducing spend with consulting firms such as Booz Allen Hamilton, Accenture, and Deloitte. In addition, a contract revolving around an HR software system managed by Oracle was also cut.

Under the SWP, it appears that the DOD is actually looking to free up capital in order to double down on more tech-focused initiatives and identify vendors that can actually handle the Pentagon’s sophisticated workflows.

With so much opportunity up for grabs, it’s likely that optimistic investors saw this as a tailwind for BigBear.ai. This logic isn’t too far off base, either.

BigBear.ai’s CEO is Kevin McAleenan, a former government official with close ties to the Trump administration. McAleenan’s strategic relationships within the government combined with the DOD’s focus on working with leading software services providers likely has some investors buying into the idea that BigBear.ai won’t be flying under the radar much longer.

Image source: Getty Images.

…how does the company really stack up beside Palantir?

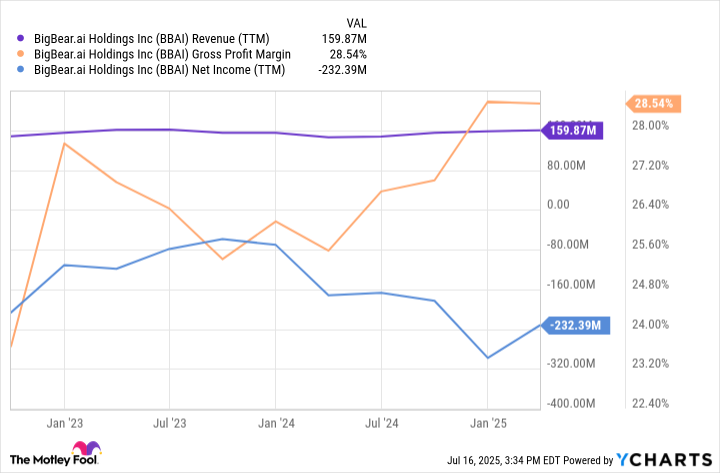

The graph below breaks down revenue, gross margin, and net income for BigBear.ai over the last year. With just $160 million in sales, the company tends to generate inconsistent gross margins — which top out at less than 30%. Moreover, with a fairly small sales base and unimpressive margin profile, it’s not surprising to see BigBear.ai’s losses continue to mount.

BBAI Revenue (TTM) data by YCharts

By comparison, Palantir generated $487 million in government revenue during the first quarter of 2025. In other words, Palantir’s government operation generates nearly triple the amount of revenue in a single quarter that BigBear.ai does in an entire year. On top of that, Palantir’s gross margins hover around 80%, while the company’s net income over the last 12 months was over $570 million.

Is BigBear.ai stock a buy right now?

Right now, BigBear.ai trades at a price-to-sales (P/S) ratio of around 11. While this may look “cheap” compared to Palantir’s P/S multiple of 120, there is a reason for the valuation disparity between the two AI defense contractors.

Palantir boasts large, fast-growing public and private sector businesses that command strong profit margins. By contrast, BigBear.ai is going to have a difficult time scaling so long as it keeps burning through heaps of cash.

Not only would I pass on BigBear.ai stock, but I also do not see the company becoming the next Palantir. Palantir is in a league of its own in the defense tech space, and I do not see BigBear.ai as a formidable challenger.

Adam Spatacco has positions in Palantir Technologies. The Motley Fool has positions in and recommends Abbott Laboratories, Accenture Plc, Oracle, and Palantir Technologies. The Motley Fool has a disclosure policy.

Brand Stories

Critical thinking in the age of artificial intelligence

Artificial intelligence is rapidly transforming the business landscape, and we must properly prepare ourselves to use this technology effectively and thrive in the new future of work. There is no doubt that in recent years, we have seen the many ways in which artificial intelligence tools are being experimented with to improve efficiency and achieve better results in less time. However, we also know that it can be overwhelming to determine the best way to integrate artificial intelligence into our lives. Critical thinking is essential at this time since not everything that is obtained is reliable or truthful, so if we firmly believe in what a program tells us, we could be making bad decisions.

