Brand Stories

After Plummeting Over $1 Trillion in Value, This Super Artificial Intelligence (AI) Stock Is Mounting a Major Comeback, With Analysts Predicting Gains of Up to 400%

Earlier this year, Nvidia lost more than $1 trillion in market capitalization. Now, it’s the most valuable company in the world.

For a few years now, the artificial intelligence (AI) movement has largely hinged on the performance of a single company: Nvidia (NVDA -0.42%).

Sure, if Microsoft or Amazon posted strong results from their respective cloud computing platforms or if Tesla managed to hype investors up over the prospects of self-driving robotaxis or humanoid robots, the technology sector might see a fleeting upward movement. At the end of the day, however, the focus seemed to eventually return to Nvidia — with analysts obsessing over how demand for the company’s chips and data center services were trending.

During the first half of the year, Nvidia’s ship was caught in an epic storm. Investors started to question the company’s long-growth prospects — inspiring prolonged periods of panic-selling in the process. All told, Nvidia’s market cap dropped by more than $1 trillion.

But now, with a market value north of $4 trillion, Nvidia has reclaimed its position as the most valuable company on the planet. Even better? Some on Wall Street are calling for further gains of up to 400%.

Let’s explore the tailwinds supporting Nvidia’s long-term growth narrative and detail why Wall Street sees such massive upside for the king of the chip realm.

One Wall Street analyst is calling for a $10 trillion valuation for Nvidia

One of the most bullish Nvidia analysts on Wall Street is the I/O Fund’s Beth Kindig. Kindig suggested that Nvidia could reach a $10 trillion market cap by 2030 — implying 140% upside from current levels. Let’s explore the main catalysts supporting Kindig’s forecast.

According to management from Microsoft, Amazon, and Alphabet, roughly $260 billion will be spent in 2025 alone on AI infrastructure. On top of that, Meta Platforms is expected to spend roughly $70 billion on capital expenditures this year — nearly double what it spent in 2024. Lastly, Oracle is beginning to make significant headway in infrastructure services — allowing companies to rent Nvidia GPUs from their cloud-based data center platform. From a macro perspective, rising capex from the cloud hyperscalers bodes well for chip demand.

Kindig takes these secular tailwinds one step further, suggesting that competition from Intel and Advanced Micro Devices does not pose much of a threat to Nvidia’s dominance. While it’s hard to know how vendor preferences could change over the next several years, current industry research trends suggest that Kindig might be right — underscored by Nvidia’s rising market share in the AI accelerator industry.

The area of Kindig’s analysis that I think is currently overlooked the most revolves around Nvidia’s software architecture, called CUDA. Since CUDA is integrated tightly with Nvidia’s hardware, developers essentially become locked into the company’s ecosystem.

Not only does this lead to customer stickiness, but it opens the door for Nvidia to be at the forefront of more sophisticated, evolving AI applications in areas such as robotics and autonomous driving.

Image source: Getty Images.

What about $20 trillion?

Former management consulting executive Phil Panaro is even more bullish than Kindig. By 2030, Panaro thinks Nvidia’s share price could reach $800 — implying roughly a $20 trillion market cap.

Panaro cites opportunities across Web3 development and evolving use cases around how enterprises and governments leverage AI to generate more efficiency and cost savings as the main pillars supporting Nvidia’s upside.

While these trends could eventually drive significant demand for Nvidia’s data center services, tech adoption within the government tends to move slowly. Meanwhile, Web3 remains an emerging concept that could take far longer to mature than Panaro is assuming.

Is Nvidia stock a buy right now?

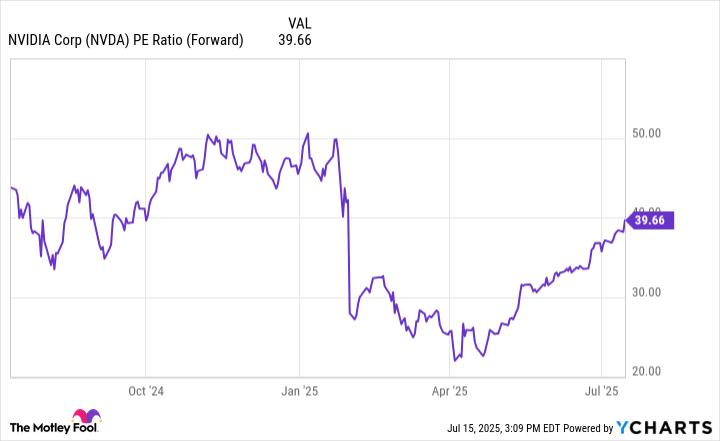

Nvidia stock has been mounting an epic comeback over the last couple of months. This valuation expansion can be easily seen through the dynamics of the company’s rising forward price-to-earnings (P/E) multiple. Nevertheless, Nvidia’s forward P/E of 40 is still well below levels seen earlier this year.