Between our fear of the unknown and the resistance to change, it is logical that we are invaded by confusion, especially if we are unaware of what progress is making accessible. On the other hand, who can feel completely up to date in terms of technology when movements are accelerated? And at the center of vertigo, we are in the eye of the hurricane of the reconfiguration that artificial intelligence is generating.

The challenge we face is to understand the techniques to know how to approach and incorporate artificial intelligence in our own projects, to promote the appropriate use of technological advances, and to promote critical thinking. We have to promote the ability to analyze information and form an opinion based on evidence and reasoning. Because while it is true that there are great advances, it is also true that not all that glitters is gold, and that when one consults artificial intelligence programs, they may be giving us false, implicit, or totally distorted data. It is still up to the human mind to discern and not swallow all the pills that are offered to us.

The challenge cannot be ignored. Harvard University predicts that more than eighty percent of companies will have used or implemented Artificial Intelligence in some form by 2027, that is, in two years, which means the very near future. This means that it is essential for businesses to help prepare workers to use these technologies effectively and to approach these technologies with critical thinking.

However, incorporating artificial intelligence can be intimidating. But losing the fear of these advances (when well used and well evaluated) can help execute our strategies successfully. Necessarily, they must be understood. The world’s leading business schools, such as Dartmouth University, designed and executed the sprint model.

Sprints are focused, collaborative sessions that take place over a compressed period of time for rapid learning and skill development. In 2022, to encourage experimentation, this format was adopted for a subset of training courses, each consisting of four and a half hours of instruction in one to five sessions and graded as pass/fail. The freedom fostered by this format was ideal for boosting the creativity and hands-on learning that were critical.

The philosophy in these courses was to help decision-making. The objective is that in each session, they face situations in which they can critically apply artificial intelligence processes:

-

Reflective prompts increase the creative surface. We are referring to these techniques that create opportunities for human ingenuity, which remains an indispensable ingredient. Techniques that help to discover that, although the artificial intelligence tools they were using produced many ideas, the final inspiration came from a human who established a less obvious connection. If AI produces many alternatives, the human mind is the one that evaluates and chooses.

-

The iterative integration of tools that enable engaging communications. In our day, it’s critical to find compelling ways to communicate ideas. Using a combination of AI tools to bring an idea to life with engaging prose, powerful visuals, and catchy videos and audio clips is what you are looking for. Creating a good result is not difficult, as it can be left to the Artificial Intelligence, but obtaining a great result requires the work of a human mind.

-

People are a powerful way to test ideas. Not to mention, machines can be very intelligent but also very stupid. Organizations look for different perspectives to shape informed decision-making; they need to understand the views of different stakeholders to anticipate rejection or acceptance and ensure that their speech resonates with the customer.

The best way to get comfortable with an AI tool is to play around with it, and the best way to play with it is in the context of a real problem. Perspective is the best ally to play with these programs. For example:

-

Criticizing a concept as if we were an investor in the company.

-

Evaluate another concept as if we were the COO who has to bring this idea to market.

-

Value this concept as if you were a 30-year-old customer who loved the existing brand.

-

Criticize that concept as if you were Greta Thunberg or some environmentalist.

The power of play is to do it with a purpose. Artificial intelligence is still an emerging technology, and its impact remains unclear. That said, based on the little experience that humanity has with these technologies, it is necessary to understand the role it will play in our sector and, therefore, in business training and the benefits that are obtained when it is used effectively.

An experiential activity, such as a sprint, is ideal for collective experimentation. It combines focus and discipline with space for learning through purposeful play; explore, discover, and create together freely, which leads to more significant results.