NVDA PE Ratio (Forward) data by YCharts

Trying to model Nvidia’s peak valuation is an exercise in false precision. The bigger takeaway is that analysts on Wall Street are not only calling for significant upside in the stock, but they have outlined the foundation for Nvidia’s long-term growth. The important theme here is that Nvidia has opportunities well beyond selling chips — many of which have yet to make meaningful contributions to the business.

I see Nvidia stock as a no-brainer. Investors with a long-run time horizon might consider scooping shares up at current prices and plan to hold on for years to come.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Intel, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short August 2025 $24 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Brand Stories

Liquid-cooling thermal management for artificial intelligence (AI)

Questions and answers:

- What are the Vertiv CoolChip CDU models for? They are designed for liquid cooling in high-performance computing (HPC) and artificial intelligence (AI) applications, including retrofit and greenfield data centers.

- What is the cooling capacity of the Vertiv CoolChip CDU 600, and what type of system is it? The Vertiv CoolChip CDU 600 provides 600 kilowatts of cooling, and is an in-row, liquid-to-liquid cooling system.

- How does the Vertiv CoolChip CDU 100 support high-density workloads? It offers 100 kilowatts of cooling in a 4U form factor with a large-surface heat exchanger, integrated controller, and built-in fluid filtration for thermal stability.

WESTERVILLE, Ohio – Vertiv Group Corp. in Westerville, Ohio, is introducing three versions of the Vertiv CoolChip Coolant Distribution Unit (CDU) for liquid cooling in high-performance computing (HPC) and artificial intelligence (AI) applications.

The the Vertiv CoolChip CDU 70, Vertiv CoolChip CDU 100, and Vertiv CoolChip CDU 600 are direct-to-chip (DTC) liquid thermal management systems.

These models are for retrofit or greenfield data center environments, with models including in-rack and row-based configurations, and liquid-to-air and liquid-to-liquid technologies. The Vertiv CoolChip CDU family is for applications ranging from retrofitting existing facilities to scaling high-density AI and HPC clusters in new builds.

_________________________

Tell me more about electronics liquid cooling

- Electronics liquid cooling uses liquids — typically water or specialized coolants — to absorb and transfer heat away from high-power electronic components. Unlike traditional air cooling, liquid cooling is more efficient at handling dense heat loads in applications like high-performance computing (HPC), data centers, and military electronics. Key methods include direct-to-chip (DTC) cooling, cold plates, and immersion cooling.

_________________________

The CoolChip CDU 70 is an in-row, liquid-to-air coolant distribution unit for liquid cooling in data centers that must use existing thermal infrastructure. The system delivers as much as 70 kilowatts of cooling capacity.

Its integrated controller supports real-time monitoring, group control and unit-to-unit communication, for coordinated thermal performance, simplified management, and efficient scaling across several different racks.

Vertiv CoolChip CDU 100 offers liquid-to-liquid in-rack cooling for high-density workloads. If offers 100 kilowatts of cooling capacity in a 4U form factor and a large-surface heat exchanger engineered for low approach temperatures. An integrated controller provides monitoring and control, and built-in filtration help maintain fluid quality and thermal stability.

Liquid-to-liquid cooling

The Vertiv CoolChip CDU 600 is an in-row liquid-to-liquid model for AI and HPC deployments. The 600-kilowatt system is for hyperscale and colocation environments, supports in-row configurations, and integrates into raised-floor or retrofit installations.

It offers a top- or bottom-piping connection and available internal manifolds, streamlines infrastructure planning, and speeds installation with redundant pumps, and advanced monitoring for temperature and fluid quality.

For more information contact Vertiv online at www.vertiv.com.

Brand Stories

California Judicial Council implements rule for generative artificial intelligence use in court

Policies must block confidential information from being input into public generative AI systems; they must also ban unlawful discrimination via AI programs. Court staff and judicial officers must also “take reasonable steps” to confirm the accuracy of material, as per a statement published by Reuters. Staff and judicial officers must also reveal whether they used AI if the final version of any publicized written, visual, or audio work was AI-generated.

Courts must implement their respective policies by September 1.