Brand Stories

California Judicial Council implements rule for generative artificial intelligence use in court

Policies must block confidential information from being input into public generative AI systems; they must also ban unlawful discrimination via AI programs. Court staff and judicial officers must also “take reasonable steps” to confirm the accuracy of material, as per a statement published by Reuters. Staff and judicial officers must also reveal whether they used AI if the final version of any publicized written, visual, or audio work was AI-generated.

Courts must implement their respective policies by September 1.

Task force chair Brad Hill told the council in a statement published by Reuters that the rule “strikes the best balance between uniformity and flexibility.” He explained that the task force steered clear of a rule that would dictate court use of the evolving technology.

Illinois, Delaware, and Arizona have also taken on generative AI rules or policies. New York, Georgia, and Connecticut are presently evaluating generative AI use in court.

California’s court system comprises five million cases, 65 courts, and around 1,800 judges. The AI task force was established to address the increasing interest in generative AI as well as public concern about its effect on the judiciary; it supervises the development of AI use policy recommendations in this branch.

Brand Stories

This Artificial Intelligence (AI) Stock Could Hit a $2 Trillion Valuation by July 31

-

Meta Platforms’ recent rally has brought its market cap close to the $2 trillion mark.

-

The digital advertising giant’s upcoming earnings report could help it hit this milestone.

-

Meta’s ability to deliver strong returns to advertisers with the help of AI tools could help it grow at a faster pace than the end market in the long run, paving the way for more upside.

Meta Platforms (NASDAQ: META) stock has been rallying impressively of late, gaining more than 32% in the past three months amid the broader rally in technology stocks. As a result, Meta’s market cap has jumped to $1.8 trillion as of this writing on July 14, making it the sixth-largest company in the world.

Meta is slated to release its second-quarter results after the market closes on July 31. The company has been able to grow at a faster pace than the digital ad market thanks to the integration of artificial intelligence (AI) tools into its offerings, which could enable it to deliver another solid set of results later this month.

Given that Meta stock is just 11% away from entering the $2 trillion market cap club as I write this, there is a good chance it could achieve that milestone in July, driven by the tech stock rally and a healthy quarterly report.

Let’s look at the reasons why Meta stock is primed for more upside this month and in the long run.

It is worth noting that Meta’s earnings have been better than consensus expectations in each of the last four quarters. One reason is the increase in spending across its family of applications by advertisers. In the first quarter, for instance, Meta reported an impressive increase of 10% year over year in the average price per ad.

Ad impressions also increased by 5% from the year-ago period, which means the company is delivering more ads. This combination of higher pricing per ad and an increase in impressions delivered enabled Meta to report a 37% year-over-year increase in its earnings to $6.43 per share in Q1. However, investors should also note that the company has been aggressively increasing its capital expenditures (capex) to bolster its AI infrastructure.

It expects to spend $68 billion on capex in 2025, at the midpoint of its guidance range. That would be a massive increase over its 2024 capex of $39 billion. This explains why analysts are expecting Meta’s earnings to increase at a slower year-over-year pace of 13% for the second quarter to $5.84 per share. While the increased investment in AI-focused data center infrastructure is undoubtedly likely to weigh on Meta’s bottom line in the short run, the higher returns its AI investments are generating on the advertising front could help it beat the market’s bottom-line expectations. And beating expectations often sends a stock up, as investors react with excitement and optimism.

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoAmazon weighs further investment in Anthropic to deepen AI alliance

-

Brand Stories1 week ago

Brand Stories1 week agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

Asia Travel Pulse2 weeks ago

Asia Travel Pulse2 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

AI in Travel2 weeks ago

AI in Travel2 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoEU pushes ahead with AI code of practice

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoChatGPT — the last of the great romantics

-

The Travel Revolution of Our Era1 month ago

The Travel Revolution of Our Era1 month agoCheQin.ai Redefines Hotel Booking with Zero-Commission Model

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoHumans must remain at the heart of the AI story

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoChildproofing the internet is a bad idea

You must be logged in to post a comment Login