Task force chair Brad Hill told the council in a statement published by Reuters that the rule “strikes the best balance between uniformity and flexibility.” He explained that the task force steered clear of a rule that would dictate court use of the evolving technology.

Illinois, Delaware, and Arizona have also taken on generative AI rules or policies. New York, Georgia, and Connecticut are presently evaluating generative AI use in court.

California’s court system comprises five million cases, 65 courts, and around 1,800 judges. The AI task force was established to address the increasing interest in generative AI as well as public concern about its effect on the judiciary; it supervises the development of AI use policy recommendations in this branch.

Brand Stories

This Artificial Intelligence (AI) Stock Could Hit a $2 Trillion Valuation by July 31

-

Meta Platforms’ recent rally has brought its market cap close to the $2 trillion mark.

-

The digital advertising giant’s upcoming earnings report could help it hit this milestone.

-

Meta’s ability to deliver strong returns to advertisers with the help of AI tools could help it grow at a faster pace than the end market in the long run, paving the way for more upside.

Meta Platforms (NASDAQ: META) stock has been rallying impressively of late, gaining more than 32% in the past three months amid the broader rally in technology stocks. As a result, Meta’s market cap has jumped to $1.8 trillion as of this writing on July 14, making it the sixth-largest company in the world.

Meta is slated to release its second-quarter results after the market closes on July 31. The company has been able to grow at a faster pace than the digital ad market thanks to the integration of artificial intelligence (AI) tools into its offerings, which could enable it to deliver another solid set of results later this month.

Given that Meta stock is just 11% away from entering the $2 trillion market cap club as I write this, there is a good chance it could achieve that milestone in July, driven by the tech stock rally and a healthy quarterly report.

Let’s look at the reasons why Meta stock is primed for more upside this month and in the long run.

It is worth noting that Meta’s earnings have been better than consensus expectations in each of the last four quarters. One reason is the increase in spending across its family of applications by advertisers. In the first quarter, for instance, Meta reported an impressive increase of 10% year over year in the average price per ad.

Ad impressions also increased by 5% from the year-ago period, which means the company is delivering more ads. This combination of higher pricing per ad and an increase in impressions delivered enabled Meta to report a 37% year-over-year increase in its earnings to $6.43 per share in Q1. However, investors should also note that the company has been aggressively increasing its capital expenditures (capex) to bolster its AI infrastructure.

It expects to spend $68 billion on capex in 2025, at the midpoint of its guidance range. That would be a massive increase over its 2024 capex of $39 billion. This explains why analysts are expecting Meta’s earnings to increase at a slower year-over-year pace of 13% for the second quarter to $5.84 per share. While the increased investment in AI-focused data center infrastructure is undoubtedly likely to weigh on Meta’s bottom line in the short run, the higher returns its AI investments are generating on the advertising front could help it beat the market’s bottom-line expectations. And beating expectations often sends a stock up, as investors react with excitement and optimism.

-

Mergers & Acquisitions2 weeks ago

Mergers & Acquisitions2 weeks agoAmazon weighs further investment in Anthropic to deepen AI alliance

-

Mergers & Acquisitions1 week ago

Mergers & Acquisitions1 week agoHow Elon Musk’s rogue Grok chatbot became a cautionary AI tale

-

Asia Travel Pulse2 weeks ago

Asia Travel Pulse2 weeks agoLooking For Adventure In Asia? Here Are 7 Epic Destinations You Need To Experience At Least Once – Zee News

-

Mergers & Acquisitions2 weeks ago

Mergers & Acquisitions2 weeks agoUK crime agency arrests 4 people over cyber attacks on retailers

-

Brand Stories2 weeks ago

Brand Stories2 weeks agoVoice AI Startup ElevenLabs Plans to Add Hubs Around the World

-

AI in Travel2 weeks ago

AI in Travel2 weeks ago‘Will AI take my job?’ A trip to a Beijing fortune-telling bar to see what lies ahead | China

-

Mergers & Acquisitions2 weeks ago

Mergers & Acquisitions2 weeks agoEU pushes ahead with AI code of practice

-

Mergers & Acquisitions2 weeks ago

Mergers & Acquisitions2 weeks agoChatGPT — the last of the great romantics

-

The Travel Revolution of Our Era1 month ago

The Travel Revolution of Our Era1 month agoCheQin.ai Redefines Hotel Booking with Zero-Commission Model

-

Mergers & Acquisitions2 weeks ago

Mergers & Acquisitions2 weeks agoHumans must remain at the heart of the AI story

You must be logged in to post a comment Login